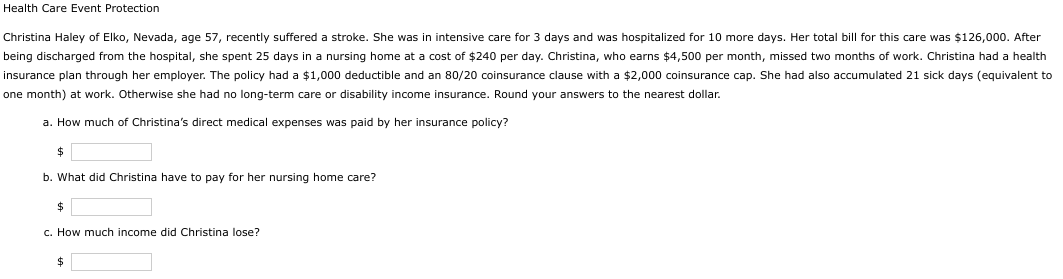

Health Care Event Protection Christina Haley of Elko, Nevada, age 57, recently suffered a stroke. She was in intensive care for 3 days and was hospitalized for 10 more days. Her total bill for this care was $126,000. After being discharged from the hospital, she spent 25 days in a nursing home at a cost of $240 per day. Christina, who earns $4,500 per month, missed two months of work. Christina had a health nsurance plan through her employer. The policy had a $1,000 deductible and an 80/20 coinsurance clause with a $2,000 coinsurance cap. She had also accumulated 21 sick days (equivalent to one month) at work. Otherwise she had no long-term care or disability income insurance. Round your answers to the nearest dollar. a. How much of Christina's direct medical expenses was paid by her insurance policy? $ b. What did Christina have to pay for her nursing home care? $ c. How much income did Christina lose? $

Health Care Event Protection Christina Haley of Elko, Nevada, age 57, recently suffered a stroke. She was in intensive care for 3 days and was hospitalized for 10 more days. Her total bill for this care was $126,000. After being discharged from the hospital, she spent 25 days in a nursing home at a cost of $240 per day. Christina, who earns $4,500 per month, missed two months of work. Christina had a health nsurance plan through her employer. The policy had a $1,000 deductible and an 80/20 coinsurance clause with a $2,000 coinsurance cap. She had also accumulated 21 sick days (equivalent to one month) at work. Otherwise she had no long-term care or disability income insurance. Round your answers to the nearest dollar. a. How much of Christina's direct medical expenses was paid by her insurance policy? $ b. What did Christina have to pay for her nursing home care? $ c. How much income did Christina lose? $

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter9: Insuring Your Health

Section: Chapter Questions

Problem 5FPE

Related questions

Question

Transcribed Image Text:Health Care Event Protection

Christina Haley of Elko, Nevada, age 57, recently suffered a stroke. She was in intensive care for 3 days and was hospitalized for 10 more days. Her total bill for this care was $126,000. After

being discharged from the hospital, she spent 25 days in a nursing home at a cost of $240 per day. Christina, who earns $4,500 per month, missed two months of work. Christina had a health

insurance plan through her employer. The policy had a $1,000 deductible and an 80/20 coinsurance clause with a $2,000 coinsurance cap. She had also accumulated 21 sick days (equivalent to

one month) at work. Otherwise she had no long-term care or disability income insurance. Round your answers to the nearest dollar.

a. How much of Christina's direct medical expenses was paid by her insurance policy?

$

b. What did Christina have to pay for her nursing home care?

$

c. How much income did Christina lose?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning