Holiday Corporation had the following stockholders' equity amounts on their balance sheet on December 31, 2020 (the end of their gth year of business): Common Stock, $10 par, 1,000,000 shares authorized, shares outstanding shares Issued, $2,300,000 8,400,000 Paid in Capital in Excess of Par - Common Paid in Capital from Treasury Stock Accumulated Other Comprehensive Income 10,000 160,000 Retained Earnings 5.321.000 Total Stockholders' Equity $16,191,000 During 2021, Holiday completed the following transactions: March 1 Sold 24,000 shares of common stock for $52 per share in cash. June 1 Purchased 12,000 shares of our own company stock for cash when the price

Holiday Corporation had the following stockholders' equity amounts on their balance sheet on December 31, 2020 (the end of their gth year of business): Common Stock, $10 par, 1,000,000 shares authorized, shares outstanding shares Issued, $2,300,000 8,400,000 Paid in Capital in Excess of Par - Common Paid in Capital from Treasury Stock Accumulated Other Comprehensive Income 10,000 160,000 Retained Earnings 5.321.000 Total Stockholders' Equity $16,191,000 During 2021, Holiday completed the following transactions: March 1 Sold 24,000 shares of common stock for $52 per share in cash. June 1 Purchased 12,000 shares of our own company stock for cash when the price

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 5MC: Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par...

Related questions

Question

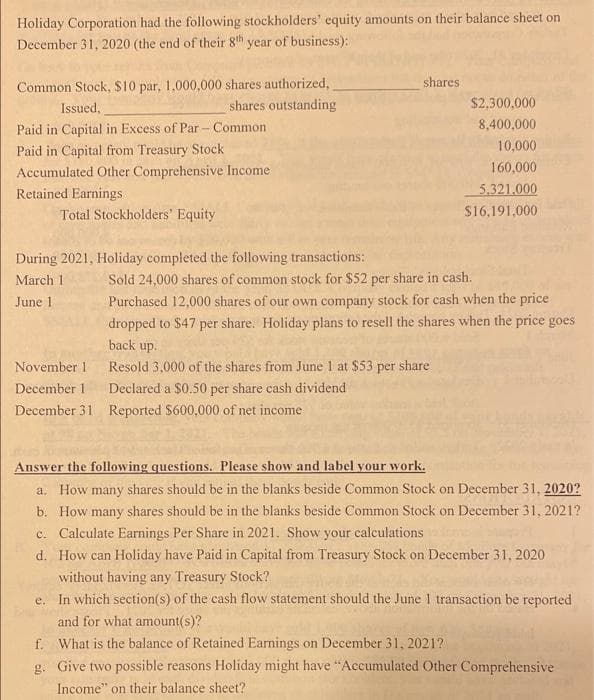

Transcribed Image Text:Holiday Corporation had the following stockholders' equity amounts on their balance sheet on

December 31, 2020 (the end of their 8th year of business):

Common Stock, $10 par, 1,000,000 shares authorized,

shares outstanding

shares

Issued,

$2,300,000

Paid in Capital in Excess of Par- Common

৪,400,000

10,000

Paid in Capital from Treasury Stock

Accumulated Other Comprehensive Income

160,000

Retained Earnings

5.321.000

Total Stockholders' Equity

$16,191,000

During 2021, Holiday completed the following transactions:

Sold 24,000 shares of common stock for $52 per share in cash.

Purchased 12,000 shares of our own company stock for cash when the price

March 1

June 1

dropped to $47 per share. Holiday plans to resell the shares when the price goes

back up.

November 1

Resold 3,000 of the shares from June 1 at $53 per share

December 1

Declared a $0.50 per share cash dividend

December 31 Reported $600,000 of net income

Answer the following questions. Please show and label your work.

a. How many shares should be in the blanks beside Common Stock on December 31, 2020?

b. How many shares should be in the blanks beside Common Stock on December 31, 2021?

c. Calculate Earnings Per Share in 2021. Show your calculations

d. How can Holiday have Paid in Capital from Treasury Stock on December 31, 2020

without having any Treasury Stock?

e. In which section(s) of the cash flow statement should the June I transaction be reported

and for what amount(s)?

f. What is the balance of Retained Earnings on December 31, 2021?

g. Give two possible reasons Holiday might have "Accumulated Other Comprehensive

Income" on their balance sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning