How to calculate the answer of Tax Allowable depreciation?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 17P: The Perez Company has the opportunity to invest in one of two mutually exclusive machines that will...

Related questions

Question

How to calculate the answer of Tax Allowable

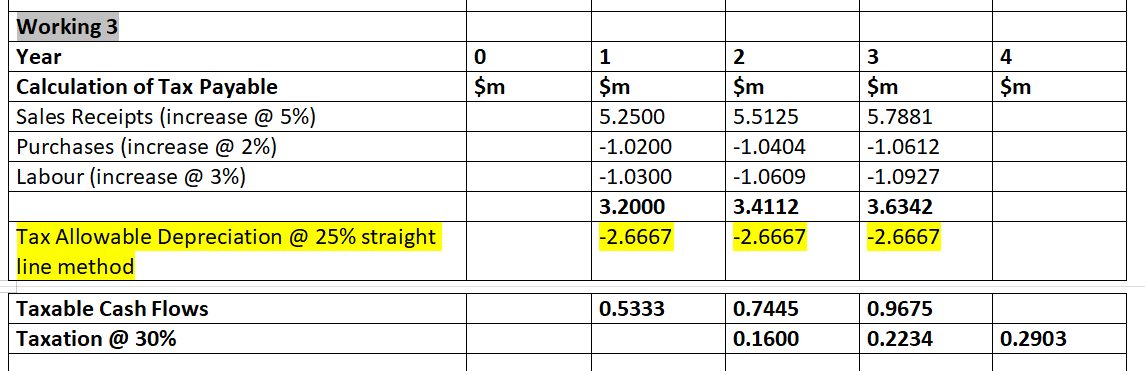

Transcribed Image Text:Working 3

Year

1

2

3

4

Calculation of Tax Payable

$m

$m

$m

$m

$m

Sales Receipts (increase @ 5%)

Purchases (increase @ 2%)

Labour (increase @ 3%)

5.2500

5.5125

5.7881

-1.0200

-1.0404

-1.0612

-1.0300

-1.0609

-1.0927

3.2000

3.4112

3.6342

Tax Allowable Depreciation @ 25% straight

-2.6667

-2.6667

-2.6667

line method

Taxable Cash Flows

0.5333

0.7445

0.9675

Taxation @ 30%

0.1600

0.2234

0.2903

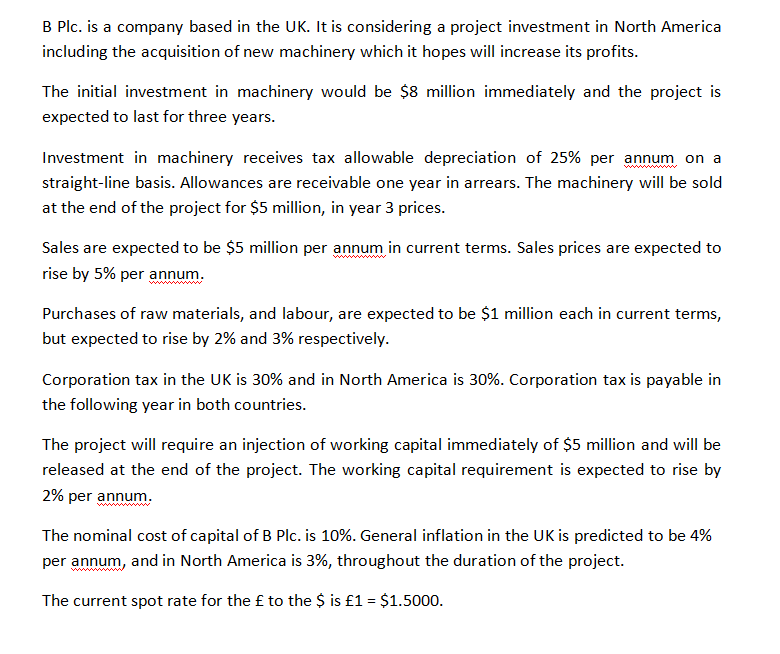

Transcribed Image Text:B Plc. is a company based in the UK. It is considering a project investment in North America

including the acquisition of new machinery which it hopes will increase its profits.

The initial investment in machinery would be $8 million immediately and the project is

expected to last for three years.

Investment in machinery receives tax allowable depreciation of 25% per annum on a

www w

straight-line basis. Allowances are receivable one year in arrears. The machinery will be sold

at the end of the project for $5 million, in year 3 prices.

Sales are expected to be $5 million per annum in current terms. Sales prices are expected to

rise by 5% per annum.

www

Purchases of raw materials, and labour, are expected to be $1 million each in current terms,

but expected to rise by 2% and 3% respectively.

Corporation tax in the UK is 30% and in North America is 30%. Corporation tax is payable in

the following year in both countries.

The project will require an injection of working capital immediately of $5 million and will be

released at the end of the project. The working capital requirement is expected to rise by

2% per annum.

The nominal cost of capital of B Plc. is 10%. General inflation in the UK is predicted to be 4%

per annum, and in North America is 3%, throughout the duration of the project.

ww

The current spot rate for the £ to the $ is £1 = $1.5000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT