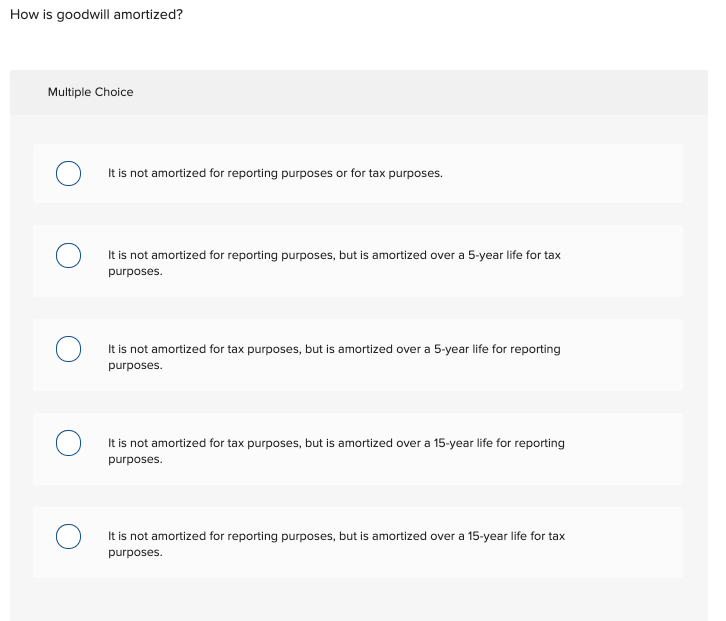

How is goodwill amortized? Multiple Choice It is not amortized for reporting purposes or for tax purposes. It is not amortized for reporting purposes, but is amortized over a 5-year life for tax purposes. It is not amortized for tax purposes, but is amortized over a 5-year life for reporting purposes. It is not amortized for tax purposes, but is amortized over a 15-year life for reporting purposes. It is not amortized for reporting purposes, but is amortized over a 15-year life for tax purposes.

How is goodwill amortized? Multiple Choice It is not amortized for reporting purposes or for tax purposes. It is not amortized for reporting purposes, but is amortized over a 5-year life for tax purposes. It is not amortized for tax purposes, but is amortized over a 5-year life for reporting purposes. It is not amortized for tax purposes, but is amortized over a 15-year life for reporting purposes. It is not amortized for reporting purposes, but is amortized over a 15-year life for tax purposes.

Chapter17: Property Transactions: § 1231 And Recapture Provisions

Section: Chapter Questions

Problem 27CE

Related questions

Question

100%

Transcribed Image Text:How is goodwill amortized?

Multiple Choice

It is not amortized for reporting purposes or for tax purposes.

It is not amortized for reporting purposes, but is amortized over a 5-year life for tax

purposes.

It is not amortized for tax purposes, but is amortized over a 5-year life for reporting

purposes.

It is not amortized for tax purposes, but is amortized over a 15-year life for reporting

purposes.

It is not amortized for reporting purposes, but is amortized over a 15-year life for tax

purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning