hello, I need help on the parts that aren't filled in please and for the part b the last part says "net book value"

hello, I need help on the parts that aren't filled in please and for the part b the last part says "net book value"

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 4CE: Grandorf Company replaced the engine in a truck for 8,000 and expects the new engine will extend the...

Related questions

Question

hello, I need help on the parts that aren't filled in please and for the part b the last part says "net book value"

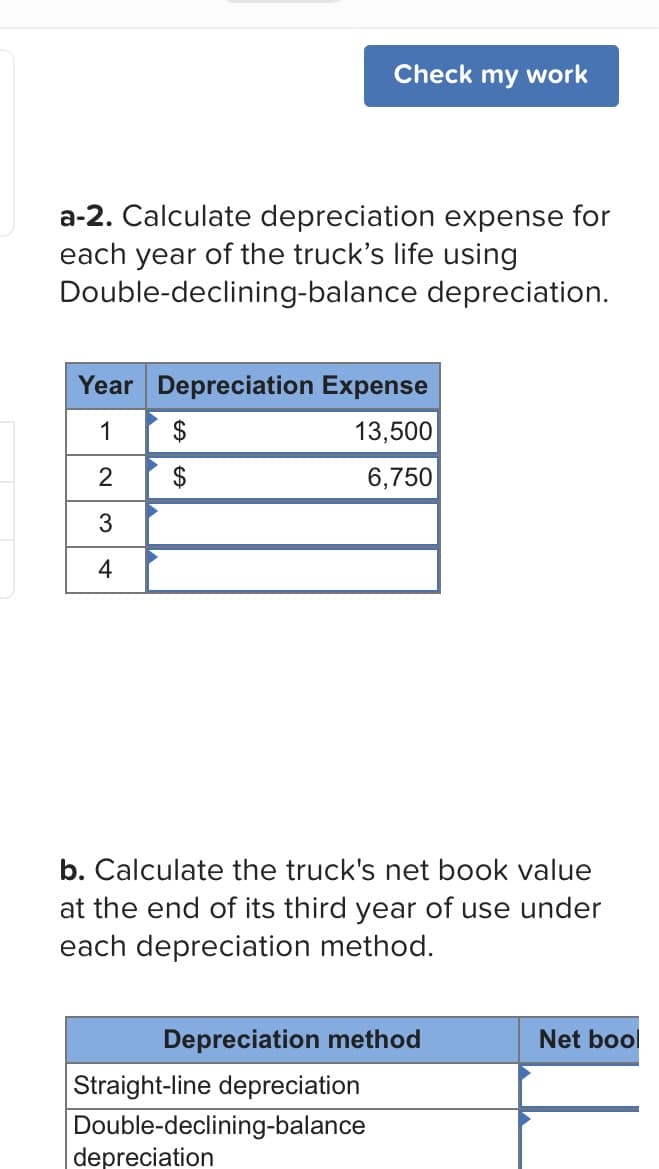

Transcribed Image Text:Check my work

a-2. Calculate depreciation expense for

each year of the truck's life using

Double-declining-balance depreciation.

Year Depreciation Expense

1

$

13,500

2

$

6,750

b. Calculate the truck's net book value

at the end of its third year of use under

each depreciation method.

Depreciation method

Net bool

Straight-line depreciation

Double-declining-balance

depreciation

%24

4.

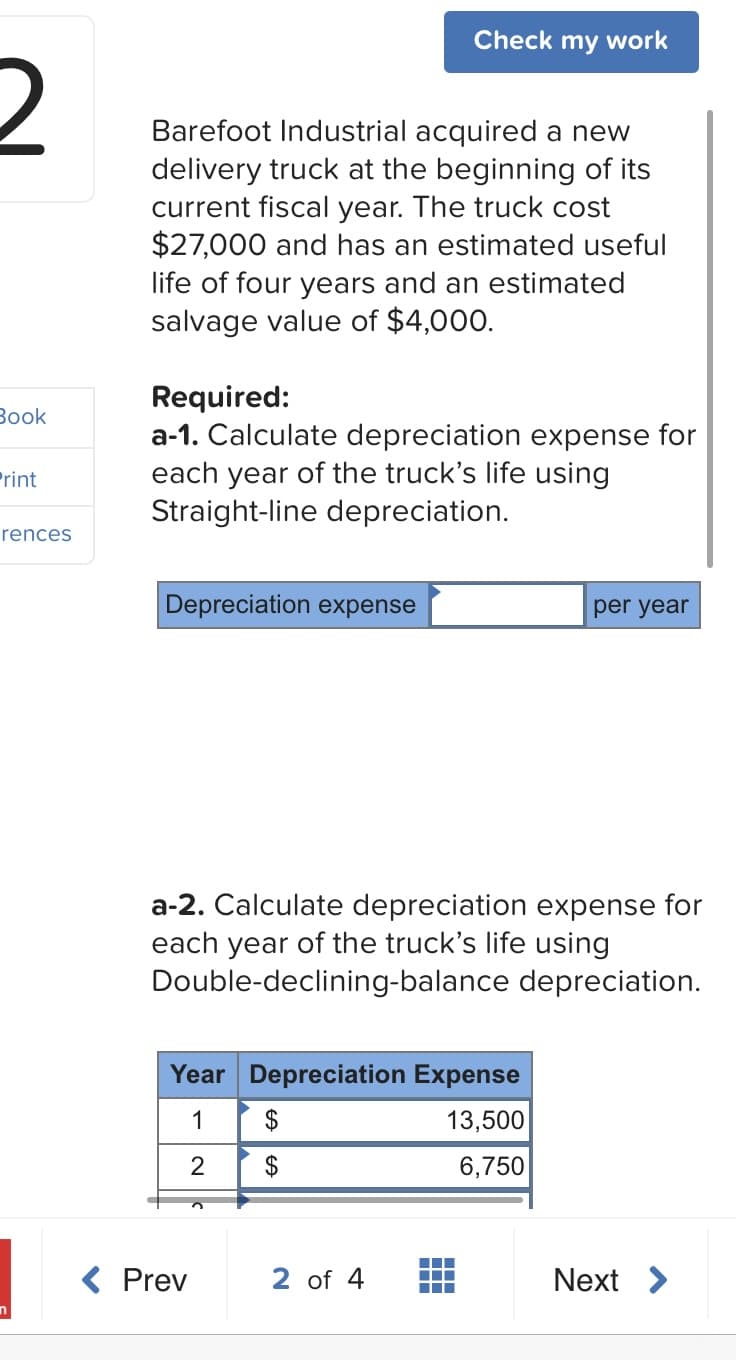

Transcribed Image Text:Check my work

Barefoot Industrial acquired a new

delivery truck at the beginning of its

current fiscal year. The truck cost

$27,000 and has an estimated useful

life of four years and an estimated

salvage value of $4,000.

Required:

a-1. Calculate depreciation expense for

each year of the truck's life using

Straight-line depreciation.

Вook

Print

rences

Depreciation expense

per year

a-2. Calculate depreciation expense for

each year of the truck's life using

Double-declining-balance depreciation.

Year Depreciation Expense

1

$

13,500

$

6,750

( Prev

2 of 4

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning