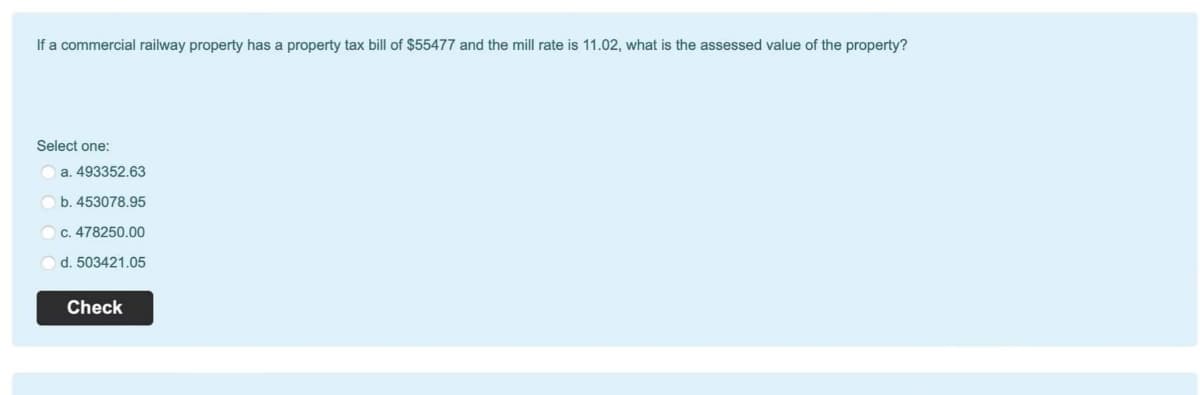

If a commercial railway property has a property tax bill of $55477 and the mill rate is 11.02, what is the assessed value of the property? Select one: a. 493352.63 b. 453078.95 c. 478250.00 d. 503421.05 Check

Q: Toxemia Salsa Corporation manufactures five flavors of salsa. Last year, Toxemia generated net…

A: Segment margin is the amount of profit or loss produced by one component of a business. Segment…

Q: Motorola Credit Corporation's annual report: Net revenue (sales) Net earnings Total assets Total…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: sing the information from the requirements above, complete the 'Analysis'. (Calculate the ratios to…

A: The dollar- value method of valuing LIFO inventories is a method of determining cost by using base…

Q: dit will be fully refundable for 2021 and her Other Dependent Credi redit is limited by her tax…

A: Child tax credit refers to the form of a tax credit allowed to the parents of dependent children by…

Q: XYZ Inc is preparing the October month-end Bank Reconciliation. The balance in the cash ledger on…

A: Bank reconciliation statement is the one which is prepared in order to reconcile the errors in…

Q: Which of the following taxpayers may qualify for the Premium Tax Credit? Each purchased health care…

A: The Correct option is A that Alanis. She files single and her tax liability is zero.

Q: *4* Assume that when consumer income increases ten percent (+10%), the demand for grits increases…

A: Income elasticity of demand is the responsivenesses of the quantity demanded for a good to a change…

Q: IFRS allows some flexibility regarding the classification of interest, dividends, and taxes.…

A: IFRS (International financial reporting standard) is defined as the set of rules and regulations…

Q: Some people describe a cover as being the exact same thing as an elevator conversation. Explain what…

A: SOLUTION:- A cover letter is a brief and formal document wherein you introduce yourself to the…

Q: Use the following end-of-period spreadsheet below to answer the question that follow. Finley Company…

A: To finish up your expense accounts, you will need to make a debit entry into the income summary…

Q: Intangible assets include each of the following except O copyrights O goodwill O land improvements…

A: Answer:- Intangible assets meaning:- An asset that is not in the physical form or nature is said to…

Q: Required: Lisa’s portfolio has provided the rates of return of 16.6%, 17.2%, - 9.6%, 15.5% and…

A: 1. Geometric Average Return = [{(1+ r1) x (1 + r2) x ............... x (1 + rn)}^(1 / n)] - 1 2.…

Q: Ameto $3 $4 B C D $2 $5 Realizable Value $4 $2 $4 $2 Down per Unit 2 ▬▬▬ 3 3,000 1,500 7,000 3,000…

A: 1) The Written Down for Item B is $2 per unit, so total amount for item B is 1,500 x 2 = 3,000 The…

Q: Indicate the pension-rela that would be reported in the company's income statement and balance sheet…

A: Pension fees are a form of the liability to the business. Because this is the obligation of the…

Q: References Knowledge Check 01 Dern Company recently sold a large order of tables to Knoll Furniture…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: Compute for the gross ta income of Dapitan below

A: Gross income is the income that available from all possible sources of income and that is the…

Q: Cost per unit $1.00 $1.05 Dec. 19 $1.10 Dec. 21 $1.12 The company sold 100 units at $2.00 per unit…

A: Under Perpetual inventory system the cost of good sold is updated simultaneously, that is after…

Q: Parker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its…

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: When you undertook the preparation of the financial statements for Steelers Company at January 31,…

A: Under LIFO Inventory Retail Method, Inventory at the end includes beginning inventory + inventory…

Q: The NVFT for an item under temporary importation and 1/60 partial GST Value of the item USD $275000…

A: SOLUTION:- The Bond for an item under temporary importation and 1/60 partial GST would be USD…

Q: On 1 January 2019, Happy Bhd acquired 75% of the ordinary shares and 30% of the preference shares of…

A: A non- controlling interest in a company means that a shareholder owns less than 50% of the…

Q: Prepare an income statement for Hansen Realty for the year ended December 31, 2023.

A: Working note 1 - Calculation of Net sales Net sales= Sales-Sales return- Sales discount…

Q: On what ground could Marley recover damages from Cliff? What would Marley have to prove to win their…

A: An agreement which is legally enforceable under which one party agree to provide a particular goods…

Q: You receive an invoice for $17,400 with terms of 3/15, n/60. The supplier has a policy of allowing a…

A: Introduction: To promote early payments by the purchaser, companies allow purchase discounts to the…

Q: How much is P1200 worth at the end of 1 year if the interestvrate of 5.5% is compunded quarterly

A: Formula: A = P(1+r/n)^nt Where, A = Amount. P = Principal amount = P1200 r = rate of interest =…

Q: Mario, a self-employed plumber, makes a maximum contribution to a SEP for his employee, Peach.…

A: A SEP IRA is a basic individual retirement account much like a traditional IRA. SEP IRAs are for…

Q: Compute Cash Conversion Cycle for Competing Firms Halliburton and Schlumberger compete in the oil…

A: Ratio analyses is done by the various parties (internal as well as external) so as to know about the…

Q: Fizzy Sodas and Hayes Companies are two of the largest and most successful beverage companies in the…

A: Introduction: Accounts receivables turnover ratio suggests that how well a company is managing its…

Q: 3. On December 31, X4, the book value of Company B's identifiable net assets was $600,000, and there…

A: Working :- 1) Calculation of Fair value of identifiable net assets on the date of acquisition :-…

Q: Bondi Bank agrees to lend Tawonga Construction Company Ltd $200 000 on 1 January. Tawonga…

A: Notes payable virtually usually need interest payments. The unpaid interest on the debt that has…

Q: CASE 26 All taxpayers are VAT taxpayers. Prices give Sale by Mr. A to Mr. B for P140,000; Sale by…

A:

Q: Can you use excel to do the data please.

A: The cost of direct material used is defined as the cost attributed to the production of end…

Q: Tubaugh Corporation has two major business segments-East and West. In December, the East business…

A: The contribution margin income statement for West business segment is presented below: Sales…

Q: Find the payment necessary to amortize a 8% loan of $800 compounded quarterly, with 9 quarterly…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: You buy goods at a list price of $1,500. If you receive a trade discount of 20% and terms are…

A: Discount period is defined as the days provided by the seller to the buyer of goods to avail the…

Q: Fox Corporation provides Luke, age 58, with $370,000 of group term life insurance coverage. Luke…

A: A group term life insurance policy would be one in which coverage is offered to numerous individuals…

Q: The cost of a certain asset is P 500,000. Its life is 10 years with a scrap value of P 50,000. Using…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: In May 2021, Whitney filed for divorce from her husband, Michael. Although they lived apart for the…

A: Married Filled Separately (MFS) Married couples who decide to report their individual earnings,…

Q: I had gotten the same solution and it counted it wrong in my homework. Is there any different steps…

A: When a receivable is no longer recoverable because a client is unable to fulfill their commitment to…

Q: On October 28, 2024, a company committed to a plan to sell a division that qualified as a component…

A: INTRODUCTION: There are three different sorts of financial reports or statements that are kept on…

Q: Selling price per unit Manufacturing costs: Variable manufacturing cost per unit produced: Direct…

A: Fixed manufacturing overhead refers to the expenses which does not change its valuation as per the…

Q: Whispering Corporation purchased 410 shares of Sherman Inc. common stock for $12,900 (Whispering…

A: The given investment would be classified as AFS as it satisfies does not satisfy the requirements of…

Q: ealthy Food Ltd is considering to invest in one of the two following projects to buy new machinery.…

A: NET PRESENT VALUE Net Present value is one of the Important Capital Budgeting Technique. Net…

Q: At December 31, 2017, bere any year-end adjustments, Cable Car Company's Insurance Expense account…

A: Insurance premiums are the costs to cover the risk. Sometimes a company pays for a future period of…

Q: Ona is an automobile salesperson who receives a salary of $1,500 per week plus a commission of 3% on…

A: The question is related to Salary for four week period and Commission based on sales.

Q: inden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Using the Cash T-Account and Bank Statement below, complete the Bank Reconciliation. *On October…

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with…

Q: Bristo Corporation has sales of 1,750 units at $40 per unit. Variable expenses are 30% of the…

A: The question is based on the concept of Cost Accounting. Degree of operating leverage is the…

Q: s. What is the total of Vanessa's Child Tax Credit and Other Dependent Credit?

A: Child tax credit refers to the form of a benefit provided by the authtoritaihve government to the…

Q: On March 31, 20Y9, the balances of the accounts appearing in the ledger of Royal Furnishings…

A: Multi- step income statement is the one which is prepared to determine each aspect of income…

Step by step

Solved in 2 steps

- 9. Calculate the assessed value (in $) and the property tax due (in $) on the property. Fair MarketValue AssessmentRate AssessedValue PropertyTax Rate PropertyTax Due $280,000 80 $ $25.60 per $1,000 $The market value(P) of a property is $833,333.33 in a jurisdiction in which the assessment ratio is 60%. The property owner has just been granted a homestead exemption of $50,000. The property is in a jurisdiction in which the current budget is $9 billion of which 80% derives from property taxes. The gross assessed value of all taxable properties is $684,000,000,000. Calculate the owner’s property tax for the yearCalculate the assessed value of the piece of property: Assessment rate Market value Assessed value 80% $210,000

- Megha Nhon Corp., a vat registered taxpayer made the following acquisition of equipment from vat registered suppliers (net of vat) during 2021 and 2022: Date Purchase price Useful life (yrs) Oct. 1, 2021 2,000,000 6 Apr. 1, 2022 2,500,000 2 The equipment acquired on Oct. 2021 was sold on Apr. 2022. How much is the creditable input vat on Apr. 2022? P216,000 P324,000 P516,000 P300,000K's Warehouse has a market value of $900,000. The property in K's is assessed at 45% of the market value. What is K's property tax? (The tax rate is $62.40 per $1,000 of assessed value.)A tax declaration contains the following data: Actual use of property Residential Market value: Land P500,000 Improvement 800,000 Property: Assessment Level Basic Tax Rate Land 15% 1% Improvement 20% 1% Requirements: 1. Total real property tax assessable on the properties.

- if a company is considering the purchase of a parcel of land that was acquired by the seller for $89,000 is offered for sale at 158,000 is assessed for tax purposes at 99,000 is considered by the purchaser as easily being worth 148,000 and is purchased for 145,000 the land should be recored in the purchaser books at (A. 99,000, B. 145,000, C. 146,500, D. 148,000, E. 158,000)The company has a list of equipment they sold during the tax year. Please review the list and answer the questions below:Equipment - MACRS Year - Property Cost - Accumulated Depreciation - Sales PriceLuxury Car 5 Year Property $45,000 $20,000 $15,000Computer 5 Year Property $3,500 $1,200 $100Furniture 7 Year Property $92,000 $48,000 $40,0006. What will be the tax treatment as follows for the sale of the Luxury Cara. Calculate the Realized Gain or Lossb. What will be the character and amount of the Recognized gain?A machine has a carrying amount of 100. For tax purposes, depreciation of 30 has already been deducted from taxable profit in prior periods and an amount of 70 will be deductible in future periods, either as depreciation or through a deduction on disposal. Revenue generated by using the machine is taxable, any gain on disposal of the machine will be taxable and any loss on disposal will be deductible for tax purposes. What is the tax base of the machine? a. 100 b. 70 c. 30 d. 0

- Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000. The municipal assessor was taxing an idle agricultural land consisting of 2 hectares valued at P 200 per square meter. If the idle land tax imposed is 5% by the ordinance, how much will the owner pay for the idle land tax?a. P 80,000.00 b. P 100,000.00 c. P 200,000 d. P 40,000.0011. The following data are shown on the tax declarations of a piece of land and thKk182. Which of the following assets would be treated as a capital assets A. A painting that the taxpayer had purchased directly from the artist B. raw material used in production C. A free U>S> government publication received by the taxpayer D. Accounts receivable acquired on the sale of inventory