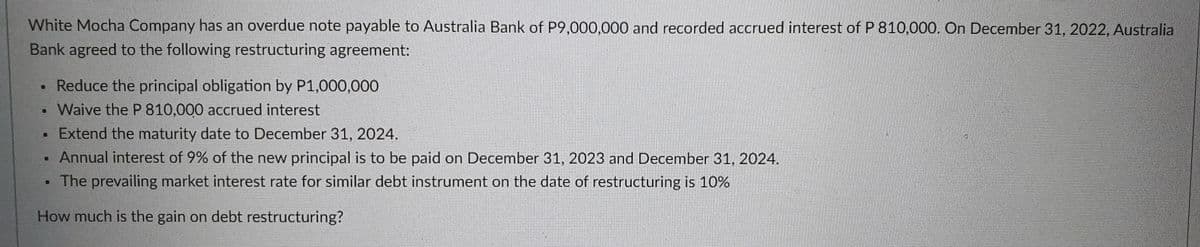

How much is the gain on debt restructuring?

Q: inception is $100,000. Assume that the present value of lease payments discounted at a 10% interest…

A: An operating lease tends to have a shorter duration than a capital lease, and the lessee does not…

Q: NEW Q1. Mark Johnson is controller for a Pharmaceutical company. During the company's midyear…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The Commissioner has the authority to prescribe real property values subject to limitations set by…

A: Under the powers and responsibilities of the commissioner, authority to value the real property has…

Q: During 20x9, PP Corporation recorded sales of inventory costing P500,0000 to SS Company, its wholly…

A: The cost of goods sold includes the costs incurred by the business in respect of manufacturing and…

Q: Selected ledger account balances for Business Solutions follow. For Three Months For Three Months…

A: Under straight-line method, depreciation expense for a given year is equal to 4 times the…

Q: Exercise 11-31 (Algo) Impairment; goodwill (LO11-8] [The following information applies to the…

A: 2)Computation of the impairment loss: In the above question, Book value of Centerpoint's net assets…

Q: Instruction : Based on the transaction, show the effect on the expanded accounting equation…

A: An Accounting equation shows the equality between the resources and the sources which finance the…

Q: Sycamore will record interest revenue in 2022 of?

A: Interest = 92278*0.10/2 - 100000*0.08/2 =P614

Q: The meaning of the term “limited liability” 2. The various sources of capital for a limited…

A: Solution Introduction In terms of the liability , the business are broadly divided into 2 categories…

Q: olders. (The user subsequently codes this information onto a magnetic coding device and places this…

A: Preventive control: Preventive control refers to the steps taken so that errors do not occur. For…

Q: A year ago, a newly married couple decided not to buy a house, and they were looking at a house with…

A: Since you have posted a question with multiple sub parts, as per answering guidelines we shall be…

Q: First statement. The drawer’s liability is secondary. Second statement. The instrument becomes…

A: Financial Instruments: A financial instrument is defined as a contract between individuals/parties…

Q: Smith Wesson Net income $10,000 $100,000 Net sales 50,000 400,000 Calculate the profit margin ratio…

A: Lets understand the basics. Profit margin is a margin generated from the sales. It is a comparison…

Q: For what decisions is the manager of a cost center not responsible?

A: The answer for the question on cost centre has been discussed hereunder : There are different…

Q: Sally has a sum of $26000 that she invests at 12% compounded monthiy. What equal monthly payments…

A: solution the present value of annuity technique is used for the problem where the equal annual…

Q: QUESTION 9 Using the incomplete Flexible Budget Performance Report below, calculate the total fixed…

A: A flexible budget is prepared on the basis of the budgeted rate and on the basis of different…

Q: TT Company holds 90 percent of BB Company’s common stock. In the current year, TT reports sales of…

A: Introduction:- The following basic information as follows under:- TT Company holds 90 percent of BB…

Q: When managerial accountants design an evaluation system that is based on criteria for which a…

A: Introduction:- Performance measurement may be termed as it is an indicator in management accounting…

Q: RUZ, INCORPORATED Comparative Balance Sheets At December 31 2021 2020 Assets Cash $ 66,100 $…

A: Cash flow statement means the statement which shows the cash inflow and outflow during the specified…

Q: In your words, what is the legal responsibility of the auditor?

A: Auditors are the authorized individual to examine the financials or accounts of the companies and…

Q: _______ A term for the debts of a firm

A: A debt is an amount owing for borrowed cash. The lender agrees to lend cash to the borrower in…

Q: Denis purchased a $10.000 face value Ontario Hydro Energy bond maturing in four years. The coupon…

A: Bond:- It is the loan that is taken by companies and the government from investors instead of banks.…

Q: Suppose you buy a January expiration put option on 200 shares with the exercise price of $45. If the…

A: solution concept Put option means the right to sell the stock Strike price means the price at which…

Q: Piece of Pizza Company is preparing its master budget for its first year of business. It expects to…

A: Lets understand the basics. Management calculates cash collection and cash disbursement details so…

Q: What is life-cycle and/or full-cost accounting? IS THERE A DIFFERENCE?

A: In this question, we have to tell about life-cycle costing and full cost accounting, whether these…

Q: Two possible transfer prices (for 4,000 units) are under consideration by the two divisions: P35 and…

A: Transfer price means the price charged by one department from other department of the same company…

Q: AA Company maintained cash in bank at Lunar Bank. This account is used for disbursement to various…

A: Calculation of the correct cash balance as of December 31, 2022:- P 2,230,000 is the correct answer.…

Q: Cane Company manufactures two products called Alpha and Beta that sell for $150 and $105,…

A: In order to determine the contribution margin per unit, the variable cost per unit is required to be…

Q: ompany’s total amount of common fixed expenses?

A: Traceable fixed manufacturing overhead is related to that particular product so that is avoidable in…

Q: Alfredo Incorporated reports net income of $233,000 for the year ended December 31. It also reports…

A: Indirect Method of Cash Flow Statement is the method that reconciles the net profit with the cash…

Q: revealed the following events: During the year ended December 31, 2021, Samar Company A counting…

A: Prior period errors are omissions from, and misstatements in, the entity’s financial statements for…

Q: The Professional Service Company expects 70% of sales for cash and 30% on credit. The company…

A: Credit Sales of June: 70% will be collected in June. 25% will be collected in July. 5% are not…

Q: July 2 Purchased 1500 Gizmos from T Co. @ $3 eạ for cash July 5 Purchased 2000 Gizmos from Z Co @ $3…

A: What is meant by Journal Entries? It is the first step to record the financial transactions in the…

Q: Feinan Sports, Inc., manufactures sporting equipment, including weight-lifting gloves. A national…

A: Relevant Costing: Relevant cost is the cost for the special orders. The Relevant Cost: All the…

Q: Assets received in donation should Obe expensed upon receipt. O should not be depreciated. O be…

A: Assets received in donation or Donated assets are assets given to the entity as a gift.

Q: Gomez Corporation uses the allowance method to account for uncollectibles. On January 31, it wrote…

A: Allowance method for bad debts is the method in which allowance is made for the account receivable…

Q: Extrim Company produces monitors. Extrim’s plant in San Antonio uses a standard costing system. The…

A: Since you have posted question with multiple sub-parts, we will do the first three sub-parts for…

Q: Tart Restaurant Holdings, Incorporated began the year with a retained earnings balance of $950,000.…

A: Formula: Ending Retained Earnings = Beginning Retained Earnings + net income - Dividends paid

Q: You plan on starting a lawn mowing business by investing $700 of your own money and purchasing $500…

A: Total contribution margin = Total sales revenue - Total variable cost where, Total variable cost =…

Q: TT Company owns 100 percent of the capital stock of both BB Corporation and CC Corporation. BB…

A: Income statement is prepared by the business organizations so as to know how much amount of gross…

Q: An entity presented the following comparative financial information: 2018…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: reported the following data. Administrative expenses 435,000 Cost of goods sold 1,289,000 Interest…

A: Single-step income statement refers to the straightforward form of statement which simplifies the…

Q: The purchase of treasury share does not affect Group of answer choices the amount of share issued.…

A: Treasury stock are those stocks which have been repurchased by the company.

Q: PAGGYTY Industries has current assets equal to $4 million. The company's current ratio is 2.0, and…

A: Lets understand the basics. Current ratio indicates the current asset in compare to current…

Q: AA Corporation holds 80 percent of the stock of Movie Production Inc. During 20x9, AA purchased an…

A: Net Income is the revenue amount reduced by cost of goods sold. The calculation is given below:

Q: Determine the sales volume corresponding to the unhealthy point.

A: Givne data Income = P2,500 per unit Fixed costs = P150,000 per month Variable costs = P1,000 per…

Q: A company issues P5,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2022. Interest is paid on…

A: The bonds are issued at discount when market rate is higher than the coupon rate of bonds payable.

Q: Davison Inc. consists of two districts, A and B. The company as a whole had sales of$400,000, a…

A: Total traceable Fixed expense = Total contribution - combined segment margin

Q: 1. What amount should Warren report as the cumulative effect of this change? 2. On January 1, year…

A: A change in depreciation method is no longer given cumulative effect treatment on the income…

Q: Do the balance sheet, income statement, and statement of cash flows contain all the information you…

A: The balance sheet is one of the three basic financial statements that are required for both…

Step by step

Solved in 2 steps

- On July 1, 2019, Aldrich Company purchased as an available-for-sale security 200,000 face value, 9% U.S. Treasury notes for 194,000. The notes mature July 1, 2020, and pay interest semiannually on January 1 and July 1. The notes were sold on December 1, 2019, for 199,000. Aldrich normally uses straight-line amortization on all of its notes. In its income statement for the year ended December 31, 2019, what amount should Aldrich report as a gain on the sale of the available-for-sale security? a. 2,500 b. 3,500 c. 5,000 d. 6,000On January 1, 2019, Northfield Corporation becomes delinquent on a 100,000, 14% note to First National Bank, on which 16,651 of interest has accrued. On January 2, 2019, the bank agrees to restructure the note. It forgives the accrued interest, extends the repayment date to December 31, 2021, and reduces the interest rate to 10%. Required: Prepare a schedule for Northfield to compute the annual interest expense in regard to the preceding note for each year of the restructuring agreement.On January 1, 2018, Granada Company has an overdue 8% note payable to First Bank at P8,000,000 and accrued interest of P640,000. As a result of a restructuring agreement on January 1, 2018, First Bank agreed to the following provisions: • The principal obligation is reduced to P7,000,000. • The accrued interest of P640,000 is forgiven. • The date of maturity is extended to December 31, 2021. • Annual interest of 10% is to be paid for 4 years every December 31. The present value of 1 at 8% for 4 periods is 0.735 and the present value of an ordinary annuity of 1 at 8% for 4 periods is 3.31.What is the gain on extinguishment of debt to be recognized for 2018?

- ABC Company, due to extreme financial difficulties has negotiated a restructuring of its 10%, P10,000,000 note payable due on December 31, 2021. The unpaid interest on the note on such date is P1,000,000. The creditor has agreed to reduce the face value to P8,000,000, forgive the unpaid interest, reduce interest rate to 8% and extend the due date three years from December 31, 2021. The present value of 1 at 10% for three periods is 0.75 and present value of an ordinary annuity of 1 at 10% for three periods is 2.49. What is the gain on extinguishment of debt to be recognized by ABC Company on December 21, 2021?Good Company has an overdue 8% notes payable to Better Company amounting to P8million and accrued interest for one year of P640,000. as a result of restructuring agreement on January 1, 2021, both parties agreed to the following provisions:* the principal obligation is reduced to P7,000,000* the accrued interest is forgiven* the date of maturity is extended to December 31, 2024* annual interest of 10% is to be paid in 4 years every December 31The prevailing rate of interest remained at 8%. The PV of 1 at 8% for 4 periods is 0.735 and the PV of an ordinary annuity of 1 at 8% for 4 periods is 3.31. How much is the gain on debt restructuring? a. P1,640,000 b. P1,178,000 c. P1,000,000 d. P538,000Due to extreme financial difficulties, Armada Company has negotiated a restructuring of its 10% P5,000,000 note payable due on December 31, 2021. The unpaid interest on the note on such date is P500,000. The creditor has agreed to reduce the face value to P4,000,000, forgive the unpaid interest, reduce the interest rate to 8% and extend the due date three years from December 31, 2021. 1. What is the interest expense for 2022? 2. What amount should Armada Company report as gain (loss) on extinguishment of debt in 2021?

- Due to extreme financial difficulties, Armada Company has negotiated a restructuring of its 10% P5,000,000 note payable due on December 31, 2021. the unpaid interest on the note on such date is P500,000. the creditor has agreed to reduce the face value to P4,000,000, forgive the unpaid interest, reduce the interest rate to 8% and extend the due date three years from December 31, 2021. Armada Company should report gain on extinguishment of debt in its 2021 income statement at Group of answer choices 1,203,200 1,703,200 540,000 2,000000On January 1, 2021, Chong Company had an overdue 10% note payable to AprilBank at P8,000,000 with accrued interest of P800,000. The company and the creditor agreed for the following restructuring agreement: 1. Reduced the principal obligation to P7,000,000. 2. Forgave the P700,000 of the accrued interest, and the remainder shall be added to the reduced principal obligation, payable at the end of the term. 3. Extended the maturity date to two years. The interest rate remained the same, payable annually. The market rate of interest is also the same with the nominal rate. What is the gain (or loss) on restructuring to be recognized in the profit or loss? The PV of 1 at 10% for two periods is 0.83, and the PV of an ordinary annuity of 1 at 10% for two periods is 1.74.On December 31, 2020, American Bank enters into a debt restructuring agreement with Barkley Company, which is now experiencing financial trouble. The bank agrees to restructure a 12%, issued at par, $3,000,000 note receivable by the following modifications: 1. Reducing the principal obligation from $3,000,000 to $2,400,000. 2. Extending the maturity date from December 31, 2020, to January 1, 2024. 3. Reducing the interest rate from 12% to 10%. Barkley pays interest at the end of each year. On January 1, 2024, Barkley Company pays $2,400,000 in cash to American Bank. Instructions a. Will the gain recorded by Barkley be equal to the loss recorded by American Bank under the debt restructuring? Explain. b. Can Barkley Company record a gain under the term modification mentioned above? Explain. c. Assuming that the interest rate Barkley should use to compute interest expense in future periods is 1.4276%, prepare the interest payment schedule of the note for Barkley Company…

- Due to extreme financial difficulties, Armand Company had negotiated a restructuring of a 10% P 5,000,000 note payable due on Dec. 31, 2020. The unpaid interest on such date was P 500,000. The creditor agreed to reduce the face amount to P 4,000,000, forgive the unpaid interest, reduce the interest rate to 8% and extend the due date three years from Dec. 31, 2020. The present value of 1 at 10% for 3-periods is 0.75 and the present value of an ordinary annuity of 1 at 10% for 3-periods is 2.49. REQUIRED What is the gain on extinguishment for 2020? What is the interest expense for 2021?On December 31, 2020, American Bank enters into a debt restructuring agreement with Shamrock Company, which is now experiencing financial trouble. The bank agrees to restructure a 12%, issued at par, $3,760,000 note receivable by the following modifications: 1. Reducing the principal obligation from $3,760,000 to $3,008,000. 2. Extending the maturity date from December 31, 2020, to January 1, 2024. 3. Reducing the interest rate from 12% to 10%. Shamrock pays interest at the end of each year. On January 1, 2024, Shamrock Company pays $3,008,000 in cash to American Bank. Assuming that the interest rate Shamrock should use to compute interest expense in future periods is 1.4276%, prepare the interest payment schedule of the note for Shamrock Company after the debt restructuring. (Round answers to 0 decimal places, e.g. 38,548.) SHAMROCK COMPANYInterest Payment Schedule After Debt RestructuringEffective-Interest Rate Date CashPaid InterestExpense…On December 31, 2018, ABC Corp. acquired Garlic Corp.’s P1,000,000 notes for P927,880. The market interest rate at that time was 12%. The stated interest rate was 10%, payable annually. THe notes mature in five years and classifies as financial asset at amortized cost. At December 31, 2020, the note is considered credit-impaired. Management determined that it was probable that the issuer would pay back only P600,000 of the principal at maturity. At December 31,2021, because of the improvement in the credit rating of Garlic Corp., Sinait Corp. reassessed the collectibility of the note and now expects to collect P900,000 from Garlic Corp, at maturity date. The required loss allowance at December 31,2020 is Interest income to be recognized in 2021 profit or loss The impairment gain to be recognized in 2021 profit or loss is