Headland Co. sells $497,000 of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2023. The bonds yield 12%. Give entries through December 31, 2021. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to 0 decimal places, e.g. 38,548.) Schedule of Bond Discount Amortization Effective-Interest Method Bonds Sold to Yield Date Cash Paid Interest Expense Discount Amortized Carrying Amount of Bonds 3/1/20 $ $ $ $ 9/1/20 3/1/21 9/1/21 3/1/22 9/1/22 3/1/23 9/1/23

Headland Co. sells $497,000 of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2023. The bonds yield 12%. Give entries through December 31, 2021. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to 0 decimal places, e.g. 38,548.) Schedule of Bond Discount Amortization Effective-Interest Method Bonds Sold to Yield Date Cash Paid Interest Expense Discount Amortized Carrying Amount of Bonds 3/1/20 $ $ $ $ 9/1/20 3/1/21 9/1/21 3/1/22 9/1/22 3/1/23 9/1/23

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 10RE: Use the information in RE3-6, (a) assuming Ringo Company makes reversing entries, prepare the...

Related questions

Question

Headland Co. sells $497,000 of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2023. The bonds yield 12%. Give entries through December 31, 2021.

Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to 0 decimal places, e.g. 38,548.)

|

Schedule of Bond Discount Amortization

Effective-Interest Method Bonds Sold to Yield |

||||||||

|

Date |

Cash Paid |

Interest Expense |

Discount Amortized |

Carrying

Amount of Bonds |

||||

| 3/1/20 | $

|

$

|

$

|

$

|

||||

| 9/1/20 |

|

|

|

|

||||

| 3/1/21 |

|

|

|

|

||||

| 9/1/21 |

|

|

|

|

||||

| 3/1/22 |

|

|

|

|

||||

| 9/1/22 |

|

|

|

|

||||

| 3/1/23 |

|

|

|

|

||||

| 9/1/23 |

|

|

|

|

PLEASE, see the images attached for the 2nd part of this problem.

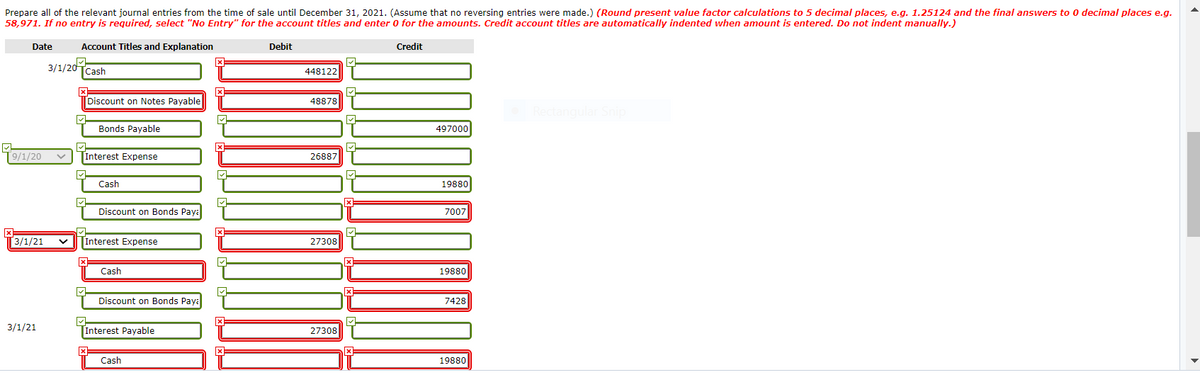

Transcribed Image Text:Prepare all of the relevant journal entries from the time of sale until December 31, 2021. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 0 decimal places e.g.

58,971. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

3/1/20

Cash

448122

Discount on Notes Payable

48878

Bonds Payable

497000

9/1/20

Interest Expense

26887

Cash

19880

Discount on Bonds Paya

7007

T3/1/21

Interest Expense

27308

Cash

19880

Discount on Bonds Paya

7428

3/1/21

[Interest Payable

27308

Cash

19880

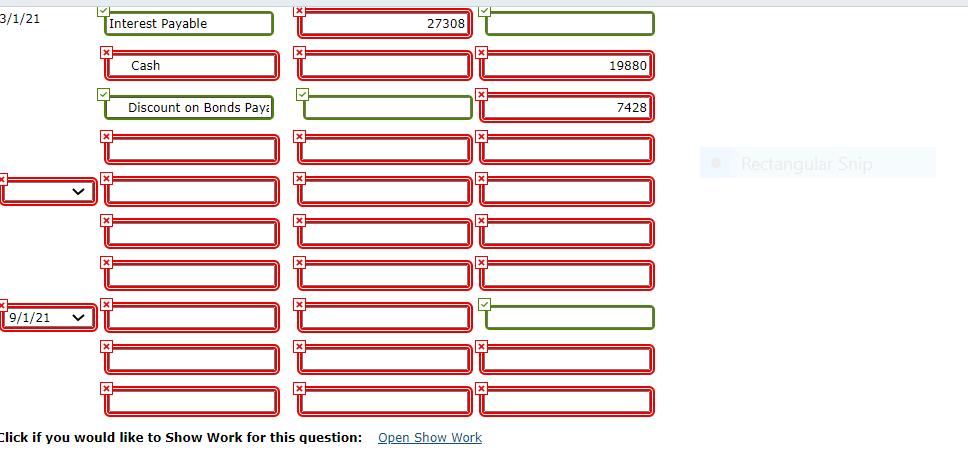

Transcribed Image Text:3/1/21

Interest Payable

27308

Cash

19880

Discount on Bonds Paya

7428

Rectangular Snip

9/1/21

Click if you would like to Show Work for this question:

Open Show Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning