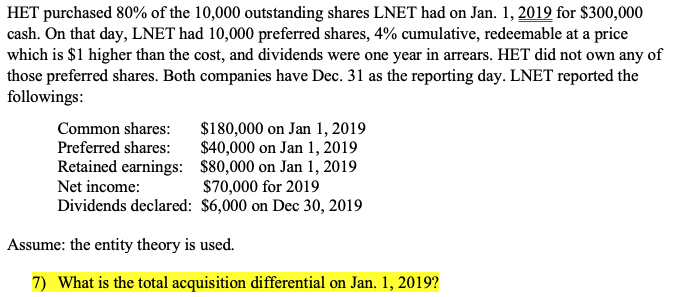

HET purchased 80% of the 10,000 outstanding shares LNET had on Jan. 1, 2019 for $300,000 cash. On that day, LNET had 10,000 preferred shares, 4% cumulative, redeemable at a price which is $1 higher than the cost, and dividends were one year in arrears. HET did not own any o those preferred shares. Both companies have Dec. 31 as the reporting day. LNET reported the followings: Common shares: $180,000 on Jan 1, 2019 $40,000 on Jan 1, 2019 Retained earnings: $80,000 on Jan 1, 2019 $70,000 for 2019 Dividends declared: $6,000 on Dec 30, 2019 Preferred shares: Net income: Assume: the entity theory is used. 7) What is the total acquisition differential on Jan. 1, 2019?

HET purchased 80% of the 10,000 outstanding shares LNET had on Jan. 1, 2019 for $300,000 cash. On that day, LNET had 10,000 preferred shares, 4% cumulative, redeemable at a price which is $1 higher than the cost, and dividends were one year in arrears. HET did not own any o those preferred shares. Both companies have Dec. 31 as the reporting day. LNET reported the followings: Common shares: $180,000 on Jan 1, 2019 $40,000 on Jan 1, 2019 Retained earnings: $80,000 on Jan 1, 2019 $70,000 for 2019 Dividends declared: $6,000 on Dec 30, 2019 Preferred shares: Net income: Assume: the entity theory is used. 7) What is the total acquisition differential on Jan. 1, 2019?

Chapter6: Corporations: Redemptions And Liquidations

Section: Chapter Questions

Problem 46P

Related questions

Question

Transcribed Image Text:HET purchased 80% of the 10,000 outstanding shares LNET had on Jan. 1, 2019 for $300,000

cash. On that day, LNET had 10,000 preferred shares, 4% cumulative, redeemable at a price

which is $1 higher than the cost, and dividends were one year in arrears. HET did not own any of

those preferred shares. Both companies have Dec. 31 as the reporting day. LNET reported the

followings:

Common shares:

$180,000 on Jan 1, 2019

$40,000 on Jan 1, 2019

Retained earnings: $80,000 on Jan 1, 2019

$70,000 for 2019

Dividends declared: $6,000 on Dec 30, 2019

Preferred shares:

Net income:

Assume: the entity theory is used.

7) What is the total acquisition differential on Jan. 1, 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning