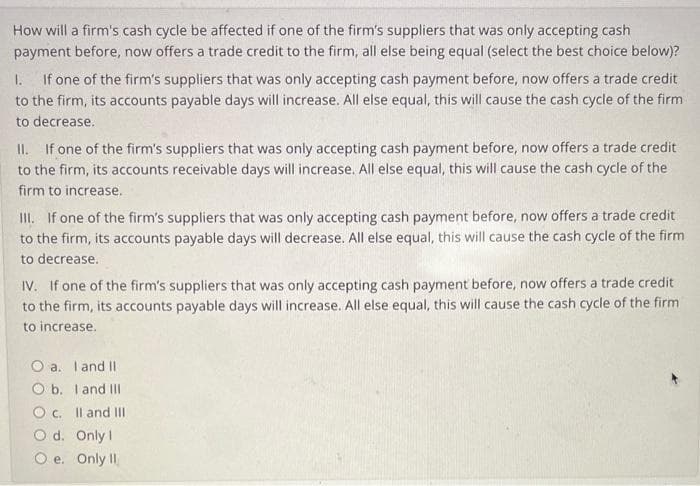

How will a firm's cash cycle be affected if one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, all else being equal (select the best choice below)? 1. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, its accounts payable days will increase. All else equal, this will cause the cash cycle of the firm to decrease. II. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, its accounts receivable days will increase. All else equal, this will cause the cash cycle of the firm to increase. III. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, its accounts payable days will decrease. All else equal, this will cause the cash cycle of the firm. to decrease. IV. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, its accounts payable days will increase. All else equal, this will cause the cash cycle of the firm to increase. O a. I and II O b. I and III O c. II and III Od. Only I e. Only II.

How will a firm's cash cycle be affected if one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, all else being equal (select the best choice below)? 1. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, its accounts payable days will increase. All else equal, this will cause the cash cycle of the firm to decrease. II. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, its accounts receivable days will increase. All else equal, this will cause the cash cycle of the firm to increase. III. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, its accounts payable days will decrease. All else equal, this will cause the cash cycle of the firm. to decrease. IV. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit to the firm, its accounts payable days will increase. All else equal, this will cause the cash cycle of the firm to increase. O a. I and II O b. I and III O c. II and III Od. Only I e. Only II.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter23: Other Topics In Working Capital Management

Section: Chapter Questions

Problem 4Q

Related questions

Question

Transcribed Image Text:How will a firm's cash cycle be affected if one of the firm's suppliers that was only accepting cash

payment before, now offers a trade credit to the firm, all else being equal (select the best choice below)?

1. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit

to the firm, its accounts payable days will increase. All else equal, this will cause the cash cycle of the firm

to decrease.

II. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit

to the firm, its accounts receivable days will increase. All else equal, this will cause the cash cycle of the

firm to increase.

III. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit

to the firm, its accounts payable days will decrease. All else equal, this will cause the cash cycle of the firm

to decrease.

IV. If one of the firm's suppliers that was only accepting cash payment before, now offers a trade credit

to the firm, its accounts payable days will increase. All else equal, this will cause the cash cycle of the firm

to increase.

O a. I and II

O b. I and III

O c.

Od.

Only 1

O e. Only II

II and III

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College