How is this ratio calculated? What does the ratio show? Using the data below (Sunn Corporation) , calculate and discuss the implications of Sunn's RM Inventory Turnover. Days' Sales in Raw Materials Inventory B. How is this ratio calculated? What does the ratio show? Using the data below (Sunn Corporation) calculate and discuss the implications of Sunn's Days' Sales in RM Inventory

How is this ratio calculated? What does the ratio show? Using the data below (Sunn Corporation) , calculate and discuss the implications of Sunn's RM Inventory Turnover. Days' Sales in Raw Materials Inventory B. How is this ratio calculated? What does the ratio show? Using the data below (Sunn Corporation) calculate and discuss the implications of Sunn's Days' Sales in RM Inventory

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 3.4C

Related questions

Question

PART 1:

Raw Materials Inventory Turnover

A. How is this ratio calculated?

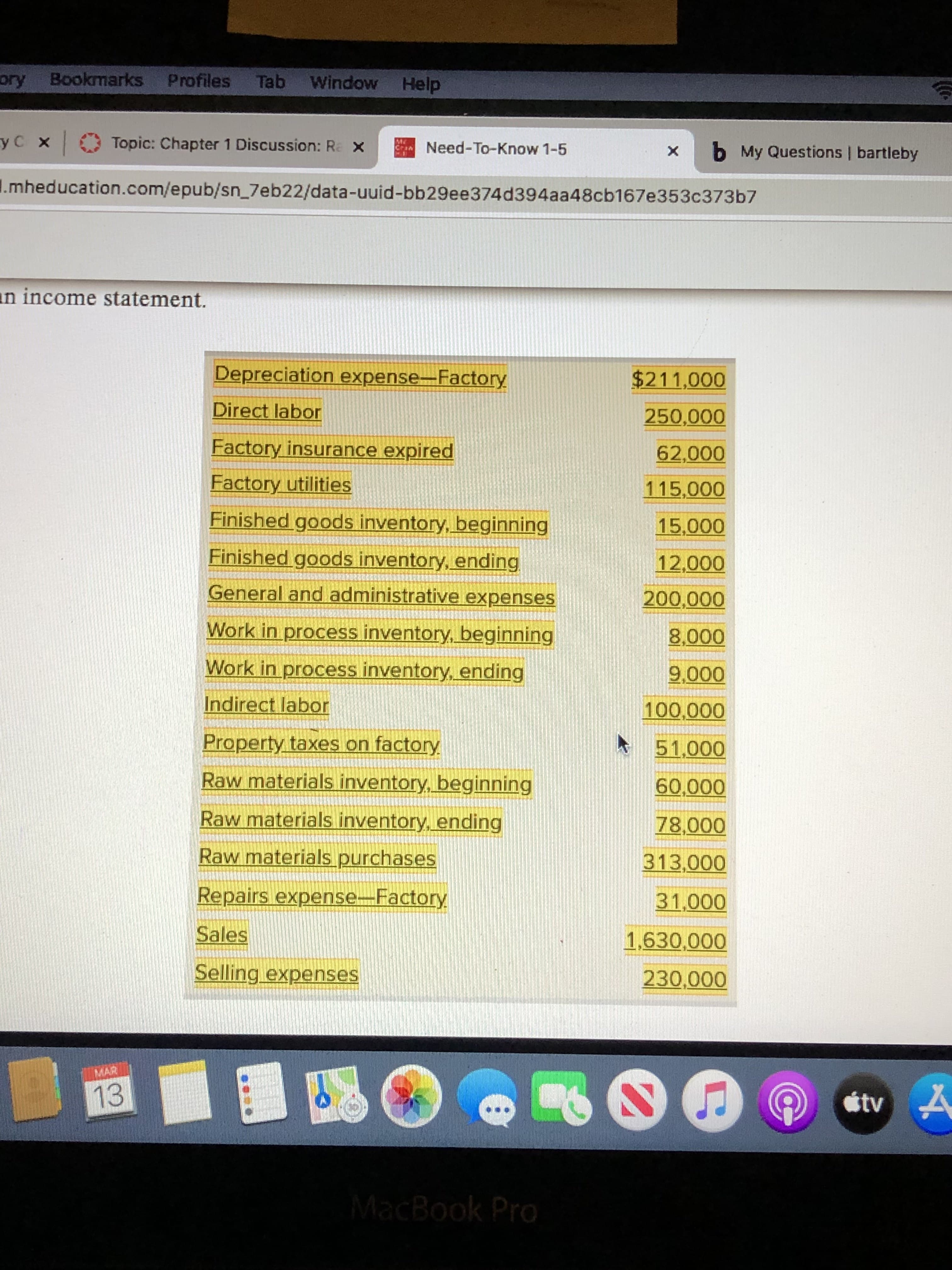

What does the ratio show?

Using the data below (Sunn Corporation) , calculate and discuss the implications of Sunn's RM Inventory Turnover.

Days' Sales in Raw Materials Inventory

B. How is this ratio calculated?

What does the ratio show?

Using the data below (Sunn Corporation) calculate and discuss the implications of Sunn's Days' Sales in RM Inventory

Transcribed Image Text:Bookmarks Profiles Tab

Window Help

yC x Topic: Chapter 1 Discussion: Re x

Need-To-Know 1-5

b My Questions | bartleby

Cran

I.mheducation.com/epub/sn_7eb22/data-uuid-bb29ee374d394aa48cb167e353c373b7

an income statement.

Depreciation expense-Factory

$211,000

Direct labor

250,000

Factory insurance expired

62,000

Factory utilities

115,000

Finished goods inventory, beginning

15,000

Finished goods inventory, ending

12,000

General and administrative expenses

000'007

Work in process inventory, beginning

000

Work in process inventory, ending

Indirect labor

Property taxes on factory

000'

Raw materials inventory, beginning

000'09

Raw materials inventory, ending

000'8

Raw materials purchases

313,000

Repairs expense-Factory

000

Sales

1,630,000

Selling expenses

230,000

MAR

13

étv A

MacBook Pro

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning