he Glover Scholastic Aid Foundation has received a €20 million global government bond portfolio from a Greek donor. This bond ortfolio will be held in euros and managed separately from Glover's existing U.S. dollar-denominated assets. Although the bond ortfolio is currently unhedged, the portfolio manager, Raine Sofia, is investigating various alternatives to hedge the currency risk of e portfolio. The bond portfolio's current allocation and the relevant country performance data are given in Exhibits 1 and 2. Historical orrelations for the currencies being considered by Sofia are given in Exhibit 3. Sofia expects that future returns and correlations will e approximately equal to those given in Exhibits 2 and 3. xhibit 1. Glover Scholastic Aid Foundation Current Allocation Global Government Bond Portfolio Country Greece A B с Allocation (%) Maturity (years) 35 5 30 5 10 10 10 5

he Glover Scholastic Aid Foundation has received a €20 million global government bond portfolio from a Greek donor. This bond ortfolio will be held in euros and managed separately from Glover's existing U.S. dollar-denominated assets. Although the bond ortfolio is currently unhedged, the portfolio manager, Raine Sofia, is investigating various alternatives to hedge the currency risk of e portfolio. The bond portfolio's current allocation and the relevant country performance data are given in Exhibits 1 and 2. Historical orrelations for the currencies being considered by Sofia are given in Exhibit 3. Sofia expects that future returns and correlations will e approximately equal to those given in Exhibits 2 and 3. xhibit 1. Glover Scholastic Aid Foundation Current Allocation Global Government Bond Portfolio Country Greece A B с Allocation (%) Maturity (years) 35 5 30 5 10 10 10 5

Chapter18: Long-term Debt Financing

Section: Chapter Questions

Problem 12QA

Related questions

Question

Bhadiben

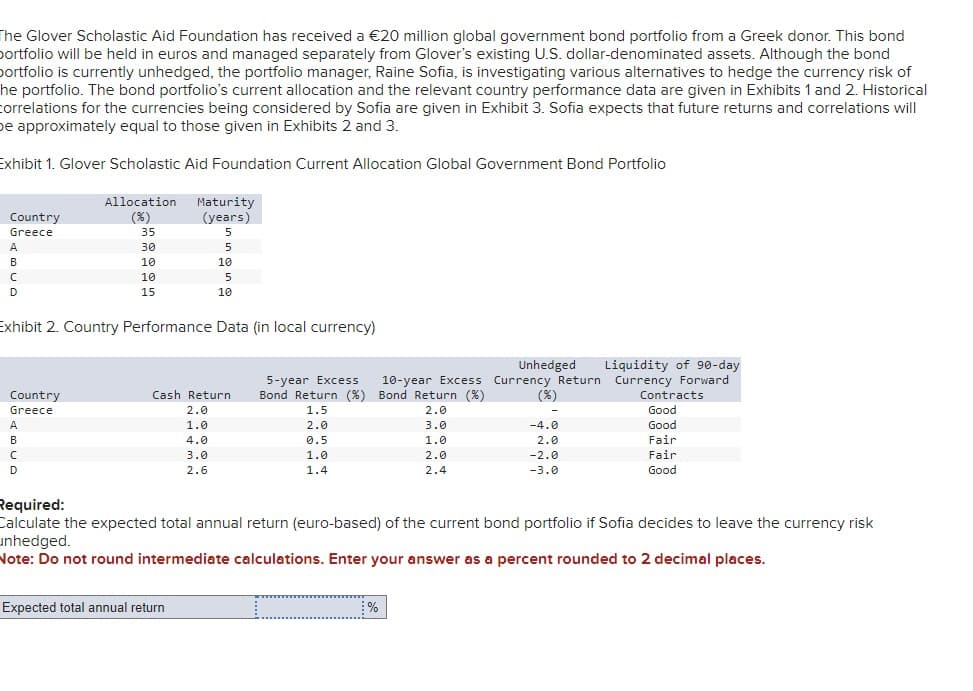

Transcribed Image Text:The Glover Scholastic Aid Foundation has received a €20 million global government bond portfolio from a Greek donor. This bond

portfolio will be held in euros and managed separately from Glover's existing U.S. dollar-denominated assets. Although the bond

portfolio is currently unhedged, the portfolio manager, Raine Sofia, is investigating various alternatives to hedge the currency risk of

he portfolio. The bond portfolio's current allocation and the relevant country performance data are given in Exhibits 1 and 2. Historical

correlations for the currencies being considered by Sofia are given in Exhibit 3. Sofia expects that future returns and correlations will

be approximately equal to those given in Exhibits 2 and 3.

Exhibit 1. Glover Scholastic Aid Foundation Current Allocation Global Government Bond Portfolio

Country

Greece

Allocation

(%)

Maturity

(years)

A

B

C

D

35

5

30

5

10

10

10

5

15

10

Exhibit 2. Country Performance Data (in local currency)

5-year Excess

Country

Cash Return

Bond Return (%)

10-year Excess Currency Return

Bond Return (%)

Unhedged

(%)

Liquidity of 90-day

Currency Forward

Contracts

Greece

2.0

1.5

2.0

Good

A

B

1.0

2.0

3.0

-4.0

Good

4.0

0.5

1.0

2.0

Fair

C

3.0

1.0

2.0

-2.0

Fair

D

2.6

1.4

2.4

-3.0

Good

Required:

Calculate the expected total annual return (euro-based) of the current bond portfolio if Sofia decides to leave the currency risk

unhedged.

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

Expected total annual return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning