Here are data on $1,000 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley at the end of 2020. Assume you are thinking about buying these bonds. Answer the following questions: 1. Assuming the interest is paid annually, calculate the values of the bonds if your required rates of return of Microsoft, GE Capital, and Morgan Stanley are 6%, 8%, and 10%, respectively. In addition, the information on coupon rates and maturity is given in the following table. Coupon rate Maturity Microsoft 7.25% 30 GE capital Morgan Stanley 4.75% 5 $1,100 b. GE Capital $1,030 c. Morgan Stanley $1,015 4.25% 10 2. At the end of 2020, the bond prices are as follows: a. Microsoft What were the expected rates of return for each bond (Hint: expected rate of return is calculated based on bond prices, not the intrinsic value)? 3. Identify which bonds are premium bonds and which bonds are discount bonds (Hint: this can be determined by comparing the intrinsic value to the par value or by comparing the investors' required rate of return to the coupon rate. Details are provided in Chapter 7). 4. Estimate the value of the bond if your required rate of return (1) increased 2 percentage points or (2) decreased 2 percentage points? What conclusions can you get? 5. Should you buy these bonds? Explain (Hint: should be under-priced bonds).

Here are data on $1,000 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley at the end of 2020. Assume you are thinking about buying these bonds. Answer the following questions: 1. Assuming the interest is paid annually, calculate the values of the bonds if your required rates of return of Microsoft, GE Capital, and Morgan Stanley are 6%, 8%, and 10%, respectively. In addition, the information on coupon rates and maturity is given in the following table. Coupon rate Maturity Microsoft 7.25% 30 GE capital Morgan Stanley 4.75% 5 $1,100 b. GE Capital $1,030 c. Morgan Stanley $1,015 4.25% 10 2. At the end of 2020, the bond prices are as follows: a. Microsoft What were the expected rates of return for each bond (Hint: expected rate of return is calculated based on bond prices, not the intrinsic value)? 3. Identify which bonds are premium bonds and which bonds are discount bonds (Hint: this can be determined by comparing the intrinsic value to the par value or by comparing the investors' required rate of return to the coupon rate. Details are provided in Chapter 7). 4. Estimate the value of the bond if your required rate of return (1) increased 2 percentage points or (2) decreased 2 percentage points? What conclusions can you get? 5. Should you buy these bonds? Explain (Hint: should be under-priced bonds).

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 9P

Related questions

Question

100%

Please clearly write down how you get your answers, such as the variables you used to put in the financial calculator/formulas. Thank you

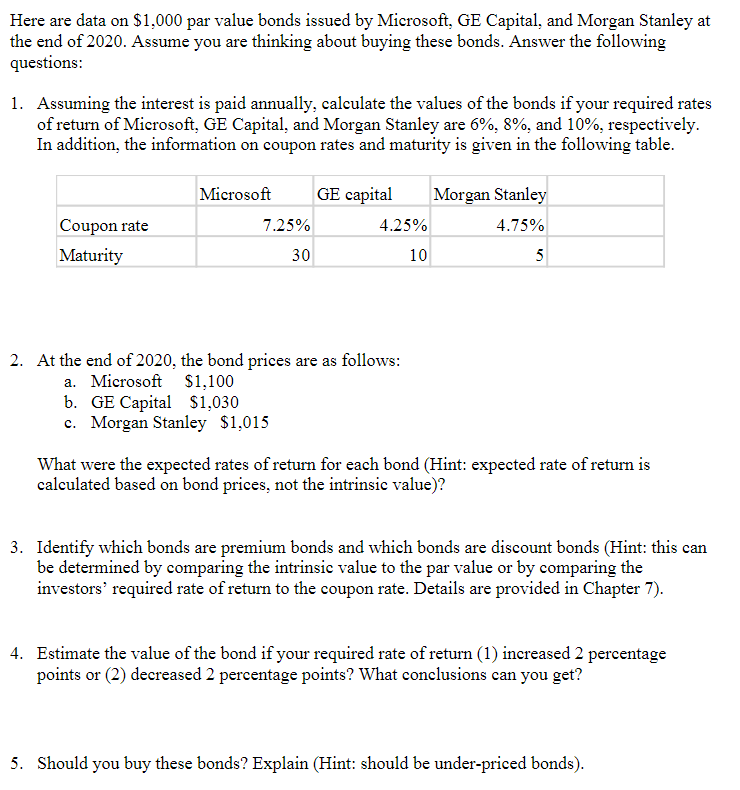

Transcribed Image Text:Here are data on $1,000 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley at

the end of 2020. Assume you are thinking about buying these bonds. Answer the following

questions:

1. Assuming the interest is paid annually, calculate the values of the bonds if your required rates

of return of Microsoft, GE Capital, and Morgan Stanley are 6%, 8%, and 10%, respectively.

In addition, the information on coupon rates and maturity is given in the following table.

Coupon rate

Maturity

Microsoft GE capital Morgan Stanley

4.75%

5

7.25%

30

4.25%

10

2. At the end of 2020, the bond prices are as follows:

a. Microsoft $1,100

b. GE Capital $1,030

c. Morgan Stanley $1,015

What were the expected rates of return for each bond (Hint: expected rate of return is

calculated based on bond prices, not the intrinsic value)?

3. Identify which bonds are premium bonds and which bonds are discount bonds (Hint: this can

be determined by comparing the intrinsic value to the par value or by comparing the

investors' required rate of return to the coupon rate. Details are provided in Chapter 7).

4. Estimate the value of the bond if your required rate of return (1) increased 2 percentage

points or (2) decreased 2 percentage points? What conclusions can you get?

5. Should you buy these bonds? Explain (Hint: should be under-priced bonds).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Could someone answer the following two questions 4 and 5? Thank you

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,