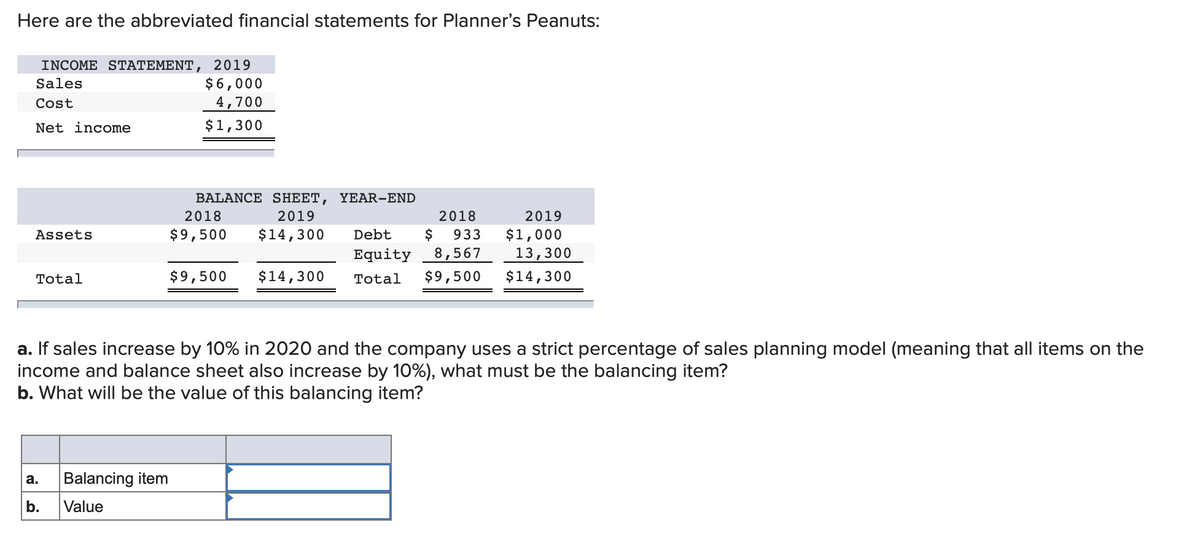

Here are the abbreviated financial statements for Planner's Peanuts: INCOME STATEMENT, 2019 $6,000 4,700 Sales Cost Net income $1,300 BALANCE SHEET, YEAR-END 2018 2018 933 2019 2019 $9,500 $14,300 Debt $1,000 13,300 Assets Equity 8,567 Total $9,500 $14,300 Total $9,500 $14,300 a. If sales increase by 10% in 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 10%), what must be the balancing item? b. What will be the value of this balancing item? a. Balancing item b. Value

Here are the abbreviated financial statements for Planner's Peanuts: INCOME STATEMENT, 2019 $6,000 4,700 Sales Cost Net income $1,300 BALANCE SHEET, YEAR-END 2018 2018 933 2019 2019 $9,500 $14,300 Debt $1,000 13,300 Assets Equity 8,567 Total $9,500 $14,300 Total $9,500 $14,300 a. If sales increase by 10% in 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the income and balance sheet also increase by 10%), what must be the balancing item? b. What will be the value of this balancing item? a. Balancing item b. Value

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

Transcribed Image Text:Here are the abbreviated financial statements for Planner's Peanuts:

INCOME STATΕΜENT,

2019

$6,000

4,700

Sales

Cost

Net income

$1,300

BALANCE SHEET, YEAR-END

2018

2019

2018

2019

$9,500

$14,300

$

8,567

933

$1,000

13,300

Assets

Debt

Equity

Total

$9,500

$14,300

Total

$9,500

$14,300

a. If sales increase by 10% in 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the

income and balance sheet also increase by 10%), what must be the balancing item?

b. What will be the value of this balancing item?

Balancing item

а.

b.

Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning