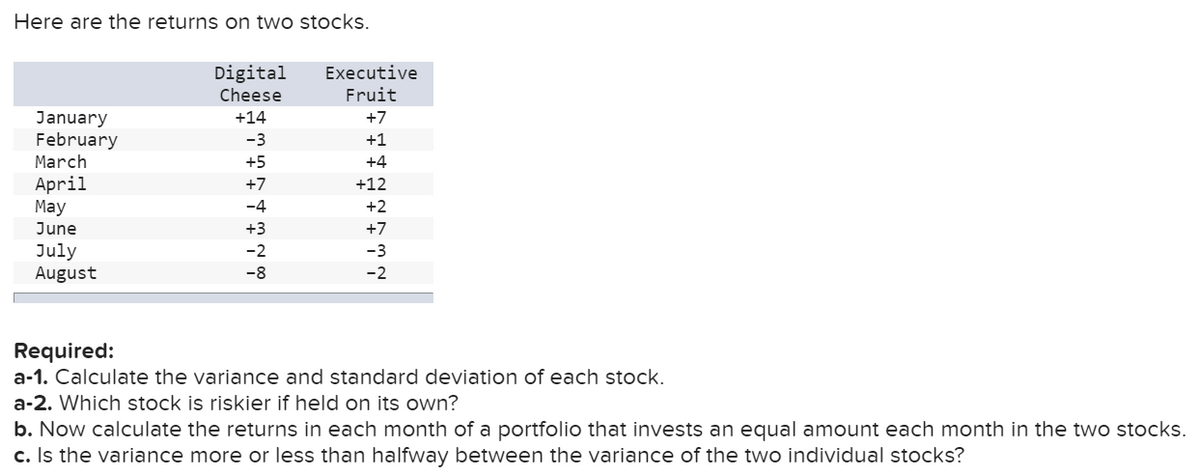

Here are the returns on two stocks. Digital Executive Cheese Fruit January February March April May +14 +7 -3 +1 +5 +4 +7 +12 -4 +2 June +3 +7 July August -2 -3 -8 -2 Required: a-1. Calculate the variance and standard deviation of each stock. a-2. Which stock is riskier if held on its own? b. Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks.

Here are the returns on two stocks. Digital Executive Cheese Fruit January February March April May +14 +7 -3 +1 +5 +4 +7 +12 -4 +2 June +3 +7 July August -2 -3 -8 -2 Required: a-1. Calculate the variance and standard deviation of each stock. a-2. Which stock is riskier if held on its own? b. Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter3: Risk And Return: Part Ii

Section: Chapter Questions

Problem 3P: Two-Asset Portfolio

Stock A has an expected return of 12% and a standard deviation of 40%. Stock B...

Related questions

Question

Transcribed Image Text:Here are the returns on two stocks.

Digital

Executive

Cheese

Fruit

January

February

+14

+7

-3

+1

March

+5

+4

April

May

+7

+12

-4

+2

June

+3

+7

July

August

-8

Required:

a-1. Calculate the variance and standard deviation of each stock.

a-2. Which stock is riskier if held on its own?

b. Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks.

c. Is the variance more or less than halfway between the variance of the two individual stocks?

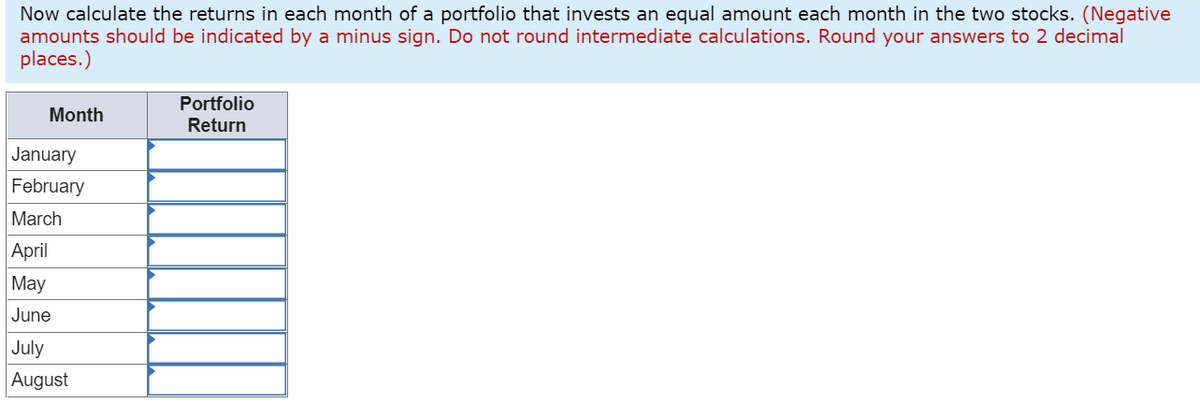

Transcribed Image Text:Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks. (Negative

amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal

places.)

Portfolio

Month

Return

January

February

March

April

May

June

July

August

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT