he that Robinson Company sells its ment on November 1, 2018, at 90 plus ed interest. a) Robinson records this unt amortization as follows: b) utation Gain/Loss on Sale of Bonds and al entry.

he that Robinson Company sells its ment on November 1, 2018, at 90 plus ed interest. a) Robinson records this unt amortization as follows: b) utation Gain/Loss on Sale of Bonds and al entry.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 5E

Related questions

Question

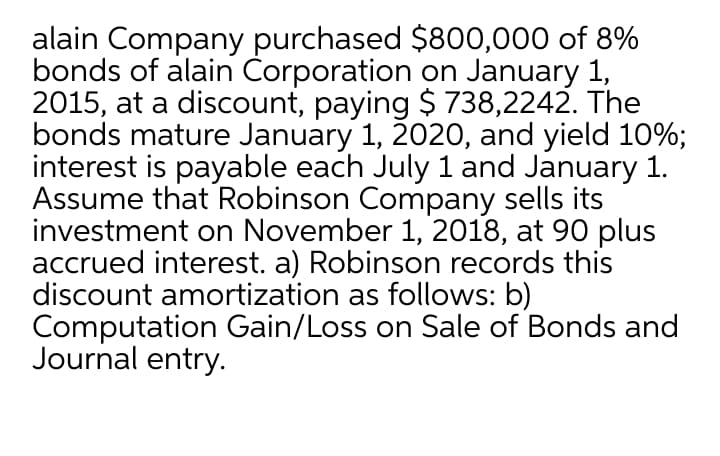

Transcribed Image Text:alain Company purchased $800,000 of 8%

bonds of alain Corporation on January 1,

2015, at a discount, paying $ 738,2242. The

bonds mature January 1, 2020, and yield 10%;

interest is payable each July 1 and January 1.

Assume that Robinson Company sells its

investment on November 1, 2018, at 90 plus

accrued interest. a) Robinson records this

discount amortization as follows: b)

Computation Gain/Loss on Sale of Bonds and

Journal entry.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning