HOW DO I MAKE AN ADJUSTIMENT TABLE GIVIN THE INFORMATION THAT I HAVE ATTACHED ? Sandhill Store is located in midtown Madison. During the past several years, net income has

HOW DO I MAKE AN ADJUSTIMENT TABLE GIVIN THE INFORMATION THAT I HAVE ATTACHED ? Sandhill Store is located in midtown Madison. During the past several years, net income has

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 11EA: Prepare adjusting journal entries, as needed, considering the account balances excerpted from the...

Related questions

Question

HOW DO I MAKE AN ADJUSTIMENT TABLE GIVIN THE INFORMATION THAT I HAVE ATTACHED ?

Sandhill Store is located in midtown Madison. During the past several years, net income has been declining because of suburban shopping centers. At the end of the company’s fiscal year on November 30, 2020, the following accounts appeared in two of its

|

Unadjusted

|

Adjusted

|

Unadjusted

|

Adjusted

|

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Accounts Payable | $25,900 | $25,900 | Notes payable | $35,000 | $35,000 | |||||

| 31,000 | 31,000 | Owner’s Capital | 85,100 | 85,100 | ||||||

| Accumulated Depr.—Equipment | 34,000 | 45,000 | Owner’s Drawings | 10,000 | 10,000 | |||||

| Cash | 26,000 | 26,000 | Prepaid Insurance | 10,400 | 3,200 | |||||

| Cost of Goods Sold | 504,500 | 504,500 | Property Tax Expense | 2,500 | ||||||

| Freight-Out | 6,000 | 6,000 | Property Taxes Payable | 2,500 | ||||||

| Equipment | 146,000 | 146,000 | Rent Expense | 15,000 | 15,000 | |||||

| 11,000 | Salaries and Wages Expense | 96,000 | 96,000 | |||||||

| Insurance Expense | 7,200 | Sales Revenue | 720,000 | 720,000 | ||||||

| Interest Expense | 6,100 | 6,100 | Sales Commissions Expense | 6,500 | 11,000 | |||||

| Interest Revenue | 2,000 | 2,000 | Sales Commissions Payable | 4,500 | ||||||

| Inventory | 28,000 | 28,000 | Sales Returns and Allowances | 8,000 | 8,000 | |||||

| Utilities Expense |

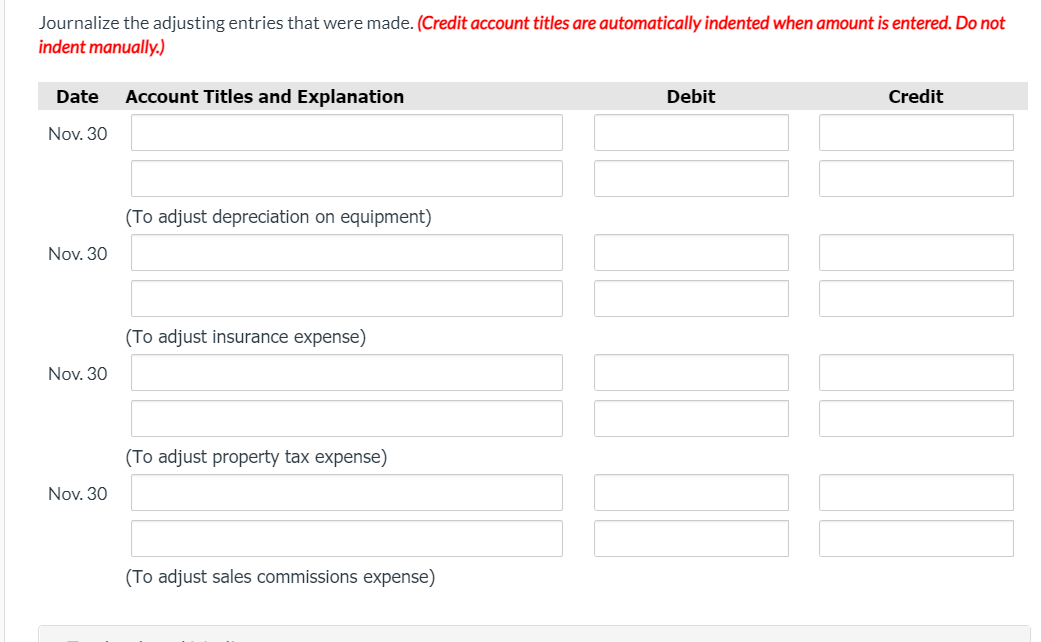

Transcribed Image Text:Journalize the adjusting entries that were made. (Credit account titles are automatically indented when amount is entered. Do not

indent manually.)

Date

Account Titles and Explanation

Debit

Credit

Nov. 30

(To adjust depreciation on equipment)

Nov. 30

(To adjust insurance expense)

Nov. 30

(To adjust property tax expense)

Nov. 30

(To adjust sales commissions expense)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage