He is married and files a joint return. He is married and files a separate return. His filing status is single. His filing status is head of household.

Q: Kegler Bowling buys scorekeeping equipment with an invoice cost of $155,000. The electrical work…

A: As per IAS 16 "Property, plant, and equipment", PPE should initially need to record at cost. Cost…

Q: Differential Analysis for a Lease-or-buy Decision Moffett Industries is considering new equipment.…

A: The differential analysis is performed to compare the different alternatives available such as…

Q: Fisk Corporation is trying to improve its inventory control system and has installed an online…

A: Economic order quantity that is EOQ means the number of units that should be bought together to make…

Q: When is the balance of the net gain or loss account subject to amortization? O When it exceeds 10%…

A: The balance of the net gain or loss account subject to amortization is based when it exceeds 10% of…

Q: costs per direct labor hour are as follows. Indirect labor Indirect materials Utilities $1.20 0.60…

A: The overhead costs can be classified as fixed or variable depending on the different elements of…

Q: A subsidiary of Dunder Inc., a U.S. company, was located in a foreign country. The functional…

A: Consolidated financial statements are prepared in combination of parent company and subsidiary…

Q: Calculate the common-sized percentage 2023. for Gross Margin in

A: GROSS MARGIN Gross Margin is the Ratio between Gross Profit & Net Sales. Gross Margin is one of…

Q: a Express the ratio of the Gross Profit of Year 1 to the Cost of Goods Sold ar 2 in Fract

A: Hi student Since there are multiple subparts asked, we will answer only first three subparts. Ratio…

Q: 8. Under 75% sales assumption, using variable costing, the variable product cost balance can be…

A: The variable costing method computes the product cost or inventoriable cost at the variable…

Q: The actual Revenues account of a government is debited when: The budget is recorded at the…

A: Government revenue, often known as national revenue, is the sum of money that a government receives…

Q: The Losponato Company had a beginning checkbook balance of $1,982.15. Record the following in the…

A: A checkbook is a compact book that contains paper that has been preprinted with the customer's…

Q: Short-Term Liquidity Ratios The financial statements for Puck Enterprises, a retailer, follow.…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Relevant exchange rates for 1 Kr were as follows: 2013 2014 January 1, 2020 April 1, 2020 July 1,…

A: Introduction:- This question deals with the accounting treatment of a company named Agee and…

Q: LED Corporation owns $1,000,000 of Branch Pharmaceuticals bonds and classifies its investment as…

A: Available for sale securities: These are the securities which are not intended to be sold in the…

Q: Primare Corporation has provided the following data concerning last month's manufacturing…

A: Total manufacturing cost :— It is the sum of direct material, direct labor and manufacturing…

Q: Macee Store has three operating departments, and it conducts advertising that benefits all…

A: In this question, we need to compute the percent of total sales for each departmental sales and need…

Q: Mystic Lake Inc. bottles and distributes spring water. On July 9 of the current year, Mystic Lake…

A: Treasury shares are those common shares which are repurchased by the entity from the market. These…

Q: Sport Box sells a wide variety of sporting equipment. The following is information on the purchases…

A: Inventory means the detailed list or stock of items, goods, or materials held by a business or…

Q: Question 9 of 20 View Policies Current Attempt in Progress Pension expense for 2022 is O $1923200.…

A: Employee benefits cost is one of important cost being incurred in business. This is also known as…

Q: Bartlett Car Wash Company is considering the purchase of a new facility. It would allow Bartlett to…

A: Accounting rate of return is the net income divided by the investment Payback period is the period…

Q: Net sales Less: Less: Less: Less: Net income XY CORPORATE SUMMARY REPORT CONTRIBUTION INCOME…

A: The process of collecting and presenting financial data about several business segments within a…

Q: On December 31, Westworld Incorporated has the following equity accounts and balances. $ 7,900…

A: The stockholder's equity is the part of financial statements of the company. It includes paid-up…

Q: Compute Topp Company's price-earnings (PE) ratio if its common stock has a market value of $22.20…

A: PE ratio stands for "Price to Earnings Ratio". It is a financial metric used to evaluate the…

Q: bramble company expects to have a cash balance of $43,200 on january 1,2022. relevant monthly budget…

A: The cash budget is prepared to estimate the cash balance for the period. The cash budget helps to…

Q: Required information [The following information applies to the questions displayed below.] Legacy…

A: The bonds are the financial instruments of the business that are issued to raise money from the…

Q: TMT, Inc. Balance Sheet For the year ended 12/31/20X1 Assets Current Assets: Cash and Cash…

A: DEBT TO EQUITY RATIO Debt to Equity Ratio is the Ratio Between Total Debt & Total Equity. Debt…

Q: 3 Part 3 of 3 Required information [The following information applies to the questions displayed…

A: The allowance for doubtful accounts is an account created for recording the estimated amount of bad…

Q: LANSING COMPANY Selected Balance Sheet Accounts At December 31 Accounts receivable Inventory…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Buffalo Inc. is considering whether to lease or purchase a piece of equipment. The total cost to…

A: Leasing is an aggreement between two parties one is lessor other one is lessee, where lessor gives…

Q: Sell as is or Process Further Sweet cukes produces cucumbers which a variable manufacturing cost of…

A: Further processing or not to process will depend whether this will provide additional income or not.

Q: Carla Vista Inc. has a customer loyalty program that rewards a customer with 1 customer loyalty…

A: Total transaction price is the amount which is allocated to the different activities to know the…

Q: St. Germaine Corporation has found that 70% of its sales in any given month are credit sales, while…

A: The cash budget is prepared in advance which means the cash budget is prepared for the future and it…

Q: The per-unit standards for direct materials are 2.4 pounds at $5.59 per pound. Last month, 3,900…

A: Either the efficiency of direct labor or the consumption of direct materials may account for the…

Q: National Orthopedics Companu issued 9% bonds, dated January 1, with a face amount of $900,000 on…

A: Table Value are Based on: n= (4 year * 2) 8 i = (10% / 2) 5% Cash Flow…

Q: Directions: The general ledger for Ozaki Tax Services on December 31 of the current year is…

A: Journal Entry - Journal entry is the recording of business transaction in books of account, this is…

Q: Stock Dividends Penguin Company has the following information regarding its common stock: $24 par,…

A: The dividend is declared to the shareholders from the retained earnings of the business. The…

Q: During 19X1 and 19X2, Company B used the percentage- of-completion method of accounting for…

A: Switching from the percentage-of-completion method to the completed-contract method of accounting…

Q: Current Attempt in Progress The computation of pension expense includes all the following except O…

A: Pension expense is the cost associated with a company's pension plan for a given period, and it…

Q: Crazy Jane Company reports the following financial information before adjustments. Accounts…

A: Given, Accounts Receivable = $160,000Allowance for Doubtful Accounts = $2,850Sales Revenue (all on…

Q: Use the present value and future value tables to answer the following questions. A. If you would…

A: Present value - It is the amount that the company can receive in the future and is calculated by…

Q: Tyrell Company entered into the following transactions involving short-term liabilities. Year 1…

A: Interest due It represents the amount required to pay the interest cost of a loan for the payment…

Q: Crane Corporation has a defined benefit pension plan covering its 1260 employees. Crane agrees to…

A: Lets understand the basics. Management gives various benefits to employees including pension…

Q: Suzy sells an office building and the associated land on May 10, 2022. Under the terms of the sales…

A: Cash received = $450,000 Mortgage assumed by purchaser = $175,000 Points charged by lender = $12,000…

Q: Holiday Corporation has two divisions, Quail and Marlin. Quail produces a widget that Marlin could…

A: Introduction:- This question deals with the concept of transfer pricing, which is the pricing…

Q: The following data pertains to inventory during the past year. A physical inventory at year-end…

A: Under LIFO Inventory flow goods sold last will be sold first. Hence, Lastest inventory`s Purchases…

Q: Jackson Corporation has asked you to analyze their sales and cost data. They have provided you with…

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing Income Statement is One of the Important Cost…

Q: The fair value of plan assets at December 31, 2026 is O $2777000. O $2850000. O $3180000. O…

A: Plan assets must be valued at not cost it should be values at fair value only.

Q: Specialty Corp is a cash basis

A: In cash basis , the tax payer gets tax deduction if the bills are paid in cash in the…

Q: Prepare the journal entry to record Zende Company’s issuance of 75,000 shares of $4 par value common…

A: Journal entry is the first stage of accounting process. Journal entry used to record business…

Q: Computing Ending Inventory using Dollar-Value LIFO On January 1 of Year 5, Benn Company changed from…

A: Dollar value LIFO method: This method is different model for the last-in first layering model. Under…

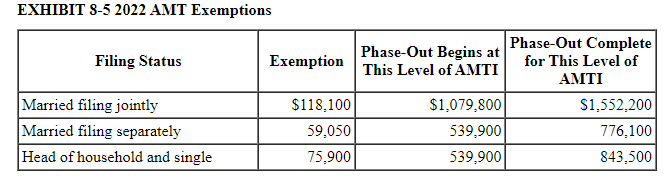

Corbett's AMTI is $619,000.

What is his AMT exemption under the following alternative circumstances? Exhibit 8-5.

Required:

- He is married and files a joint return.

- He is married and files a separate return.

- His filing status is single.

- His filing status is head of household.

Step by step

Solved in 3 steps

- Question #44 of 85 Question ID: 1251825 Which of the following are correct statements regarding a payable on death (POD) account used as a will substitute? Use of a POD designation is a completed gift, but is entitled to an annual exclusion for each named beneficiary. The named beneficiary can transfer up to one-half of the assets in the account. The account assets will be included in the account owner's gross estate. The account assets will be transferred outside of probate. A) III and IV B) I, III, and IV C) II only D) I and IIITrue/False 7. Interest paid or accrued during 2018 on aggregate acquisition indebtedness of $2 million or less ($1 million or less for married persons filing separate returns) is deductible as qualified residence interest.Instructions: 1. Download BIR Forms 1701 Version 2018 at www.bir.gov.ph. 2. Compute the income tax payable, if any for taxable year 2021. YOU are engaged in the merchandising business and at the same time employed by PA-MINE Corp. as an Accountant for the TY 2021. In compliance with the existing rules in doing business, you applied for your TIN where your home BIR RDO (select the BIR which has jurisdiction over the place of your residence) assigned you Taxpayer Identification No. 123-456-789-0000. Additional information: You chose graduated tax rate You opted for itemized deduction Your financial records showed the following: Gross Sales – Php 4,000,000 Cost of Sales – Php 2,000,000 Expenses – Salaries and wages of staff – Php 360,000 Depreciation of car used in delivery – Php 100,000 Representation expense – Php 10,000 Office Rent expense – Php 360,000 Rent expense on your condominium – Php – 240,000 Utilities in office – Php 120,000 Electricity expenses in condominium – Php…

- Ac. 1). On 15 Mard 2022, fusiness Taxpwyer, reportirg on a calendar year basis, sold furniture fueven year peogerty) it had phaced in service on 1 Nowernier 2020 (Q4), The furniture was the only asset placed in service during 2000 and had an initial basis of $12,000. Trapayer did not elect 179 inmediate expensing and elected out of bomis deprecation in 2020 (meaning no 179 or bonus). Determine the depreciation deduction for the furniture in 2022 , the year of sale. 2099 230 1049 295 2). Tiepayer and Spouse are a married couple filing jointly. This year, Taxperyer earned salary from her employer of $215,000 and Sporise earned salary from his tinployer of $5,000. Deterinine the couple's Additional Merficare Tax liability for the year 134 810 2610 1520 360SCHEDULE 1(Form 1040)Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income ► Attach to Form 1040.► Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 1545-0074 2018 AttachmentSequence No. 01 Name(s) shown on Form 1040Noah Yobs Your social security number 123-45-6789 Additional Income 1-9b Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1-9b 10 Taxable refunds, credits, or offsets of state and local income taxes . . . . . . 10 11 Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 12 Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . . . . . . . . 12 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here ► ◻ 13 14 Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . . . . . . . . 14 15a…[Fourth Item: Problem Solving] Izzy Transport is engaged in the transportation business. It is registered as a domestic common carrier by land. The receipts for June of the current taxable year are as follows: Sourced from the transport of passengers P1,800,000 Sourced from the transport of goods 2,200,000 Sourced from the transport of cargoes 800,000 The common carriers’ tax due and payable is a. Nil b. P54,000 c. P78,000 d. P90.000

