If a borrower lives in a recourse state and defaults on a mortgage note that contains an exculpatory clause and the lender receives less than the amount owed on the mortgage when the property is sold, the lender will.. file for bankruptcy protection seek the difference from the borrower's title insurance company do nothing since the lender is limited to the proceeds from the sale of the property take legal action against the borrower to recover the difference

If a borrower lives in a recourse state and defaults on a mortgage note that contains an exculpatory clause and the lender receives less than the amount owed on the mortgage when the property is sold, the lender will.. file for bankruptcy protection seek the difference from the borrower's title insurance company do nothing since the lender is limited to the proceeds from the sale of the property take legal action against the borrower to recover the difference

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 4DQ

Related questions

Question

Transcribed Image Text:Question Cómpletion

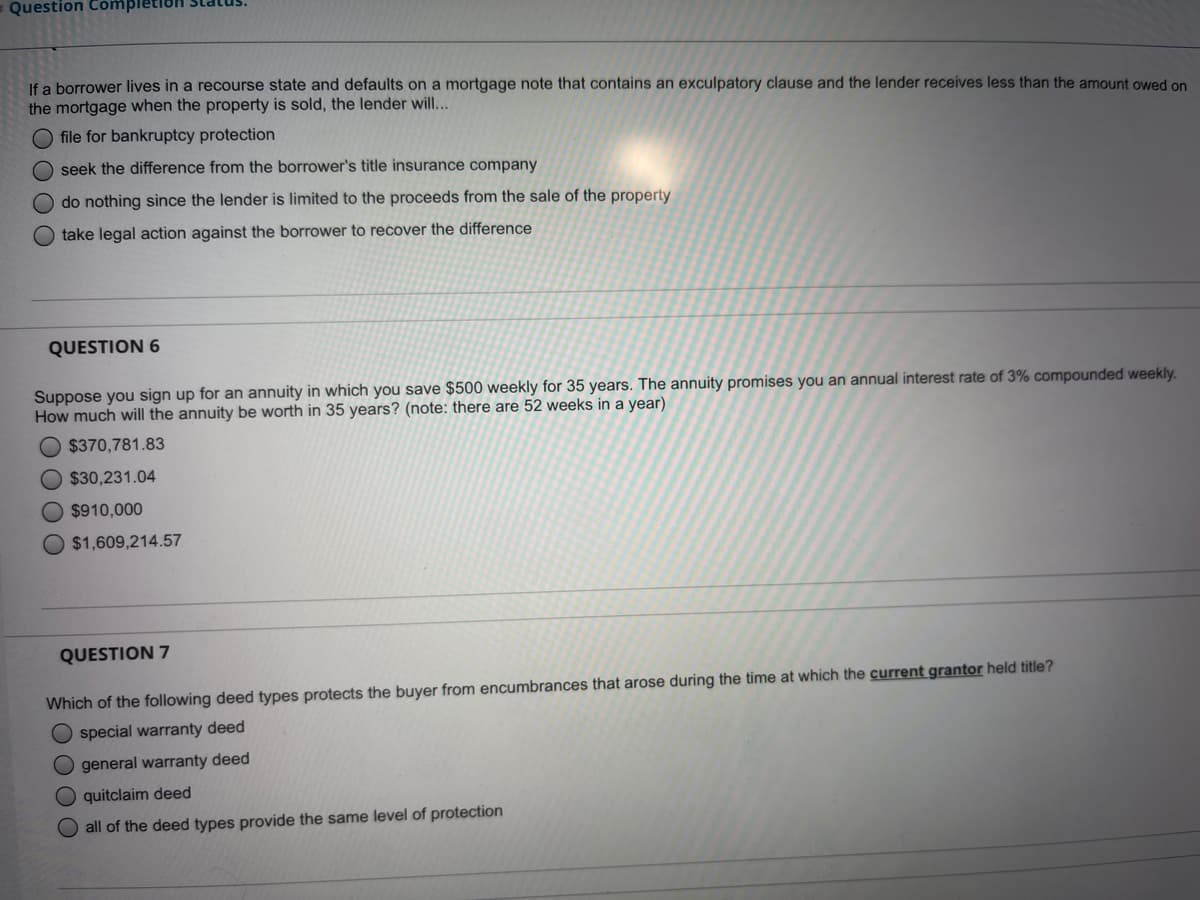

If a borrower lives in a recourse state and defaults on a mortgage note that contains an exculpatory clause and the lender receives less than the amount owed on

the mortgage when the property is sold, the lender will..

O file for bankruptcy protection

seek the difference from the borrower's title insurance company

O do nothing since the lender is limited to the proceeds from the sale of the property

O take legal action against the borrower to recover the difference

QUESTION 6

Suppose you sign up for an annuity in which you save $500 weekly for 35 years. The annuity promises you an annual interest rate of 3% compounded weekly.

How much will the annuity be worth in 35 years? (note: there are 52 weeks in a year)

$370,781.83

$30,231.04

$910,000

$1,609,214.57

QUESTION 7

Which of the following deed types protects the buyer from encumbrances that arose during the time at which the current grantor held title?

O special warranty deed

O general warranty deed

quitclaim deed

O all of the deed types provide the same level of protection

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning