How does partnership accounting differ from corporate accounting? Multiple Choice Revenues are recognized at a different time by a partnership than is appropriate for a corporation. Individual capital accounts replace the contributed capital and retained earnings belances found in corporate accounting The matching principle is not considered appropriate for partnership accounting. Partnerships report all assets at fair velue as of the latest balance sheet date.

How does partnership accounting differ from corporate accounting? Multiple Choice Revenues are recognized at a different time by a partnership than is appropriate for a corporation. Individual capital accounts replace the contributed capital and retained earnings belances found in corporate accounting The matching principle is not considered appropriate for partnership accounting. Partnerships report all assets at fair velue as of the latest balance sheet date.

Chapter21: Partnerships

Section: Chapter Questions

Problem 6BCRQ

Related questions

Question

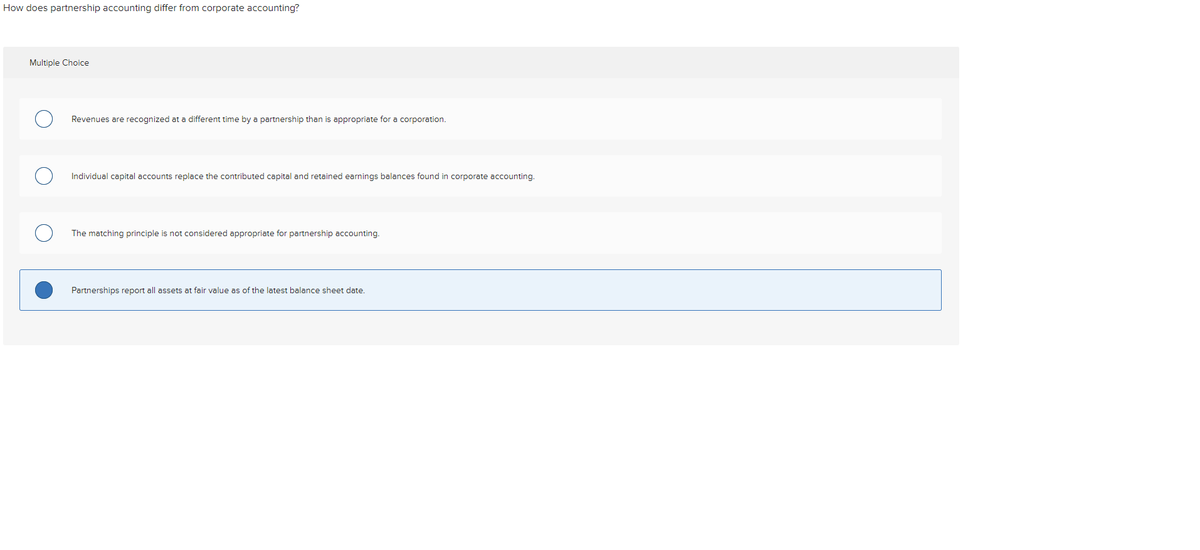

Transcribed Image Text:How does partnership accounting differ from corporate accounting?

Multiple Choice

Revenues are recognized at a different time by a partnership than is appropriate for a corporation.

Individual capital accounts replace the contributed capital and retained earnings balances found in corporate accounting.

The matching principle is not considered appropriate for partnership accounting.

Partnerships report all assets

fair value as of the latest balance sheet date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College