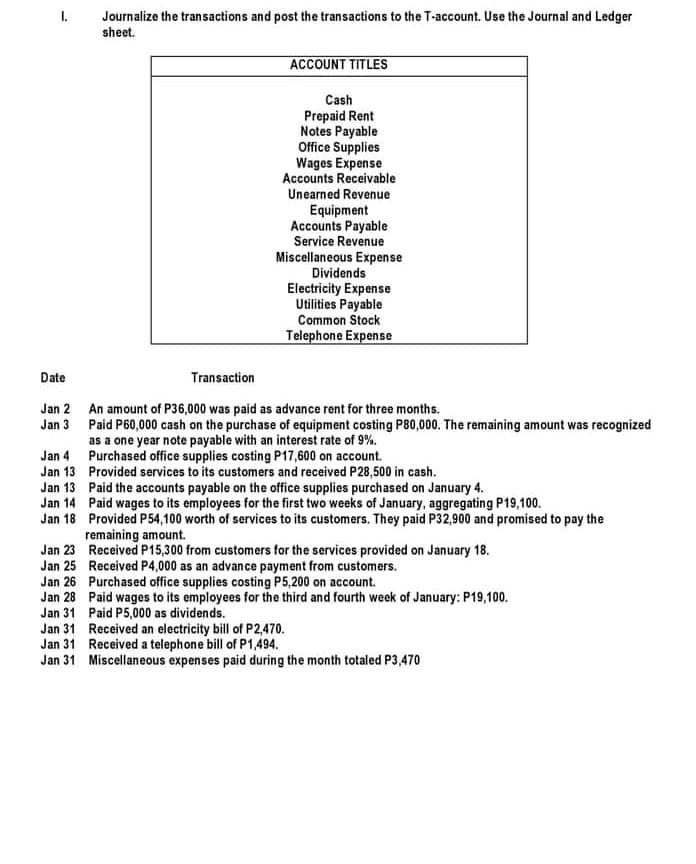

I. Journalize the transactions and post the transactions to the T-account. Use the Journal and Ledger sheet. ACCOUNT TITLES Cash Prepaid Rent Notes Payable Office Supplies Wages Expense Accounts Receivable Unearned Revenue Equipment Accounts Payable Service Revenue Miscellaneous Expense Dividends Electricity Expense Utilities Payable Common Stock Telephone Expense Date Transaction Jan 2 An amount of P36,000 was paid as advance rent for three months. Jan 3 Paid P60,000 cash on the purchase of equipment costing P80,000. The remaining amount was recognized as a one year note payable with an interest rate of 9%. Jan 4 Purchased office supplies costing P17,600 on account. Jan 13 Provided services to its customers and received P28,500 in cash. Jan 13 Paid the accounts payable on the office supplies purchased on January 4. Jan 14 Paid wages to its employees for the first two weeks of January, aggregating P19,100. Jan 18 Provided P54,100 worth of services to its customers. They paid P32,900 and promised to pay the remaining amount. Jan 23 Received P15,300 from customers for the services provided on January 18. Jan 25 Received P4,000 as an advance payment from customers. Jan 26 Purchased office supplies costing P5,200 on account. Jan 28 Paid wages to its employees for the third and fourth week of January: P19,100. Jan 31 Paid P5,000 as dividends. Jan 31 Received an electricity bill of P2,470. Jan 31 Received a telephone bill of P1,494. Jan 31 Miscellaneous expenses paid during the month totaled P3,470

I. Journalize the transactions and post the transactions to the T-account. Use the Journal and Ledger sheet. ACCOUNT TITLES Cash Prepaid Rent Notes Payable Office Supplies Wages Expense Accounts Receivable Unearned Revenue Equipment Accounts Payable Service Revenue Miscellaneous Expense Dividends Electricity Expense Utilities Payable Common Stock Telephone Expense Date Transaction Jan 2 An amount of P36,000 was paid as advance rent for three months. Jan 3 Paid P60,000 cash on the purchase of equipment costing P80,000. The remaining amount was recognized as a one year note payable with an interest rate of 9%. Jan 4 Purchased office supplies costing P17,600 on account. Jan 13 Provided services to its customers and received P28,500 in cash. Jan 13 Paid the accounts payable on the office supplies purchased on January 4. Jan 14 Paid wages to its employees for the first two weeks of January, aggregating P19,100. Jan 18 Provided P54,100 worth of services to its customers. They paid P32,900 and promised to pay the remaining amount. Jan 23 Received P15,300 from customers for the services provided on January 18. Jan 25 Received P4,000 as an advance payment from customers. Jan 26 Purchased office supplies costing P5,200 on account. Jan 28 Paid wages to its employees for the third and fourth week of January: P19,100. Jan 31 Paid P5,000 as dividends. Jan 31 Received an electricity bill of P2,470. Jan 31 Received a telephone bill of P1,494. Jan 31 Miscellaneous expenses paid during the month totaled P3,470

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 17EB: Indicate whether each of the following accounts has a normal debit or credit balance. A. prepaid...

Related questions

Topic Video

Question

Transcribed Image Text:I.

Journalize the transactions and post the transactions to the T-account. Use the Journal and Ledger

sheet.

ACCOUNT TITLES

Cash

Prepaid Rent

Notes Payable

Office Supplies

Wages Expense

Accounts Receivable

Unearned Revenue

Equipment

Accounts Payable

Service Revenue

Miscellaneous Expense

Dividends

Electricity Expense

Utilities Payable

Common Stock

Telephone Expense

Date

Transaction

Jan 2 An amount of P36,000 was paid as advance rent for three months.

Jan 3 Paid P60,000 cash on the purchase of equipment costing P80,000. The remaining amount was recognized

as a one year note payable with an interest rate of 9%.

Jan 4 Purchased office supplies costing P17,600 on account.

Jan 13 Provided services to its customers and received P28,500 in cash.

Jan 13 Paid the accounts payable on the office supplies purchased on January 4.

Jan 14 Paid wages to its employees for the first two weeks of January, aggregating P19,100.

Jan 18 Provided P54,100 worth of services to its customers. They paid P32,900 and promised to pay the

remaining amount.

Jan 23 Received P15,300 from customers for the services provided on January 18.

Jan 25 Received P4,000 as an advance payment from customers.

Jan 26 Purchased office supplies costing P5,200 on account.

Jan 28 Paid wages to its employees for the third and fourth week of January: P19,100.

Jan 31 Paid P5,000 as dividends.

Jan 31 Received an electricity bill of P2,470.

Jan 31 Received a telephone bill of P1,494.

Jan 31 Miscellaneous expenses paid during the month totaled P3,470

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,