Hi can you kindly assist with multiple choice questions 17-20 Question 17 Calculate the weighted average number of shares of Power Limited for the year ended 2021 and 2020. Question 17 options: A) R410 000 and R372 500 B) R386 000 and R374 000 C) R374 000 and R324 500 D) R374 000 and R324 500 Question 18 Calculate the diluted weighted average number of shares of Power Limited for the year ended 2021 and 2020. Question 18 options: A) 386 000 and 374 000 B) 374 000 and 324 500 C) 374 000 and 324 500 D) 410 000 and 372 500 Question 19 Calculate the diluted basic earnings of Power Limited for the year ended 2021 and 2020, to be used for calculation of diluted earnings per share. Question 19 options: A) R712 000 and R722 368 B) R722 368 and R430 624 C) R720 000 and R424 800 D) R712 000 and R416 800 Question 20 Calculate the diluted basic earnings per share of Power Limited for the year ended 2021 and 2020. Question 20 options: A)1,76 cents and 1,16 cents B)1,90 cents and 1,28 cents C) 1,67 cents and 1,82 cents D) 1,09 cents and 1,61 cents

Hi can you kindly assist with multiple choice questions 17-20 Question 17 Calculate the weighted average number of shares of Power Limited for the year ended 2021 and 2020. Question 17 options: A) R410 000 and R372 500 B) R386 000 and R374 000 C) R374 000 and R324 500 D) R374 000 and R324 500 Question 18 Calculate the diluted weighted average number of shares of Power Limited for the year ended 2021 and 2020. Question 18 options: A) 386 000 and 374 000 B) 374 000 and 324 500 C) 374 000 and 324 500 D) 410 000 and 372 500 Question 19 Calculate the diluted basic earnings of Power Limited for the year ended 2021 and 2020, to be used for calculation of diluted earnings per share. Question 19 options: A) R712 000 and R722 368 B) R722 368 and R430 624 C) R720 000 and R424 800 D) R712 000 and R416 800 Question 20 Calculate the diluted basic earnings per share of Power Limited for the year ended 2021 and 2020. Question 20 options: A)1,76 cents and 1,16 cents B)1,90 cents and 1,28 cents C) 1,67 cents and 1,82 cents D) 1,09 cents and 1,61 cents

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 12P: Comprehensive Colt Company reports pretax financial income of 143,000 in 2019. In addition to pretax...

Related questions

Question

Hi can you kindly assist with multiple choice questions 17-20

Question 17

Calculate the weighted average number of shares of Power Limited for the year ended 2021 and 2020.

Question 17 options:

A) R410 000 and R372 500

B) R386 000 and R374 000

C) R374 000 and R324 500

D) R374 000 and R324 500

Question 18

Calculate the diluted weighted average number of shares of Power Limited for the year ended 2021 and 2020.

Question 18 options:

A) 386 000 and 374 000

B) 374 000 and 324 500

C) 374 000 and 324 500

D) 410 000 and 372 500

Question 19

Calculate the diluted basic earnings of Power Limited for the year ended 2021 and 2020, to be used for calculation of diluted earnings per share.

Question 19 options:

A) R712 000 and R722 368

B) R722 368 and R430 624

C) R720 000 and R424 800

D) R712 000 and R416 800

Question 20

Calculate the diluted basic earnings per share of Power Limited for the year ended 2021 and 2020.

Question 20 options:

A)1,76 cents and 1,16 cents

B)1,90 cents and 1,28 cents

C) 1,67 cents and 1,82 cents

D) 1,09 cents and 1,61 cents

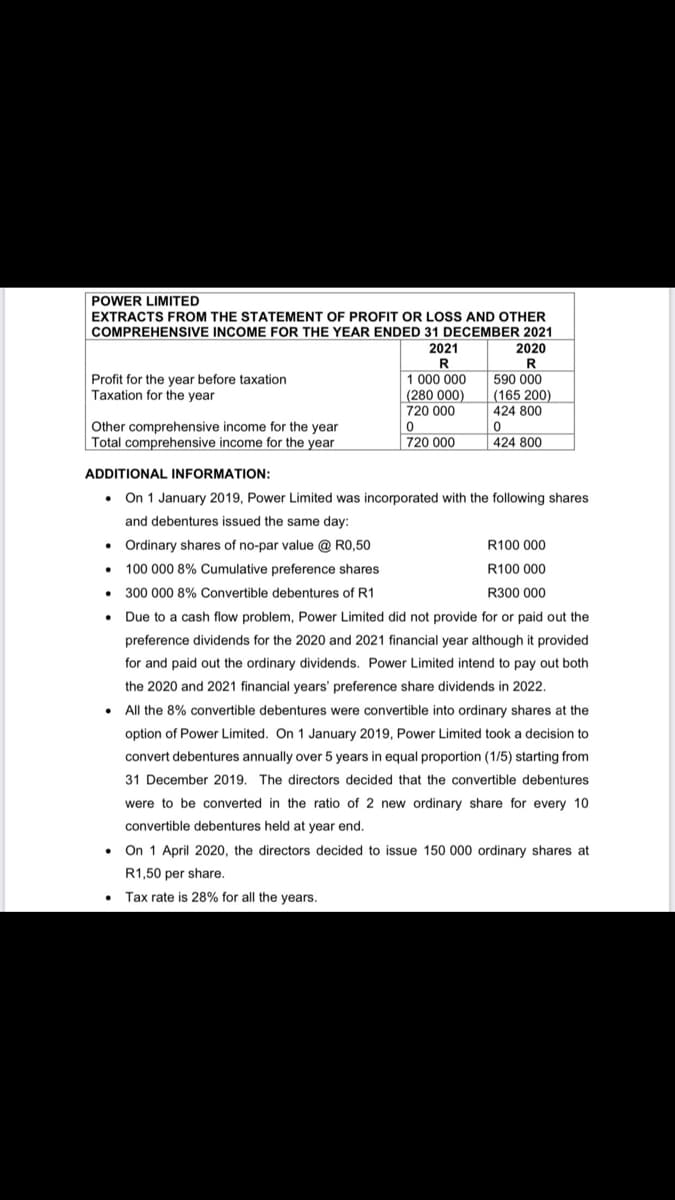

Transcribed Image Text:POWER LIMITED

EXTRACTS FROM THE STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021

2021

R

2020

R

Profit for the year before taxation

Taxation for the year

1 000 000

(280 000)

590 000

|(165 200)

720 000

424 800

Other comprehensive income for the year

Total comprehensive income for the year

| 720 000

424 800

ADDITIONAL INFORMATION:

On 1 January 2019, Power Limited was incorporated with the following shares

and debentures issued the same day:

• Ordinary shares of no-par value @ RO,50

• 100 000 8% Cumulative preference shares

R100 000

R100 000

• 300 000 8% Convertible debentures of R1

R300 000

Due to a cash flow problem, Power Limited did not provide for or paid out the

preference dividends for the 2020 and 2021 financial year although it provided

for and paid out the ordinary dividends. Power Limited intend to pay out both

the 2020 and 2021 financial years' preference share dividends in 2022.

All the 8% convertible debentures were convertible into ordinary shares at the

option of Power Limited. On 1 January 2019, Power Limited took a decision to

convert debentures annually over 5 years in equal proportion (1/5) starting from

31 December 2019. The directors decided that the convertible debentures

were to be converted in the ratio of 2 new ordinary share for every 10

convertible debentures held at year end.

On 1 April 2020, the directors decided to issue 150 000 ordinary shares at

R1,50 per share.

• Tax rate is 28% for all the years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning