"identifying accounting principles and assumptions C4 Enter the letter A through H for the principle or assumption in the blank space next to each numbered description that it best reflects. A. General accounting principle B.Measurement (cost) principle C.Business entity assumption D.Revenue recognition principle E.Specific accounting principle F.Expense recognition (matching) principle G.Going-concern assumption H. Full disclosure principle A company reports details behind financial statements that would impact users' decisions. 2. Financial statements reflect the assumption that the business continues operating. 3. A company records the expenses incurred to generate the revenues reported. Concepts, assumptions, and guidelines for preparing financial statements. 5. Each business is accounted for separately from its owner or owners. 6. Revenue is recorded when products and services are delivered. Detailed rules used in reporting events and transactions.

"identifying accounting principles and assumptions C4 Enter the letter A through H for the principle or assumption in the blank space next to each numbered description that it best reflects. A. General accounting principle B.Measurement (cost) principle C.Business entity assumption D.Revenue recognition principle E.Specific accounting principle F.Expense recognition (matching) principle G.Going-concern assumption H. Full disclosure principle A company reports details behind financial statements that would impact users' decisions. 2. Financial statements reflect the assumption that the business continues operating. 3. A company records the expenses incurred to generate the revenues reported. Concepts, assumptions, and guidelines for preparing financial statements. 5. Each business is accounted for separately from its owner or owners. 6. Revenue is recorded when products and services are delivered. Detailed rules used in reporting events and transactions.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterFS: Financial Statements For Mornin' Joe International

Section: Chapter Questions

Problem 2DQ

Related questions

Question

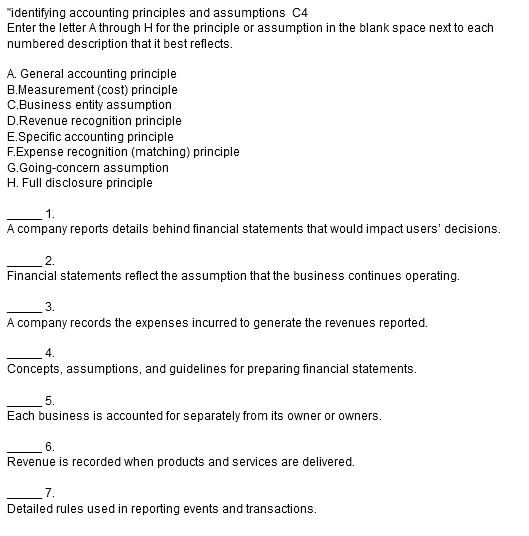

Transcribed Image Text:8.

Information is based on actual costs incurred in transactions."

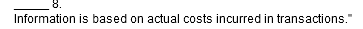

Transcribed Image Text:"identifying accounting principles and assumptions C4

Enter the letter A through H for the principle or assumption in the blank space next to each

numbered description that it best reflects.

A. General accounting principle

B.Measurement (cost) principle

C.Business entity assumption

D.Revenue recognition principle

E.Specific accounting principle

F.Expense recognition (matching) principle

G.Going-concern assumption

H. Full disclosure principle

1.

A company reports details behind financial statements that would impact users' decisions.

2.

Financial statements reflect the assumption that the business continues operating.

3.

A company records the expenses incurred to generate the revenues reported.

Concepts, assumptions, and guidelines for preparing financial statements.

5.

Each business is accounted for separately from its owner or owners.

6.

Revenue is recorded when products and services are delivered.

7.

Detailed rules used in reporting events and transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning