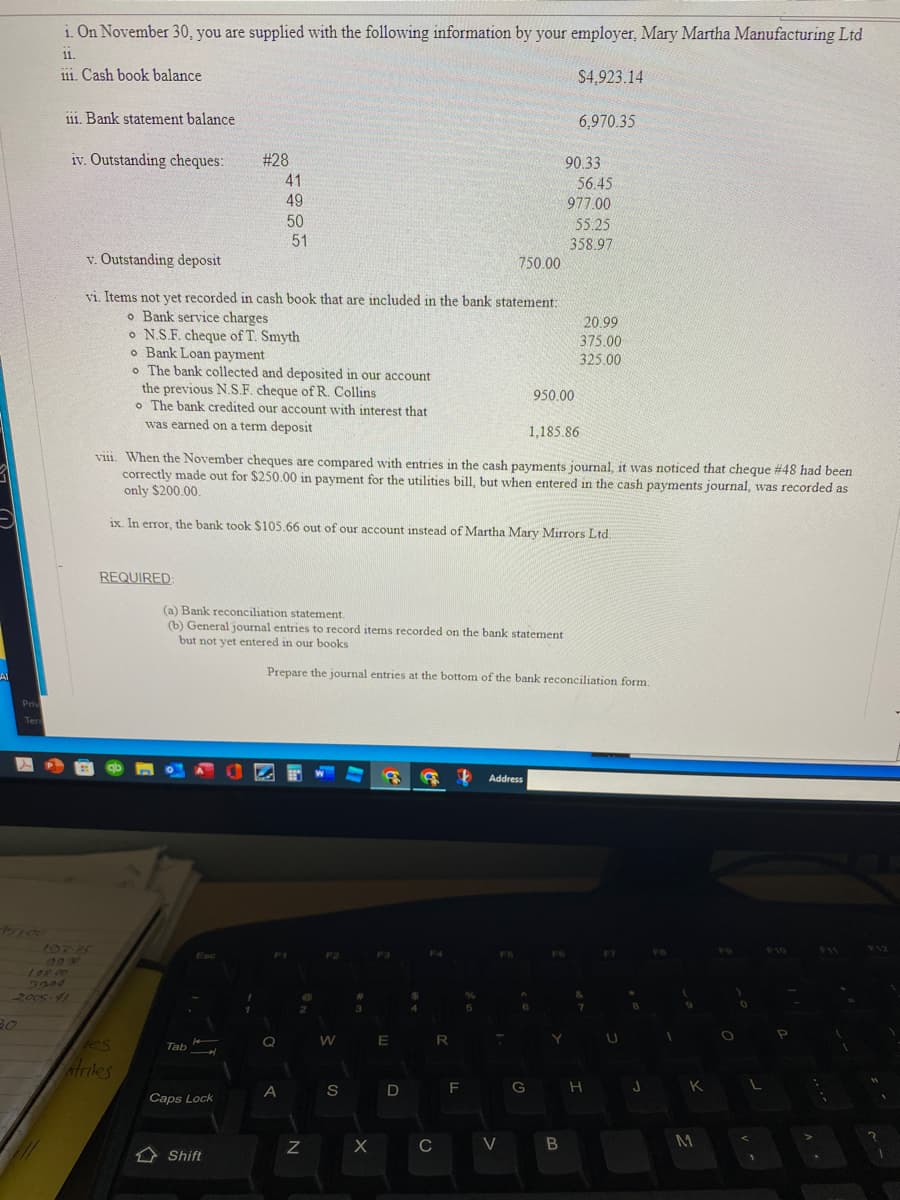

i. On November 30, you are supplied with the following information by your employer, Mary Martha Manufacturing Ltd 11. 111. Cash book balance $4,923.14 111. Bank statement balance 6,970.35 iv. Outstanding cheques: #28 90.33 41 56.45 49 977.00 50 55.25 51 358.97 v. Outstanding deposit 750.00 vi. Items not yet recorded in cash book that are included in the bank statement: o Bank service charges o N.S.F. cheque of T. Smyth o Bank Loan payment • The bank collected and deposited in our account the previous N.S.F. cheque of R. Collins • The bank credited our account with interest that was earned on a term deposit 20.99 375.00 325.00 950.00 1,185.86 viii. When the November cheques are compared with entries in the cash payments journal, it was noticed that cheque #48 had been correctly made out for $250.00 in payment for the utilities bill, but when entered in the cash payments journal, was recorded as only $200.00. ix. In error, the bank took $105.66 out of our account instead of Martha Mary Mirrors Ltd. REQUIRED

i. On November 30, you are supplied with the following information by your employer, Mary Martha Manufacturing Ltd 11. 111. Cash book balance $4,923.14 111. Bank statement balance 6,970.35 iv. Outstanding cheques: #28 90.33 41 56.45 49 977.00 50 55.25 51 358.97 v. Outstanding deposit 750.00 vi. Items not yet recorded in cash book that are included in the bank statement: o Bank service charges o N.S.F. cheque of T. Smyth o Bank Loan payment • The bank collected and deposited in our account the previous N.S.F. cheque of R. Collins • The bank credited our account with interest that was earned on a term deposit 20.99 375.00 325.00 950.00 1,185.86 viii. When the November cheques are compared with entries in the cash payments journal, it was noticed that cheque #48 had been correctly made out for $250.00 in payment for the utilities bill, but when entered in the cash payments journal, was recorded as only $200.00. ix. In error, the bank took $105.66 out of our account instead of Martha Mary Mirrors Ltd. REQUIRED

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 2AP

Related questions

Question

100%

Bank reconciliations and journal entries

Transcribed Image Text:i. On November 30, you are supplied with the following information by your employer, Mary Martha Manufacturing Ltd

11.

111. Cash book balance

$4,923.14

111. Bank statement balance

6,970.35

iv. Outstanding cheques:

# 28

90.33

41

56.45

49

977.00

50

5.25

51

358.97

v. Outstanding deposit

750.00

vi. Items not yet recorded in cash book that are included in the bank statement:

o Bank service charges

o N.S.F. cheque of T. Smyth

o Bank Loan payment

• The bank collected and deposited in our account

the previous N.S.F. cheque of R. Collins

o The bank credited our account with interest that

was earned on a term deposit

20.99

375.00

325.00

950.00

1,185.86

viii. When the November cheques are compared with entries in the cash payments journal, it was noticed that cheque #48 had been

correctly made out for $250.00 in payment for the utilities bill, but when entered in the cash payments journal, was recorded as

only $200.00.

ix. In error, the bank took$105.66 out of our account instead of Martha Mary Mirrors Ltd,

REQUIRED:

(a) Bank reconciliation statement.

(b) General journal entries to record items recorded on the bank statement

but not yet entered in our books

AI

Prepare the journal entries at the bottom of the bank reconciliation form.

Priv

Ter

Address

10271

090

Les 00

3904

2005 41

F10

F12

F4

es

trikes

WE R

Tab

A S D F

G H J K L

Caps Lock

X C V B

M

1 Shift

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning