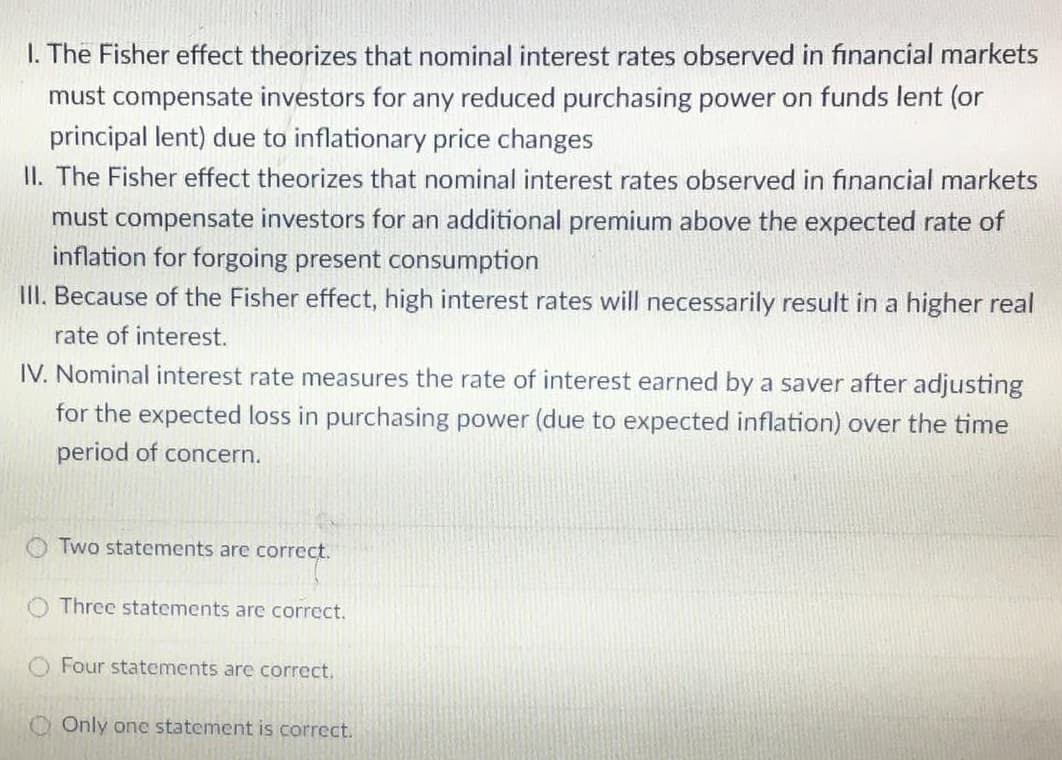

I. The Fisher effect theorizes that nominal interest rates observed in financial markets must compensate investors for any reduced purchasing power on funds lent (or principal lent) due to inflationary price changes II. The Fisher effect theorizes that nominal interest rates observed in financial markets must compensate investors for an additional premium above the expected rate of inflation for forgoing present consumption III. Because of the Fisher effect, high interest rates will necessarily result in a higher real rate of interest. IV. Nominal interest rate measures the rate of interest earned by a saver after adjusting for the expected loss in purchasing power (due to expected inflation) over the time period of concern. Two statements are correct. Three statements are correct. O Four statements are correct. O Only one statement is correct.

I. The Fisher effect theorizes that nominal interest rates observed in financial markets must compensate investors for any reduced purchasing power on funds lent (or principal lent) due to inflationary price changes II. The Fisher effect theorizes that nominal interest rates observed in financial markets must compensate investors for an additional premium above the expected rate of inflation for forgoing present consumption III. Because of the Fisher effect, high interest rates will necessarily result in a higher real rate of interest. IV. Nominal interest rate measures the rate of interest earned by a saver after adjusting for the expected loss in purchasing power (due to expected inflation) over the time period of concern. Two statements are correct. Three statements are correct. O Four statements are correct. O Only one statement is correct.

Calculus: Early Transcendentals

8th Edition

ISBN:9781285741550

Author:James Stewart

Publisher:James Stewart

Chapter1: Functions And Models

Section: Chapter Questions

Problem 1RCC: (a) What is a function? What are its domain and range? (b) What is the graph of a function? (c) How...

Related questions

Question

HELP ME PLEASE

Transcribed Image Text:I. The Fisher effect theorizes that nominal interest rates observed in financial markets

must compensate investors for any reduced purchasing power on funds lent (or

principal lent) due to inflationary price changes

II. The Fisher effect theorizes that nominal interest rates observed in financial markets

must compensate investors for an additional premium above the expected rate of

inflation for forgoing present consumption

III. Because of the Fisher effect, high interest rates will necessarily result in a higher real

rate of interest.

IV. Nominal interest rate measures the rate of interest earned by a saver after adjusting

for the expected loss in purchasing power (due to expected inflation) over the time

period of concern.

Two statements are correct.

Three statements are correct.

O Four statements are correct.

O Only one statement is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781319050740

Author:

Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:

W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:

9781337552516

Author:

Ron Larson, Bruce H. Edwards

Publisher:

Cengage Learning