How much is the cost of th

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 40P

Related questions

Question

How much is the cost of the machinery?

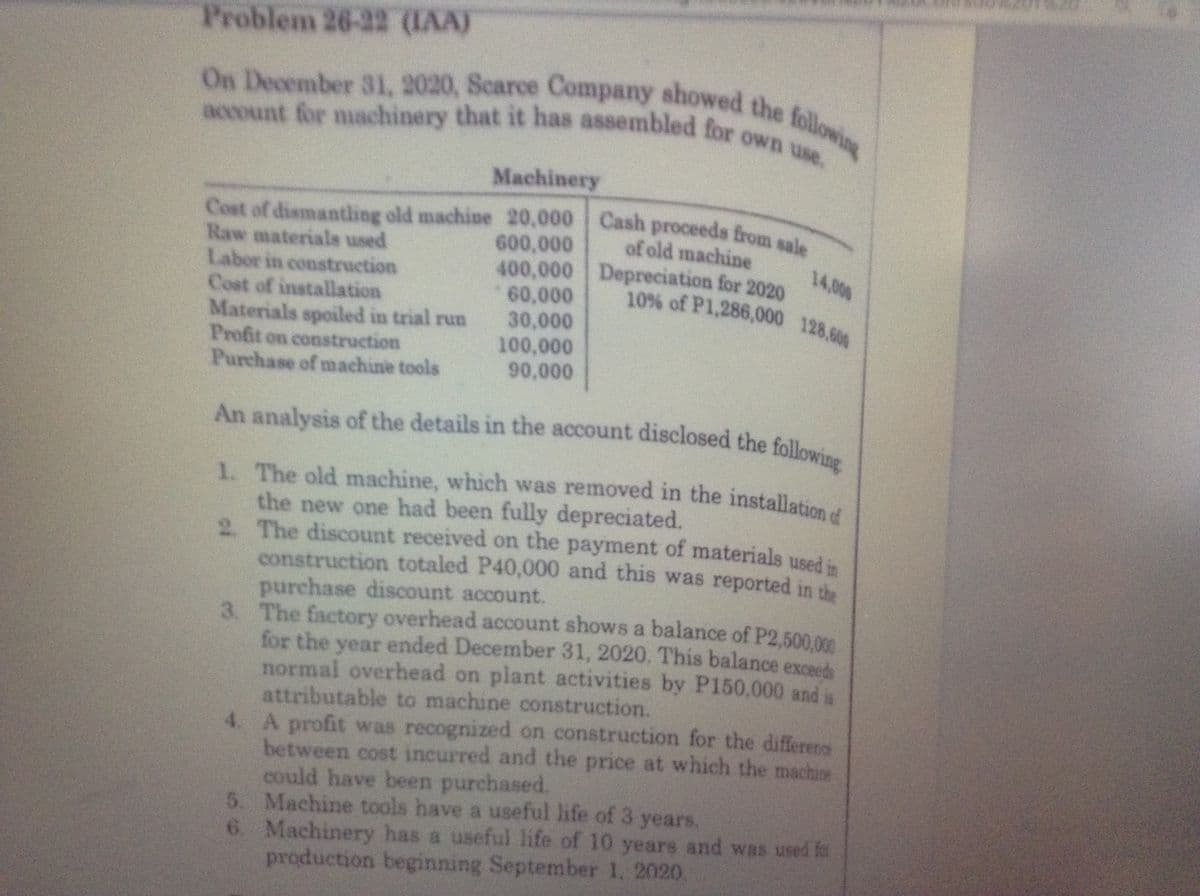

Transcribed Image Text:Problem 26-22 (IAA)

1. The old machine, which was removed in the installation of

On December 31, 2020, Scarce Company showed the following

10% of P1,286,000 128,600

account for machinery that it has assembled for own use.

An analysis of the details in the account disclosed the following

Cost of dismantling old machine 20,000 Cash proceeds from sale

account for machinery that it has assembled for owelo

Machinery

Cost of dismantling old machine 20,000 Cash proceeds from sal

Raw materials used

Labor in construction

Cost of installation

Materials spoiled in trial run

Profit on construction

Purchase of machine tools

of old machine

600,000

400,000 Depreciation for 2020

60,000

30,000

100,000

90,000

14,000

the new one had been fully depreciated.

2 The discount received on the payment of materials used in

construction totaled P40,000 and this was reported in the

purchase discount account.

3. The factory overhead account shows a balance of P2,500.000

for the year ended December 31, 2020. This balance exceeds

normal overhead on plant activities by P150,000 and

attributable to machine construction.

4. A profit was recognized on construction for the differens

between cost incurred and the price at which the machine

could have been purchased.

5. Machine tools have a useful life of 3 years.

6. Machinery has a useful life of 10 years and was used for

production beginning September 1. 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning