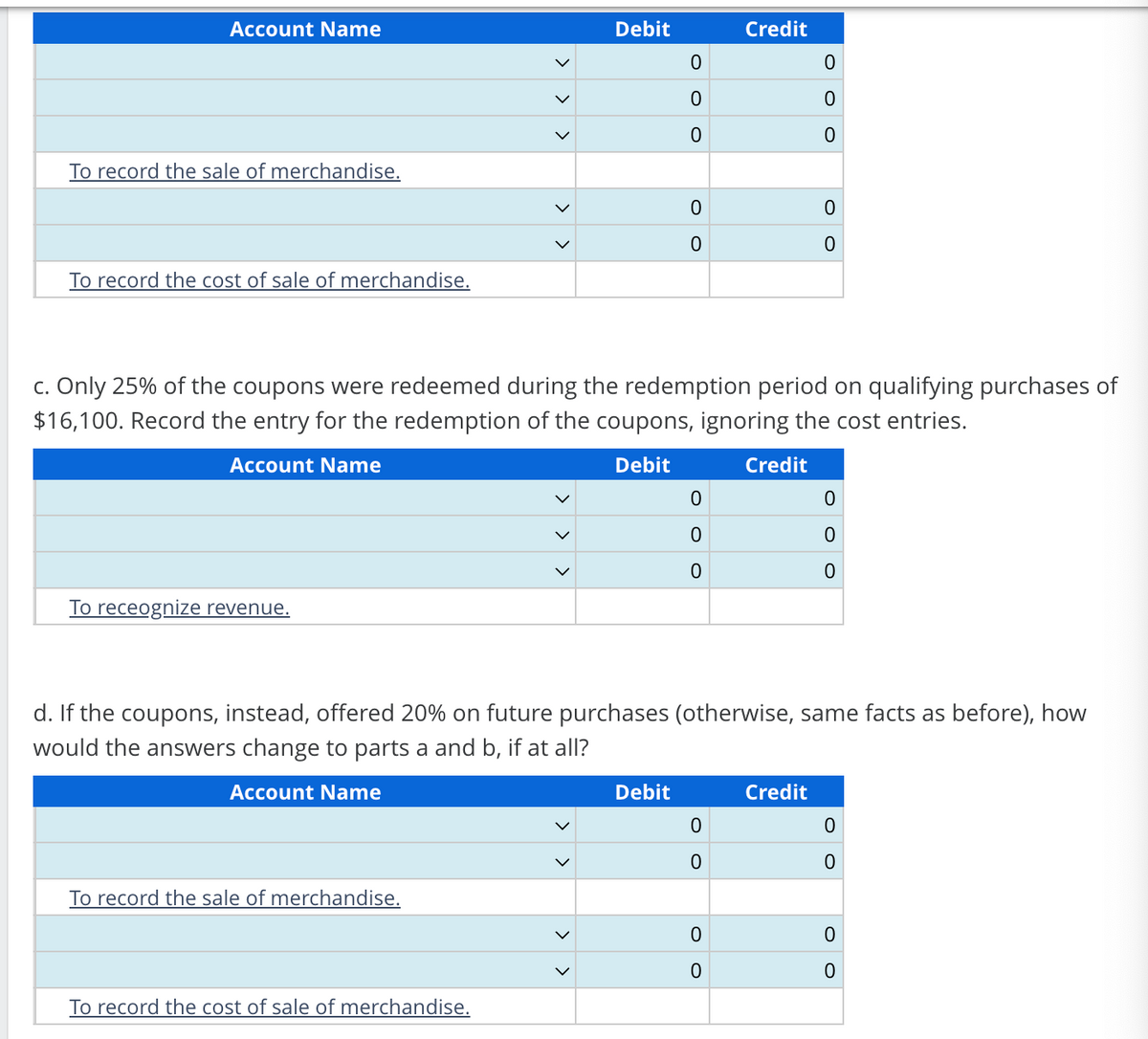

Account Name Debit Credit 0 0 0 0 0 0 To record the sale of merchandise. To record the cost of sale of merchandise. 0 0 0 0 c. Only 25% of the coupons were redeemed during the redemption period on qualifying purchases of $16,100. Record the entry for the redemption of the coupons, ignoring the cost entries. Account Name To receognize revenue. Debit Credit 0 0 0 0 0 0 d. If the coupons, instead, offered 20% on future purchases (otherwise, same facts as before), how would the answers change to parts a and b, if at all? Account Name To record the sale of merchandise. Debit Credit 0 0 0 0 0 0 0 0 To record the cost of sale of merchandise. Identifying and Recording Customer Option for Additional Merchandise Pets Inc. launches a new advertising promotion where, for each purchase over $30, it offers a coupon for a 35% discount on a future purchase. There is a limit of one coupon per customer. Pets Inc. estimates that 28% of customers receiving the coupon will redeem the coupon on an average purchase of $24. Sales on the first day of the one-week promotional period totaled $280,000 resulting in 2,800 coupons distributed. Assume all sales were cash sales. Cost of sales is 45% of the selling price. a. Determine how many performance obligations are included in a sales transaction during the advertising promotion program. Assume that coupons readily available to the public online or in company fliers have a maximum discount of 20%. One performance obligation b. Record the journal entry to record revenue in the first day of the promotion period using the relative percentages to allocate standalone selling prices. •Note: Carry all decimals in calculations; round the final answer to the nearest dollar. Performance Obligations Merchandise Customer option-merchandise credit Transaction Price as Stated Standalone Selling Price $ 0 $ 0 $ 0 0 $ 0 $ 0 $ Total Allocated Transaction Price (rounded) 0 0 0

Account Name Debit Credit 0 0 0 0 0 0 To record the sale of merchandise. To record the cost of sale of merchandise. 0 0 0 0 c. Only 25% of the coupons were redeemed during the redemption period on qualifying purchases of $16,100. Record the entry for the redemption of the coupons, ignoring the cost entries. Account Name To receognize revenue. Debit Credit 0 0 0 0 0 0 d. If the coupons, instead, offered 20% on future purchases (otherwise, same facts as before), how would the answers change to parts a and b, if at all? Account Name To record the sale of merchandise. Debit Credit 0 0 0 0 0 0 0 0 To record the cost of sale of merchandise. Identifying and Recording Customer Option for Additional Merchandise Pets Inc. launches a new advertising promotion where, for each purchase over $30, it offers a coupon for a 35% discount on a future purchase. There is a limit of one coupon per customer. Pets Inc. estimates that 28% of customers receiving the coupon will redeem the coupon on an average purchase of $24. Sales on the first day of the one-week promotional period totaled $280,000 resulting in 2,800 coupons distributed. Assume all sales were cash sales. Cost of sales is 45% of the selling price. a. Determine how many performance obligations are included in a sales transaction during the advertising promotion program. Assume that coupons readily available to the public online or in company fliers have a maximum discount of 20%. One performance obligation b. Record the journal entry to record revenue in the first day of the promotion period using the relative percentages to allocate standalone selling prices. •Note: Carry all decimals in calculations; round the final answer to the nearest dollar. Performance Obligations Merchandise Customer option-merchandise credit Transaction Price as Stated Standalone Selling Price $ 0 $ 0 $ 0 0 $ 0 $ 0 $ Total Allocated Transaction Price (rounded) 0 0 0

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 20E

Related questions

Question

Transcribed Image Text:Account Name

Debit

Credit

0

0

0

0

0

0

To record the sale of merchandise.

To record the cost of sale of merchandise.

0

0

0

0

c. Only 25% of the coupons were redeemed during the redemption period on qualifying purchases of

$16,100. Record the entry for the redemption of the coupons, ignoring the cost entries.

Account Name

To receognize revenue.

Debit

Credit

0

0

0

0

0

0

d. If the coupons, instead, offered 20% on future purchases (otherwise, same facts as before), how

would the answers change to parts a and b, if at all?

Account Name

To record the sale of merchandise.

Debit

Credit

0

0

0

0

0

0

0

0

To record the cost of sale of merchandise.

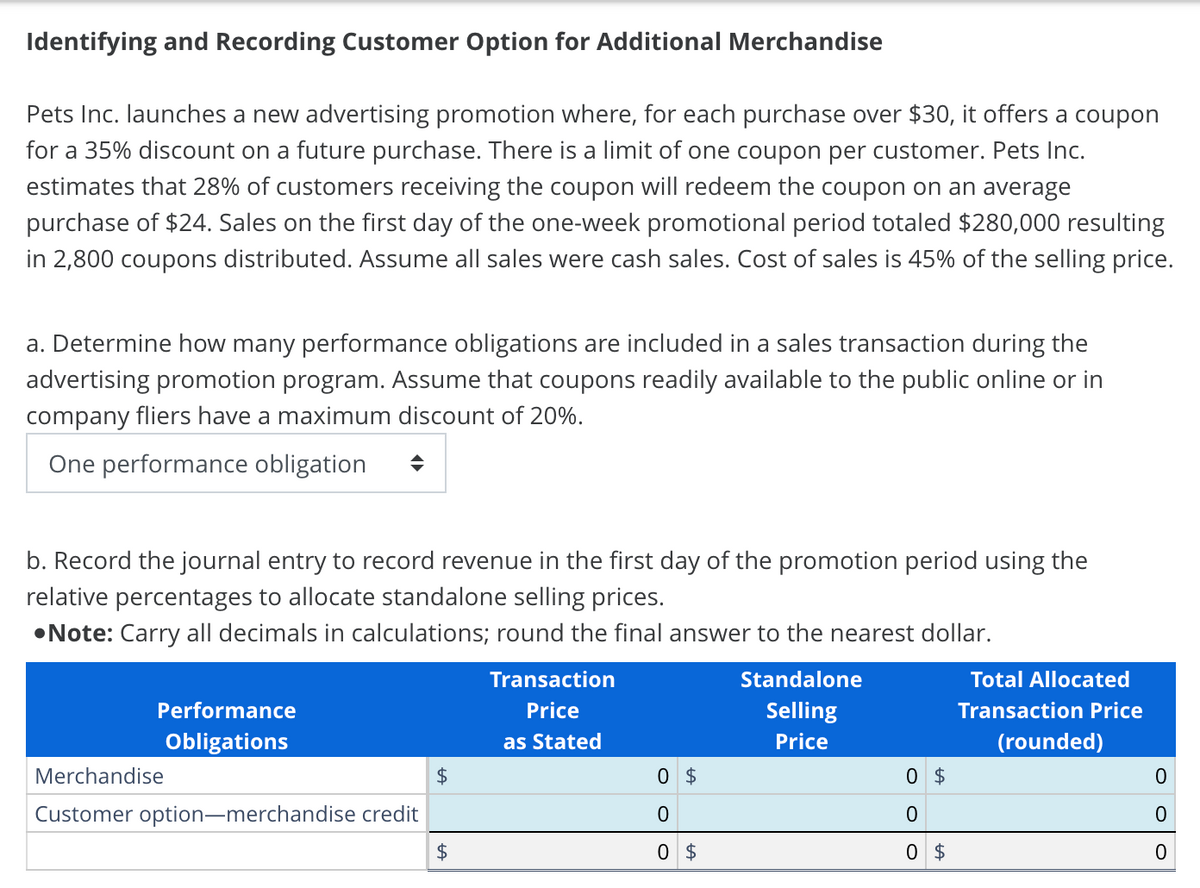

Transcribed Image Text:Identifying and Recording Customer Option for Additional Merchandise

Pets Inc. launches a new advertising promotion where, for each purchase over $30, it offers a coupon

for a 35% discount on a future purchase. There is a limit of one coupon per customer. Pets Inc.

estimates that 28% of customers receiving the coupon will redeem the coupon on an average

purchase of $24. Sales on the first day of the one-week promotional period totaled $280,000 resulting

in 2,800 coupons distributed. Assume all sales were cash sales. Cost of sales is 45% of the selling price.

a. Determine how many performance obligations are included in a sales transaction during the

advertising promotion program. Assume that coupons readily available to the public online or in

company fliers have a maximum discount of 20%.

One performance obligation

b. Record the journal entry to record revenue in the first day of the promotion period using the

relative percentages to allocate standalone selling prices.

•Note: Carry all decimals in calculations; round the final answer to the nearest dollar.

Performance

Obligations

Merchandise

Customer option-merchandise credit

Transaction

Price

as Stated

Standalone

Selling

Price

$

0 $

0 $

0

0

$

0 $

0 $

Total Allocated

Transaction Price

(rounded)

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you