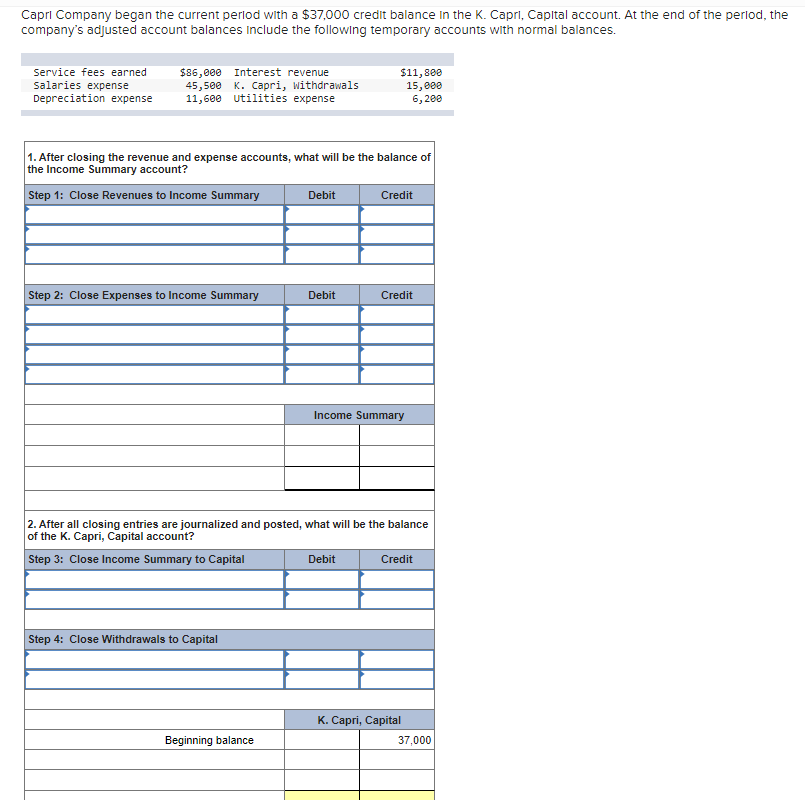

Capri Company began the current period with a $37,000 credit balance in the K. Capri, Capital account. At the end of the period, the company’s adjusted account balances include the following temporary accounts with normal balances. Service fees earned $ 86,000 Interest revenue $ 11,800 Salaries expense 45,500 K. Capri, Withdrawals 15,000 Depreciation expense 11,600 Utilities expense 6,200

Capri Company began the current period with a $37,000 credit balance in the K. Capri, Capital account. At the end of the period, the company’s adjusted account balances include the following temporary accounts with normal balances. Service fees earned $ 86,000 Interest revenue $ 11,800 Salaries expense 45,500 K. Capri, Withdrawals 15,000 Depreciation expense 11,600 Utilities expense 6,200

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.12MCE: Determining an Ending Account Balance Jessies Accounting Services was organized on June 1. The...

Related questions

Question

Capri Company began the current period with a $37,000 credit balance in the K. Capri, Capital account. At the end of the period, the company’s adjusted account balances include the following temporary accounts with normal balances.

| Service fees earned | $ | 86,000 | Interest revenue | $ | 11,800 | ||

| Salaries expense | 45,500 | K. Capri, Withdrawals | 15,000 | ||||

| 11,600 | Utilities expense | 6,200 | |||||

Transcribed Image Text:Capri Company began the current period with a $37,000 credit balance in the K. Capri, Capital account. At the end of the period, the

company's adjusted account balances include the following temporary accounts with normal balances.

Service fees earned

salaries expense

Depreciation expense

$86,000 Interest revenue

45,500 K. Capri, Withdrawals

11,600 Utilities expense

1. After closing the revenue and expense accounts, what will be the balance of

the Income Summary account?

Step 1: Close Revenues to Income Summary

Step 2: Close Expenses to Income Summary

Step 4: Close Withdrawals to Capital

Debit

Beginning balance

Debit

$11,800

15,000

6, 200

Credit

2. After all closing entries are journalized and posted, what will be the balance

of the K. Capri, Capital account?

Step 3: Close Income Summary to Capital

Debit

Credit

Income Summary

Credit

K. Capri, Capital

37,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I am a little confused where some of these numbers are coming from?

Can you please explain?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage