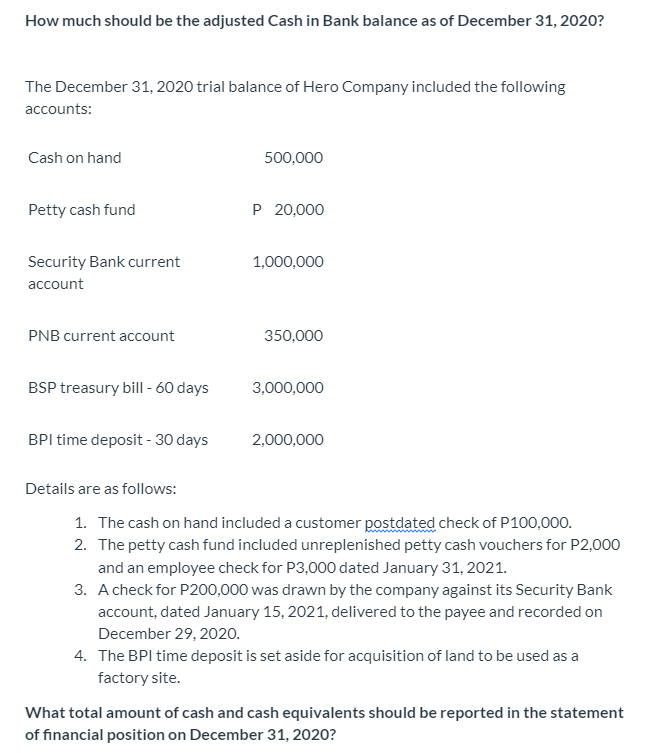

How much should be the adjusted Cash in Bank balance as of December 31, 2020? The December 31, 2020 trial balance of Hero Company included the following accounts: Cash on hand 500,000 Petty cash fund P 20,000 Security Bank current 1,000,000 account PNB current account 350,000 BSP treasury bill - 60 days 3,000,000 BPI time deposit - 30 days 2,000,000 Details are as follows: 1. The cash on hand included a customer postdated check of P100,000. 2. The petty cash fund included unreplenished petty cash vouchers for P2,000 and an employee check for P3,000 dated January 31, 2021. 3. A check for P200,000 was drawn by the company against its Security Bank account, dated January 15, 2021, delivered to the payee and recorded on December 29, 2020. 4. The BPI time deposit is set aside for acquisition of land to be used as a factory site.

How much should be the adjusted Cash in Bank balance as of December 31, 2020? The December 31, 2020 trial balance of Hero Company included the following accounts: Cash on hand 500,000 Petty cash fund P 20,000 Security Bank current 1,000,000 account PNB current account 350,000 BSP treasury bill - 60 days 3,000,000 BPI time deposit - 30 days 2,000,000 Details are as follows: 1. The cash on hand included a customer postdated check of P100,000. 2. The petty cash fund included unreplenished petty cash vouchers for P2,000 and an employee check for P3,000 dated January 31, 2021. 3. A check for P200,000 was drawn by the company against its Security Bank account, dated January 15, 2021, delivered to the payee and recorded on December 29, 2020. 4. The BPI time deposit is set aside for acquisition of land to be used as a factory site.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 20E

Related questions

Question

Transcribed Image Text:How much should be the adjusted Cash in Bank balance as of December 31, 2020?

The December 31, 2020 trial balance of Hero Company included the following

accounts:

Cash on hand

500,000

Petty cash fund

P 20,000

Security Bank current

1,000,000

account

PNB current account

350,000

BSP treasury bill - 60 days

3,000,000

BPI time deposit - 30 days

2,000,000

Details are as follows:

1. The cash on hand included a customer postdated check of P100,000.

2. The petty cash fund included unreplenished petty cash vouchers for P2,000

and an employee check for P3,000 dated January 31, 2021.

3. A check for P200,000 was drawn by the company against its Security Bank

account, dated January 15, 2021, delivered to the payee and recorded on

December 29, 2020.

4. The BPI time deposit is set aside for acquisition of land to be used as a

factory site.

What total amount of cash and cash equivalents should be reported in the statement

of financial position on December 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,