- (AUTHORIZATION MATRIX) The following are the authorized signatories for Serrano Company: Mr. A. Serrano Mrs. B. Serrano Mr. C. Serrano Ms. D. SerranoAuthorization matrix revealed the following: Amount of Disbursement Who Will Sign? P10,000 and below ANY one (1) of the four (4) signatories P20,000 and below Mr. C. Serrano AND Ms. D. Serrano, jointly Mr. A. Serrano, singly Mrs. B. Serrano, singly P50,000 and below (PRIMARY)Mr. A. Serrano AND Mrs. B. Serrano, jointly (SECONDARY)1st signatory: either Mr. A. OR Mrs. B. Serrano;2nd signatory: either Mr. C OR Ms. D. Serrano NOTE: Secondary is only used when one of the primary is not available. On November 6, the Finance Department prepared the following checks, vouchers and supporting documents for approval: Check number Payee Amount Complete Documents 00032 Juanito Dela Costa P 7,500.00 a 00033 Crisanta Ramirez 9,473.23 a 00034 Ramona Aquino 5,267.85 a 00035 Techie Supplies Inc. 23,460.00 a…37. SCHEDULE OF EXPANDED WITHHOLDING TAX (EWT) Income Payment EWT Income Payment EWT Professional/Management/Consultancy fees (Individual) Gross receipts 3M or below with sworn declaration - 5% Gross receipts over 3M or VAT-reg or without sworn declaration – 10% Purchase of goods or properties by Top Withholding Agents (TWA) - 1% - goods 2% - service Professional/Management/Consultancy fees (Non-Individual) Gross receipts 720,000 or below - 10% Gross receipts over 720,000 – 15% Partners in general professional partnerships (drawings, advances, sharings, allowances, etc.) 720,000 or less -10% Above 720,000 – 15% Contractors/subcontractors (security, janitorial, etc.) 2% Commission (if not employee) 10% Director’s fees (if not employee) 10% or 15% (720,000 threshold) Income distributed to beneficiaries of estates/trusts 15% Rental 5% Below are the data provided to you by Nicanor, a top withholding agent for the month…Becker CPA Review 15-5 Calculate the taxpayer's 2019 qualifying business income deduction for a qualified trade or business. Filing status: Single Taxable income: $100,000 Net capital gains: $0 Qualified business income (QBI): $30,000 W–2 wages: $10,000 a.$5,000 b.$70,000 c.$20,000 d.$6,000

- 36. SCHEDULE OF EXPANDED WITHHOLDING TAX (EWT) Income Payment EWT Income Payment EWT Professional/Management/Consultancy fees (Individual) Gross receipts 3M or below with sworn declaration - 5% Gross receipts over 3M or VAT-reg or without sworn declaration – 10% Purchase of goods or properties by Top Withholding Agents (TWA) - 1% - goods 2% - service Professional/Management/Consultancy fees (Non-Individual) Gross receipts 720,000 or below - 10% Gross receipts over 720,000 – 15% Partners in general professional partnerships (drawings, advances, sharings, allowances, etc.) 720,000 or less -10% Above 720,000 – 15% Contractors/subcontractors (security, janitorial, etc.) 2% Commission (if not employee) 10% Director’s fees (if not employee) 10% or 15% (720,000 threshold) Income distributed to beneficiaries of estates/trusts 15% Rental 5% Below are the data provided to you by Nicanor, a top withholding agent for the month…Part C Part C (2021 and 2022) The trial balance of A, B, and D at December 31, 2021 after all adjustments have been made is as follows: Adjusted Balances Account Title Debit Credit Cash 83,000 Other Assets 80,000 Accounts Payable 140,000 A, Capital 7,000 B, Capital 7,000 C, Capital 9,000 163,000 163,000 On January 1, 2022 the partnership is liquidated. Other assets are sold for: $ 144,000 Gains and losses are liquidated in a ratio of: A 3 B 2 D 5 Required 6 Print out the "Part. Liqu." page (see tab below). Complete the schedule. Assume any partner deficiency (debit balance) is repaid with cash by the applicable partner. 7 Prepare the…41. SCHEDULE OF EXPANDED WITHHOLDING TAX (EWT) Income Payment EWT Income Payment EWT Professional/Management/Consultancy fees (Individual) Gross receipts 3M or below with sworn declaration - 5% Gross receipts over 3M or VAT-reg or without sworn declaration – 10% Purchase of goods or properties by Top Withholding Agents (TWA) - 1% - goods 2% - service Professional/Management/Consultancy fees (Non-Individual) Gross receipts 720,000 or below - 10% Gross receipts over 720,000 – 15% Partners in general professional partnerships (drawings, advances, sharings, allowances, etc.) 720,000 or less -10% Above 720,000 – 15% Contractors/subcontractors (security, janitorial, etc.) 2% Commission (if not employee) 10% Director’s fees (if not employee) 10% or 15% (720,000 threshold) Income distributed to beneficiaries of estates/trusts 15% Rental 5% Below are the data provided to you by Nicanor, a top withholding agent for the month…