I Journalize the transactions in the general journal. Provide a brief explanation for each entry (2) Post the journal entries to the general ledger accounts Chart of Accounts Assets Revenue 111 Cash 411 Landscape Income 113 Accounts Receivable 115 Supplies Expenses 117 Prepaid Insurance 511 Salary Expense 124 Equipment 512 Rent Expense Liabilities 513 Gas & Oil Expense

I Journalize the transactions in the general journal. Provide a brief explanation for each entry (2) Post the journal entries to the general ledger accounts Chart of Accounts Assets Revenue 111 Cash 411 Landscape Income 113 Accounts Receivable 115 Supplies Expenses 117 Prepaid Insurance 511 Salary Expense 124 Equipment 512 Rent Expense Liabilities 513 Gas & Oil Expense

Chapter7: Accounting Information Systems

Section: Chapter Questions

Problem 4EB: For each of the following transactions, state which special journal (Sales Journal, Cash Receipts...

Related questions

Question

Please help with the 1st 3

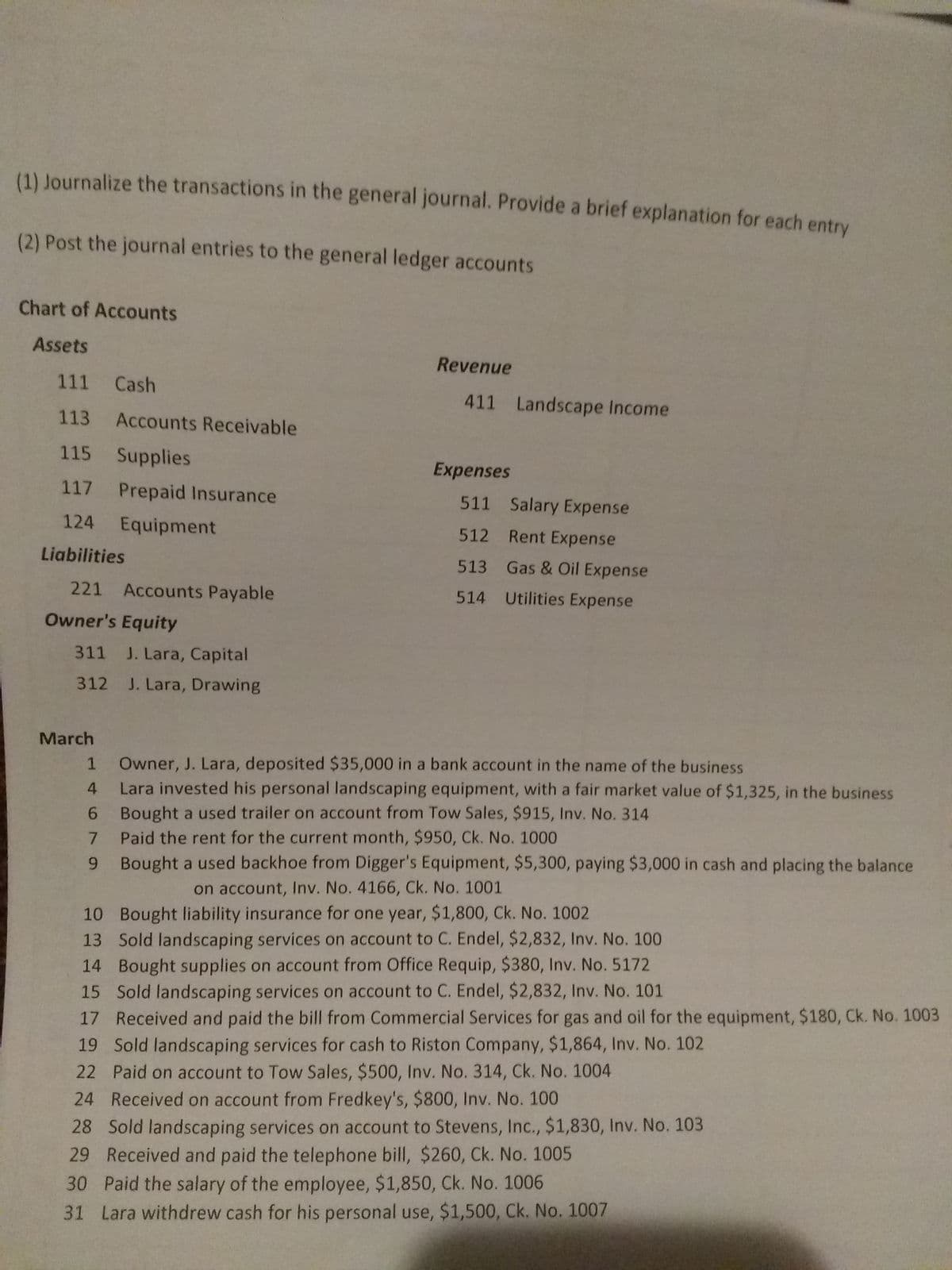

Transcribed Image Text:(1) Journalize the transactions in the general journal. Provide a brief explanation for each entry

(2) Post the journal entries to the general ledger accounts

Chart of Accounts

Assets

Revenue

111 Cash

411 Landscape Income

113 Accounts Receivable

115

Supplies

Expenses

117 Prepaid Insurance

511 Salary Expense

124 Equipment

512 Rent Expense

Liabilities

513 Gas & Oil Expense

221 Accounts Payable

514 Utilities Expense

Owner's Equity

311 J. Lara, Capital

312 J. Lara, Drawing

March

Owner, J. Lara, deposited $35,000 in a bank account in the name of the business

Lara invested his personal landscaping equipment, with a fair market value of $1,325, in the business

Bought a used trailer on account from Tow Sales, $915, Inv. No. 314

Paid the rent for the current month, $950, Ck. No. 1000

9 Bought a used backhoe from Digger's Equipment, $5,300, paying $3,000 in cash and placing the balance

4

6.

on account, Inv. No. 4166, Ck. No. 1001

10 Bought liability insurance for one year, $1,800, Ck. No. 1002

13 Sold landscaping services on account to C. Endel, $2,832, Inv. No. 100

14 Bought supplies on account from Office Requip, $380, Inv. No. 5172

15 Sold landscaping services on account to C. Endel, $2,832, Inv. No. 101

17 Received and paid the bill from Commercial Services for gas and oil for the equipment, $180, Ck. No. 1003

19 Sold landscaping services for cash to Riston Company, $1,864, Inv. No. 102

22 Paid on account to Tow Sales, $500, Inv. No. 314, Ck. No. 1004

24 Received on account from Fredkey's, $800, Inv. No. 100

28 Sold landscaping services on account to Stevens, Inc., $1,830, Inv. No. 103

29 Received and paid the telephone bill, $260, Ck. No. 1005

30 Paid the salary of the employee, $1,850, Ck. No. 1006

31 Lara withdrew cash for his personal use, $1,500, Ck. No. 1007

Transcribed Image Text:do

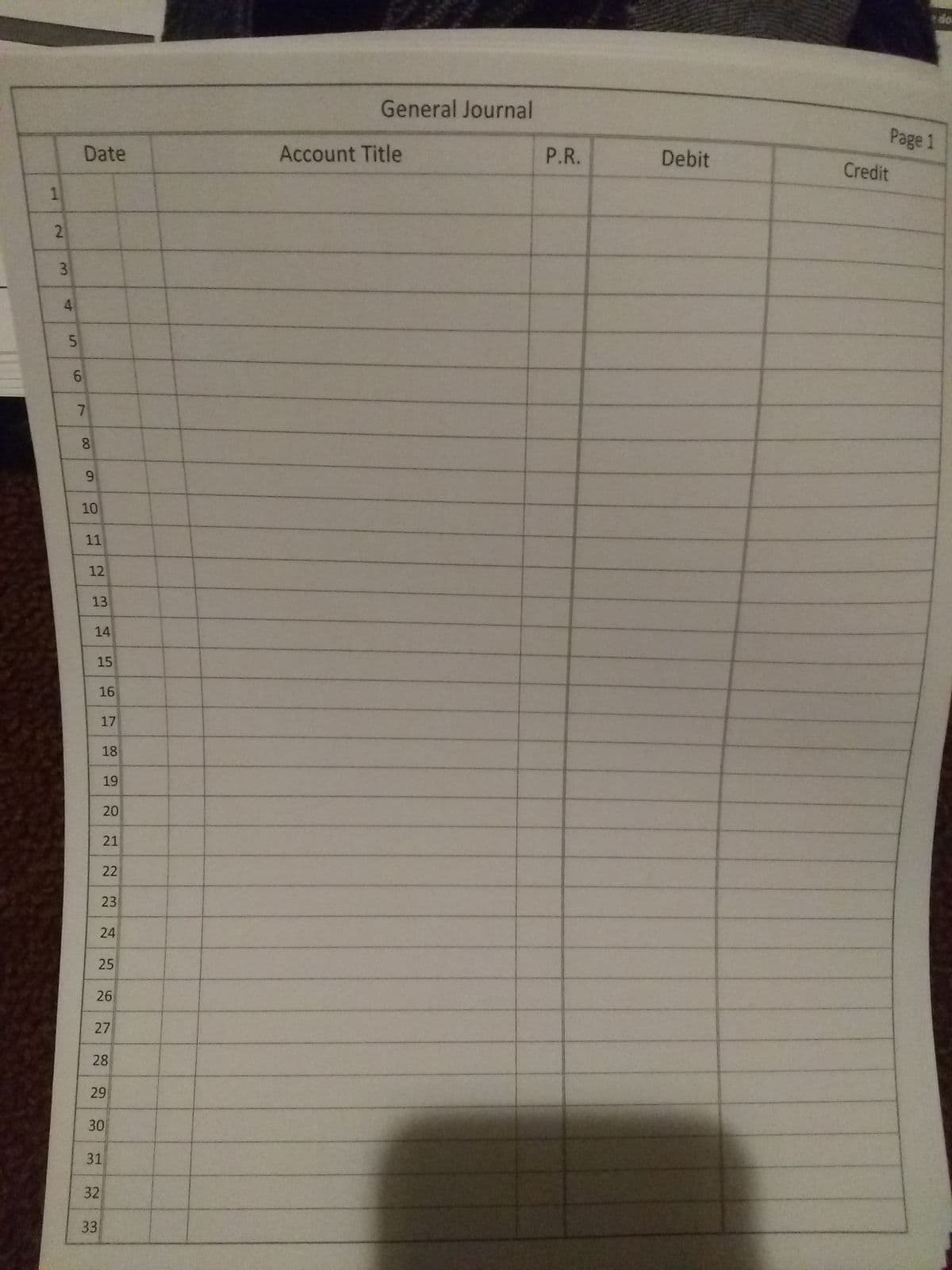

General Journal

Page 1

Date

Account Title

P.R.

Debit

Credit

1

4

7

10

11

12

13

14

16

17

18

19

20

21

22

24

26

28

29

30

31

32

33

15

23

25

5.

6,

27

3.

2.

Expert Solution

Step 1

Since you have posted multiple questions, I am answering the 1st question only. If you want the answers for the remaining questions, Kindly resubmit the question by mentioning the question to be answered.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub