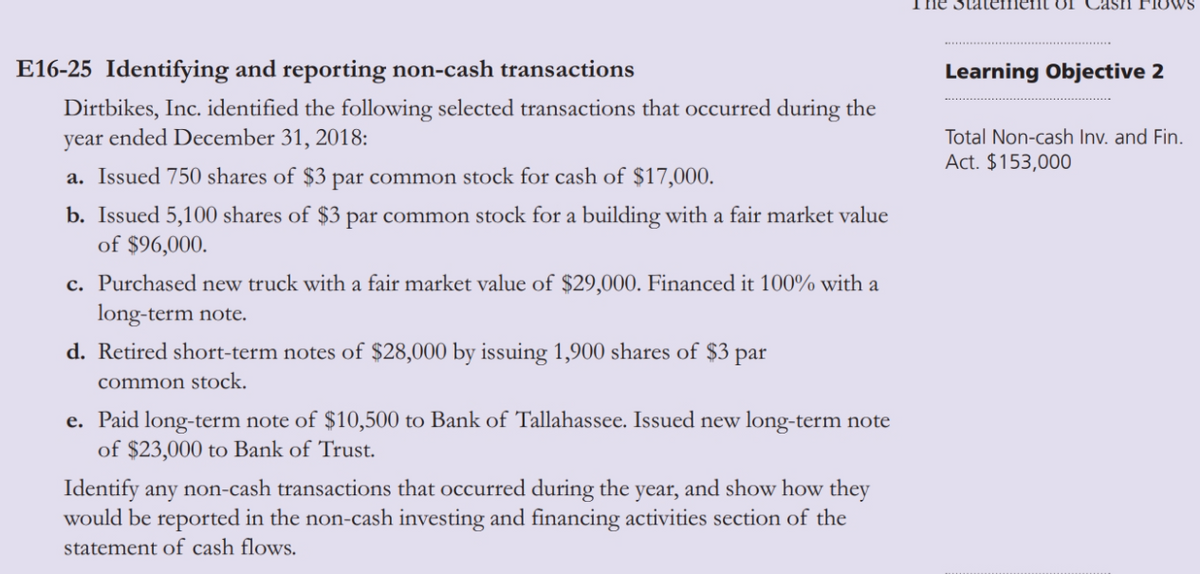

Identifying and reporting non-cash transactions Dirtbikes, Inc. identified the following selected transactions that occurred during the year ended December 31, 2018: a. Issued 750 shares of $3 par common stock for cash of $17,000. b. Issued 5,100 shares of $3 par common stock for a building with a fair market value of $96,000. c. Purchased new truck with a fair market value of $29,000. Financed it 100% with a long-term note. d. Retired short-term notes of $28,000 by issuing 1,900 shares of $3 par common stock. e. Paid long-term note of $10,500 to Bank of Tallahassee. Issued new long-term note of $23,000 to Bank of Trust. Identify any non-cash transactions that occurred during the year, and show how they would be reported in the non-cash investing and financing activities section of the statement of cash flows

E16-25 Identifying and reporting non-cash transactions Dirtbikes, Inc. identified the following selected transactions that occurred during the year ended December 31, 2018:

a. Issued 750 shares of $3 par common stock for cash of $17,000.

b. Issued 5,100 shares of $3 par common stock for a building with a fair market value of $96,000.

c. Purchased new truck with a fair market value of $29,000. Financed it 100% with a long-term note.

d. Retired short-term notes of $28,000 by issuing 1,900 shares of $3 par common stock.

e. Paid long-term note of $10,500 to Bank of Tallahassee. Issued new long-term note of $23,000 to Bank of Trust. Identify any non-cash transactions that occurred during the year, and show how they would be reported in the non-cash investing and financing activities section of the statement of cash flows.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps