i) As per your own understanding of the cash flow pattern of deposits presented above, compute the valu of the investment at the end of vear 7. Clearly highlight all computational steps.- ii) Clearly indicate who, amongst John and Marsha, is conceptually correct in terms of the type of cash flow

i) As per your own understanding of the cash flow pattern of deposits presented above, compute the valu of the investment at the end of vear 7. Clearly highlight all computational steps.- ii) Clearly indicate who, amongst John and Marsha, is conceptually correct in terms of the type of cash flow

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 50P

Related questions

Question

Explain and give answer

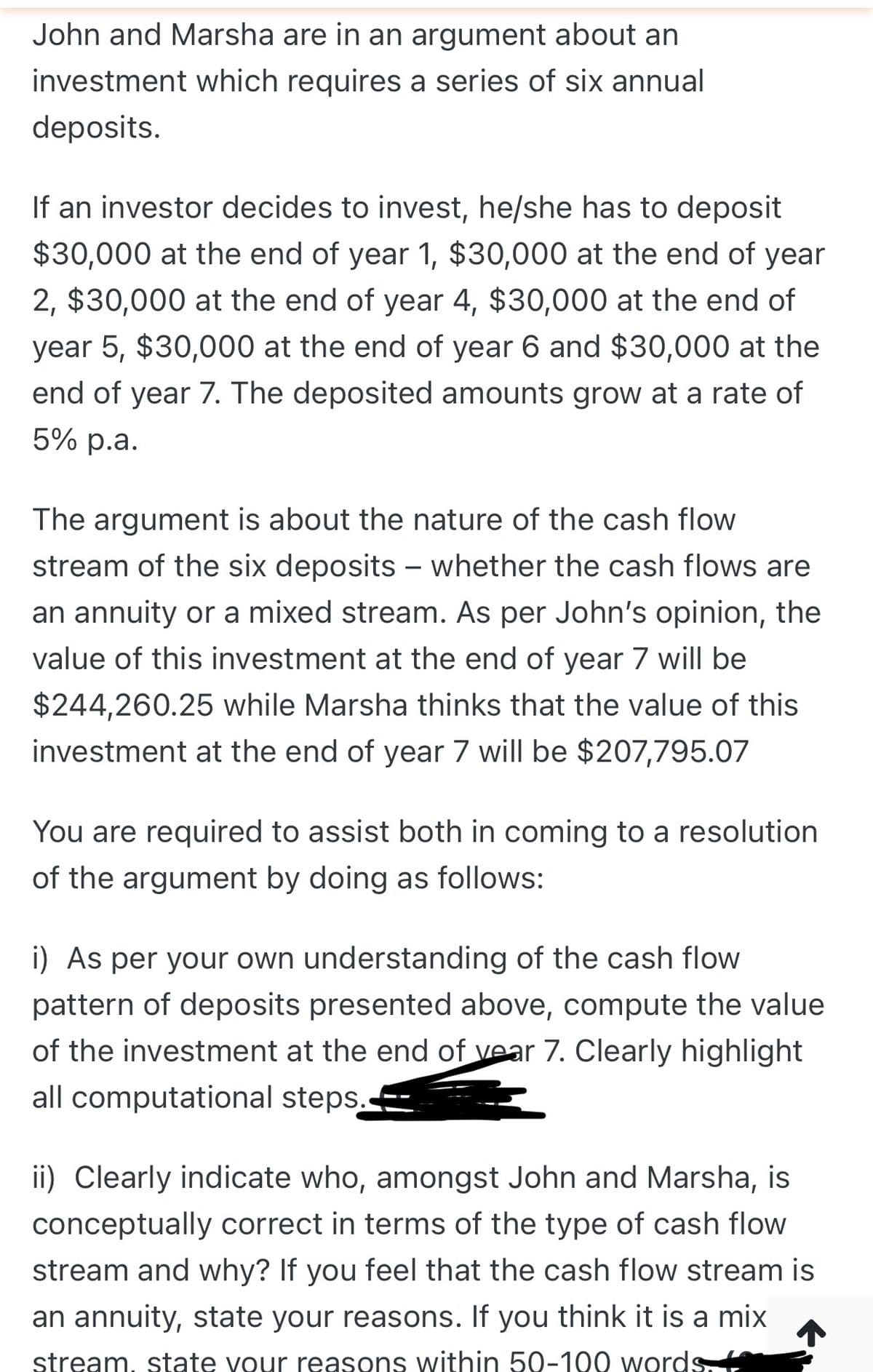

Transcribed Image Text:John and Marsha are in an argument about an

investment which requires a series of six annual

deposits.

If an investor decides to invest, he/she has to deposit

$30,000 at the end of year 1, $30,000 at the end of year

2, $30,000 at the end of year 4, $30,000 at the end of

year 5, $30,000 at the end of year 6 and $30,000 at the

end of year 7. The deposited amounts grow at a rate of

5% p.a.

The argument is about the nature of the cash flow

stream of the six deposits – whether the cash flows are

-

an annuity or a mixed stream. As per John's opinion, the

value of this investment at the end of year 7 will be

$244,260.25 while Marsha thinks that the value of this

investment at the end of year 7 will be $207,795.07

You are required to assist both in coming to a resolution

of the argument by doing as follows:

i) As per your own understanding of the cash flow

pattern of deposits presented above, compute the value

of the investment at the end of vear 7. Clearly highlight

all computational steps.

ii) Clearly indicate who, amongst John and Marsha, is

conceptually correct in terms of the type of cash flow

stream and why? If you feel that the cash flow stream is

an annuity, state your reasons. If you think it is a mix

stream, state vour reasons within 50-100 words

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT