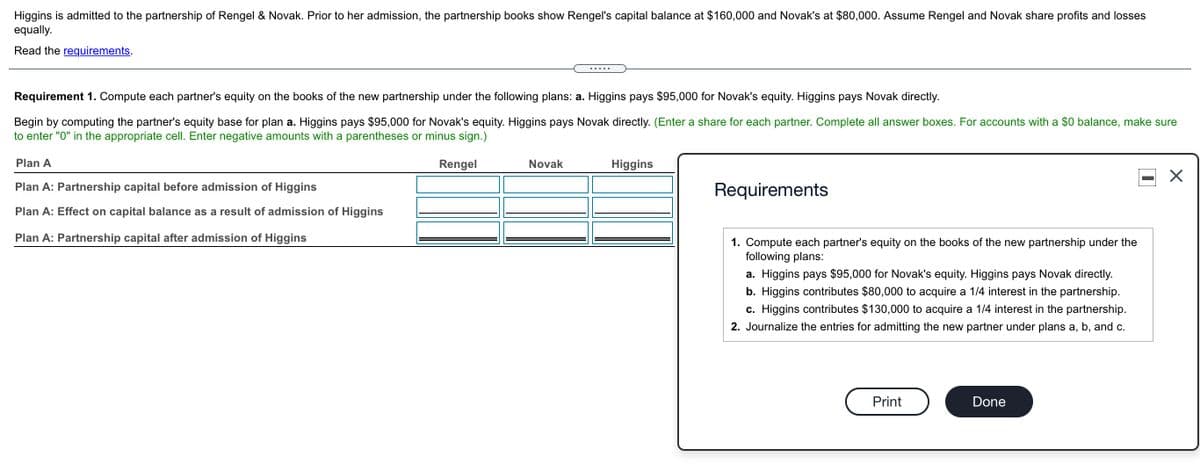

Higgins is admitted to the partnership of Rengel & Novak. Prior to her admission, the partnership books show Rengel's capital balance at $160,000 and Novak's at $80,000. Assume Rengel and Novak share profits and losses equally. Read the requirements. Requirement 1. Compute each partner's equity on the books of the new partnership under the following plans: a. Higgins pays $95,000 for Novak's equity. Higgins pays Novak directly. Begin by computing the partner's equity base for plan a. Higgins pays $95,000 for Novak's equity. Higgins pays Novak directly. (Enter a share for each partner. Complete all answer boxes. For accounts with a $0 balance, make sure to enter "0" in the appropriate cell. Enter negative amounts with a parentheses or minus sign.) Plan A Rengel Novak Higgins Plan A: Partnership capital before admission of Higgins Requirements Plan A: Effect on capital balance as a result of admission of Higgins Plan A: Partnership capital after admission of Higgins 1. Compute each partner's equity on the books of the new partnership under the following plans: a. Higgins pays $95,000 for Novak's equity. Higgins pays Novak directly. b. Higgins contributes $80,000 to acquire a 1/4 interest in the partnership. c. Higgins contributes $130,000 to acquire a 1/4 interest in the partnership. 2. Journalize the entries for admitting the new partner under plans a, b, and c. Print Done

Higgins is admitted to the partnership of Rengel & Novak. Prior to her admission, the partnership books show Rengel's capital balance at $160,000 and Novak's at $80,000. Assume Rengel and Novak share profits and losses equally. Read the requirements. Requirement 1. Compute each partner's equity on the books of the new partnership under the following plans: a. Higgins pays $95,000 for Novak's equity. Higgins pays Novak directly. Begin by computing the partner's equity base for plan a. Higgins pays $95,000 for Novak's equity. Higgins pays Novak directly. (Enter a share for each partner. Complete all answer boxes. For accounts with a $0 balance, make sure to enter "0" in the appropriate cell. Enter negative amounts with a parentheses or minus sign.) Plan A Rengel Novak Higgins Plan A: Partnership capital before admission of Higgins Requirements Plan A: Effect on capital balance as a result of admission of Higgins Plan A: Partnership capital after admission of Higgins 1. Compute each partner's equity on the books of the new partnership under the following plans: a. Higgins pays $95,000 for Novak's equity. Higgins pays Novak directly. b. Higgins contributes $80,000 to acquire a 1/4 interest in the partnership. c. Higgins contributes $130,000 to acquire a 1/4 interest in the partnership. 2. Journalize the entries for admitting the new partner under plans a, b, and c. Print Done

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 43P

Related questions

Question

Transcribed Image Text:Higgins is admitted to the partnership of Rengel & Novak. Prior to her admission, the partnership books show Rengel's capital balance at $160,000 and Novak's at $80,000. Assume Rengel and Novak share profits and losses

equally.

Read the requirements.

.... .

Requirement 1. Compute each partner's equity on the books of the new partnership under the following plans: a. Higgins pays $95,000 for Novak's equity. Higgins pays Novak directly.

Begin by computing the partner's equity base for plan a. Higgins pays $95,000 for Novak's equity. Higgins pays Novak directly. (Enter a share for each partner. Complete all answer boxes. For accounts with a $0 balance, make sure

to enter "0" in the appropriate cell. Enter negative amounts with a parentheses or minus sign.)

Plan A

Rengel

Novak

Higgins

Plan A: Partnership capital before admission of Higgins

Requirements

Plan A: Effect on capital balance as a result of admission of Higgins

Plan A: Partnership capital after admission of Higgins

1. Compute each partner's equity on the books of the new partnership under the

following plans:

a. Higgins pays $95,000 for Novak's equity. Higgins pays Novak directly.

b. Higgins contributes $80,000 to acquire a 1/4 interest in the partnership.

c. Higgins contributes $130,000 to acquire a 1/4 interest in the partnership.

2. Journalize the entries for admitting the new partner under plans a, b, and c.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT