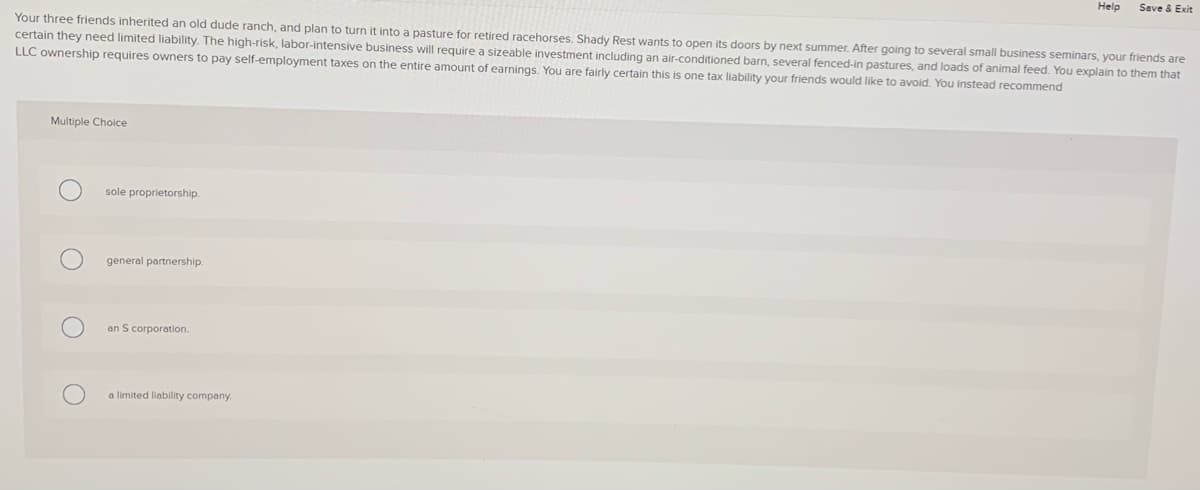

Help Seve & Exit Your three friends inherited an old dude ranch, and plan to turn it into a pasture for retired racehorses, Shady Rest wants to open its doors by next summer. After going to several small business seminars, your friends are certain they need limited liability. The high-risk, labor-intensive business will require a sizeable investment including an air-conditioned barn, several fenced-in pastures, and loads of animal feed. You explain to them that LLC ownership requires owners to pay self-employment taxes on the entire amount of earnings. You are fairly certain this is one tax liability your friends would like to avoid. You instead recommend Multiple Choice sole proprietorship. general partnership. an S corporation. a limited liability company

Help Seve & Exit Your three friends inherited an old dude ranch, and plan to turn it into a pasture for retired racehorses, Shady Rest wants to open its doors by next summer. After going to several small business seminars, your friends are certain they need limited liability. The high-risk, labor-intensive business will require a sizeable investment including an air-conditioned barn, several fenced-in pastures, and loads of animal feed. You explain to them that LLC ownership requires owners to pay self-employment taxes on the entire amount of earnings. You are fairly certain this is one tax liability your friends would like to avoid. You instead recommend Multiple Choice sole proprietorship. general partnership. an S corporation. a limited liability company

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

Transcribed Image Text:Help

Seve & Exit

Your three friends inherited an old dude ranch, and plan to turn it into a pasture for retired racehorses, Shady Rest wants to open its doors by next summer. After going to several small business seminars, your friends are

certain they need limited liability. The high-risk, labor-intensive business will require a sizeable investment including an air-conditioned barn, several fenced-in pastures, and loads of animal feed. You explain to them that

LLC ownership requires owners to pay self-employment taxes on the entire amount of earnings. You are fairly certain this is one tax liability your friends would like to avoid. You instead recommend

Multiple Choice

sole proprietorship.

general partnership.

an S corporation.

a limited liability company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.