Hunt, Tob, Turman and Kelly own a publishing company that they operate as a partnership. The partnership agreement includes the following: • Hunt receives a salary of P20,000 and a bonus of 3% of income after all bonuses. • Rob roceives a salary of P10,000 and a bonus of 2% of income after all bonuses. • All partners are to receive 10% interest on their average capital balances. The average capital balances are Hunt, P50,000; Rob, P45,000; Turman, P20,000, and Kelly, P47,000. Any remaining profits and losses are to be allocated oqually among the partners. Determine how a profit of P105,000 would be allocated among the partners.

Hunt, Tob, Turman and Kelly own a publishing company that they operate as a partnership. The partnership agreement includes the following: • Hunt receives a salary of P20,000 and a bonus of 3% of income after all bonuses. • Rob roceives a salary of P10,000 and a bonus of 2% of income after all bonuses. • All partners are to receive 10% interest on their average capital balances. The average capital balances are Hunt, P50,000; Rob, P45,000; Turman, P20,000, and Kelly, P47,000. Any remaining profits and losses are to be allocated oqually among the partners. Determine how a profit of P105,000 would be allocated among the partners.

Chapter11: Invest Or Losses

Section: Chapter Questions

Problem 51P

Related questions

Question

A. Hunt, P41,450; Rob; P29,950; Turman, P15,450; Kelly, P18,150

B. Hunt; P28,000; Rob, P16,500; Turman, P2,000; Kelly, P4,700

C. Cannot be determined

D. Hunt, P39,700; Rob, P29,200; Turman, P16,700; Kelly, P19,400

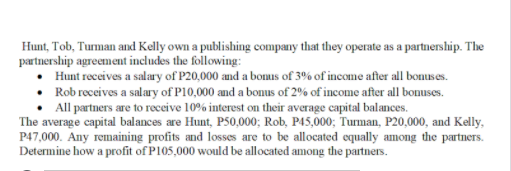

Transcribed Image Text:Hunt, Tob, Turman and Kelly own a publishing company that they operate as a partnership. The

partnership agreement includes the following:

• Hunt receives a salary of P20,000 and a bonus of 3% of income after all bonuses.

• Rob receives a salary of P10,000 and a bonus of 2% of income after all bonuses.

• All partners are to receive 10% interest on their average capital balances.

The average capital balances are Hunt, P50,000; Rob, P45,000; Turman, P20,000, and Kelly,

P47,000. Any remaining profits and losses are to be allocated equally among the partners.

Determine how a profit of P105,000 would be allocated among the partners.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College