Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter26: Capital Budgeting (capbud)

Section: Chapter Questions

Problem 5R

Related questions

Question

I just need to verify that these IRRs are correct.

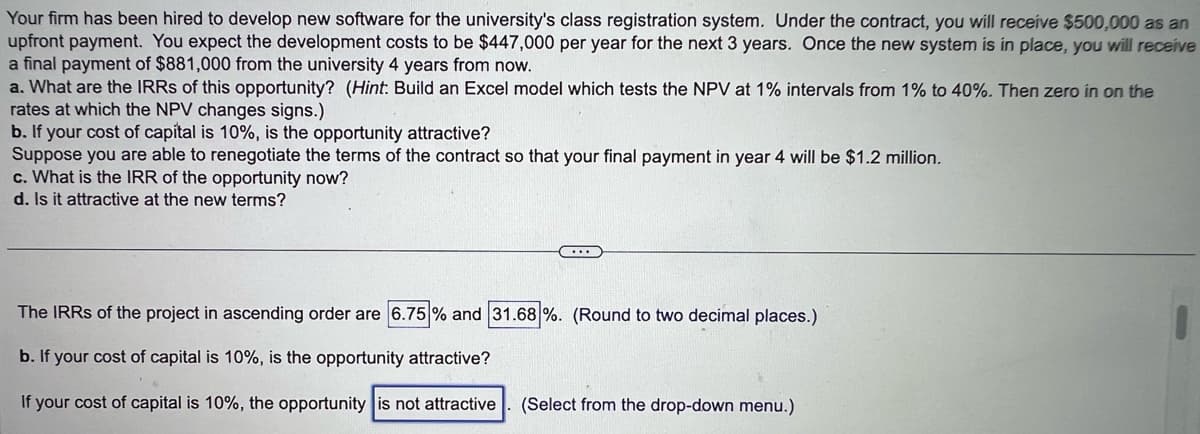

Transcribed Image Text:Your firm has been hired to develop new software for the university's class registration system. Under the contract, you will receive $500,000 as an

upfront payment. You expect the development costs to be $447,000 per year for the next 3 years. Once the new system is in place, you will receive

a final payment of $881,000 from the university 4 years from now.

a. What are the IRRs of this opportunity? (Hint: Build an Excel model which tests the NPV at 1% intervals from 1% to 40%. Then zero in on the

rates at which the NPV changes signs.)

b. If your cost of capital is 10%, is the opportunity attractive?

Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1.2 million.

c. What is the IRR of the opportunity now?

d. Is it attractive at the new terms?

...

The IRRs of the project in ascending order are 6.75% and 31.68 %. (Round to two decimal places.)

b. If your cost of capital is 10%, is the opportunity attractive?

If your cost of capital is 10%, the opportunity is not attractive (Select from the drop-down menu.)

●

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College