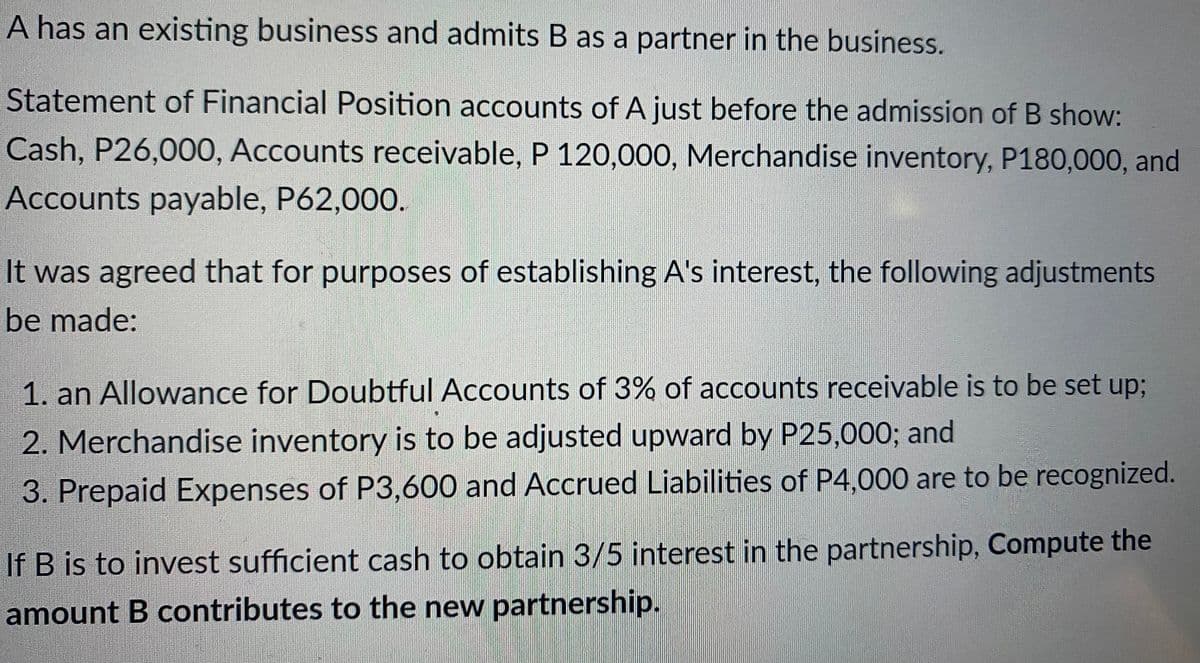

If B is to invest sufficient cash to obtain 3/5 interest in the partnership, Compute the amount B contributes to the new partnership.

Q: Portland Brewing Company is a small craft brewer that produces five varieties of beer. The beers…

A: Contribution margin: The difference between the sales and the variable costs is called contribution…

Q: On January 1, 2022, A and B formed a partnership. A and B agreed to share the partnership's profit…

A: Partnership: The arrangement in which more than one entity, whether it is an individual or…

Q: Calculate Melissa Allen’s tax liability for taxable income of $59,580. She files single and claims 3…

A: Since Melissa Allen files single, Rates given in Schedule X will be used for calculating the tax…

Q: Brandin Grocers gives one loyalty point to its customers for every dollar spent in the store. The…

A: The sales revenue is the amount that is received by the company from the sales. The sales revenue is…

Q: The Montana Company paid for the acquisition of an equipment by signing a $100,000 three year 6%…

A: Year cash flows Pv factor @ 10% Present value a b c d= b x c 1 6000 0.9091 5455 2 6000 0.8264…

Q: Date March 1 March 5 March 9 March 17 March 22 March 27 March 30 Transactions Beginning inventory…

A: 1. Calculation of inventory using the Specific Identification Method on 31st March Date…

Q: Sporting Goods Department:

A: Under the retail method, the cost to retail ratio is used in order to calculate the ending…

Q: A limited partnership is a O a. Domestic Limited partnership O b. sole proprietorship O c. limited…

A: Partnership shows the business that are carried by two or more partners. The partners are…

Q: Compute the adjusted capital account of A after the formation.

A: Whenever a new partner is admitted into the partnership firm, it is called as Reconstitution of…

Q: Comment on your calculations (given down below).

A: Meaning of certain terms: 1. Labour Rate Variance: Labour rate variance arises due to difference in…

Q: akota Co. has prepared the following flexible budget for the coming year. The budgeted level of…

A: Solution: If the budget is flexed to a level of activity of costs be = direct materials + Direct…

Q: How isaccounting for a partnership ifferent from accounting for a corporation

A: Accounting processes for a partnership business and accounting processes for a corporation have…

Q: 4-a. Determine Lakeside's pension expense for 2025. 4-b. Prepare the appropriate journal entries to…

A: A journal is a detailed account that records all the financial transactions of a business, to be…

Q: O O O $2,253.00 $4,205.13 $12,576.05 $9,215.38

A: Medicare tax payable is also called as the hospital insurance tax. It is the amount of federal…

Q: With the estimates shown below, Sarah needs to determine the trade-in (replacement) value of machine…

A: The word "replacement cost" refers to the amount of money that a company has to pay at the present…

Q: Business Decision Case The sales department of Donovan Manufacturing, Inc. has completed the…

A: Budgeting is an accounting process in which forecast of future revenues and expenses are prepared…

Q: ta Co. is about to issue $460,000 of 10-year bonds paying an 10% interest rate, with interest…

A: Answer : Principal = $460,000 Interest = $460,000 * 10% = $46,000 Discount rate = 12%

Q: 4-a. Determine Lakeside's pension expense for 2025. 4-b. Prepare the appropriate journal entries to…

A: Pension refers to the amount that is paid by the company or government to the person who stopped…

Q: service cost at January 1, 2024, from plan amendment at the beginning of (amortization: $4 million…

A: Pension expense:- Pension expense is the amount that a business charges to expense in relation to…

Q: Calculate the basic EPS

A: 1. EPS shall be calculated for the ordinary equity shares only but not for preference shares. 2. EPS…

Q: The table indicates that the founders should not have sold 400 shares in the series D round for…

A: The shares that are issued to the organizers of the company are known as the founder shares. These…

Q: ces The stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April…

A: Shares issued as stock dividend = shares issued and outstanding× 20% = 235,000×20% = 47000 shares

Q: The following is Sullivan Corp.'s comparative statement of financial position accounts at December…

A: Cash flow statement is an important tool used to manage finances by tracking the cash flow for an…

Q: Which of the following statements are true regarding dividends? (You may select more than one…

A: Dividends are considered as the distributed part of the net income of corporate form of…

Q: An asset is said to be fully depreciated when:

A: An provided economic benefit these are creating value of addition story enhance the profit…

Q: How do counterbalancing errors differ from noncounterbalancing errors?

A: Errors that occur in a specific period but are anticipated to be rectified in subsequent periods are…

Q: What do we mean by "high quality" and "low quality" accruals? How does the market respond…

A: The concept of high earning quality is associated with earning that are free from manipulations by…

Q: E10.1 (LO 1), AP C.S. Lewis Company had the following transactions involving notes payable. July 1,…

A: Note payable: Note payable also called promissory note. It is a legal instrument in which one party…

Q: Dicks Products is a division of a major corporation. The following data are for the last year of…

A: The ratio analysis helps to analyse the financial statements of the business on regular basis. The…

Q: olomon Corporation operates three investment centers. The following financial statements apply to…

A: Residual income is the remaining balance of the operating income that is remained after the…

Q: If the company employs a cost-plus markup of 30%, assuming the original volume of 28 dogs per day,…

A: Calculation of Estimated Dog hours per year = 5 x 50 x 8 x 28 = 56000 dog hours

Q: A Record costs of lump-sum purchase. Note: Enter debits before credits. Transaction 1 General…

A: A lump-sum purchase occurs when several assets are acquired for a single price. Each of the assets…

Q: What is the annual depreciation? What is the book value after 6 years? What is the total…

A: Particulars Amount (P) Cost of equipment 500000 Installation cost 60000 Other Cost 40000…

Q: Tinto Ltd obtained control of Suda ltd by acquiring 80% of the issued share capital of Suda ltd at 1…

A: Journal entry is a primary entry that records the financial transactions initially. The transaction…

Q: Allen Company has the following information for the Assembly Department for the month of October:…

A: The journal entries are prepared to record the transactions on regular basis. The inventory…

Q: (1) Compute the overhead volume variance. Indicate variance as favorable or unfavorable. (2) Compute…

A: 1. Controllable Overhead Variance: The controllable variance consists of a combination of variable…

Q: Instead of investing the entire $1,062,000, Bogut invests $278,900 today and plans to make 9 equal…

A: Future Value Factor = Future Value / Amount Invested = 2,122,938 /…

Q: Exercise 13-39 (Static) Estimate Cash Collections (LO 13-4) Hackett Produce Supply is preparing its…

A: The cash budget is prepared to estimate the cash receipts or cash payments during the period. The…

Q: (a) Prepare a schedule of budgeted cash receipts from customers for March. SHEFFIELDCOMPANY Budgeted…

A: Budgeted cash receipts are the amounts of cash you expect to collect based on the forecasted sales…

Q: Sandhill Home Improvement Company installs replacement siding, windows, and louvered glass doors for…

A: Golden Rules of Accounting: Account Debit Credit Personal Accounts The Receiver The…

Q: On January 1, the Matthews Band pays $68,200 for sound equipment. The band estimates it will use…

A: Straight line method : Under straight line method, a fixed percentage on the original cost of the…

Q: Determining Cash Flows from Financing Activities Nichols Inc. reported the following amounts on its…

A: Statement of Cash flows includes: Cash flows from operating activities Cash flows from investing…

Q: 1. Compute the velocity (number of models per hour) that the cell can theoretically achieve. If…

A: 1 .) Given Data:- Budgeted conversion costs = $8791,680 Budgeted materials =$18,616,000 Cell…

Q: What is the break-even point in sales for 1993? b. Calculate the profit or loss if 130,000 of the…

A: 1. Meaning of Break even point: The break-even point is the point at which total cost and total…

Q: neral Journal epare journal entries to record a monthly cash sale on January 31 under the original…

A: Journal entries are the first step in recording financial transactions. Recording of journal entries…

Q: Gigasales Department Store Income Statement For the Year Ended December 31, 2022…

A: Sensitivity analysis factors many elements to estimate the possible outcome or the net income…

Q: 1. Moneyman, Inc. reported $63,000 net income on its income statement for the current year.…

A: Cash Flow Statement - The Cash Flow Statement is the statement that shows the cash inflow and…

Q: which of the following does not explain the poor performance of mergers and acquisitions ? i.…

A: Mergers and acquisitions, or M&A for short, involves the process of combining two companies into…

Q: Exercise 12-1 (Algo) Indirect: Classifying Cash flows LO C1 ndicate where each item would appear on…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: The standard direct labour cost of product Berg is as follows: Three hours of skilled labour at £4…

A: Introduction: Total labour variance is the difference between actual direct labour cost incurred and…

Step by step

Solved in 3 steps with 2 images

- Moira admits Joni as a partner in the business. Balance sheet accounts of Moira just before theadmission of July shows: Cash, P43,000, Accounts Receivable, P150,000, Merchandise Inventory, P170,000, Accounts Payable, P52,000. It was agreed that for purposes of establishing Moira’s interest, the following adjustments should be made: 1.) an allowance for doubtful accounts of 3% of accounts receivable is to be established; 2.) merchandise inventory is to be increased by P25,000; 3.) prepaid expenses of P7,600 and accrued liabilities of P4,800 are to be recognized. If Joni isto invest sufficient cash to obtain 2/5 interest in the partnership, What amount should she contribute to the new business? *Z admits A as a partner in business. Accounts in the ledger for Z on November 20, 2018, just before the admission of A, show the following balances: Cash Accounts Receivable Merchandise Inventory Prepaid expense Accounts Payable Z, Capital P 6,800 14,200 20,000 1,000 9,000 33,000 It is agreed that the purposes of establishing Z's interest the following adjustments shall be made: a) An allowance for doubtful accounts of 3% of accounts receivable is to be established b) The merchandise inventory is to be valued at P23,000. c) Prepaid salary expenses of P600 and accrued rent expense of P800 are to be recognized. A is to invest sufficient cash to obtain a 1/3 interest in the partnership. (1) Z's adjusted capital before the admission of A; and (2) the amount cash investment by A:A admits B as a partner in business. Accounts in ledger for A on October 31, 2021, just before the admission of B show the following balances: Cash: 50,000 Accounts Receivable: 110,000 Notes Receivable: 20,000 Inventories: 50,000 Accounts Payable: 30,000 It is agreed that for the purposes of establishing A's interest, the following adjustments shall be made: An allowance for doubtful accounts of 5% of accounts receivable is to be established. An inventory amounting to 10,000 is worthless. Prepaid expenses of 1,000 and accrued expense of 2,000 are to be recognied. An interest of 10% on notes receivable amounting 10,000 dated April 30,2020 is to be accrued. B is to invest sufficient cash to obtain a 1/4 interest in the partnership. Determine the amount of cash investment by Partner B.

- PROBLEM: Moira admits Joni as a partner in the business. Balance sheet accounts of Moira just before the admission of July shows: Cash, P43,000, Accounts Receivable, P150,000, Merchandise Inventory, P170,000, and Accounts Payable, P52,000. It was agreed that for purposes of establishing Moira’s interest, the following adjustments should be made: 1.) an allowance for doubtful accounts of 3% of accounts receivable is to be established; 2.) merchandise inventory is to be increased by P25,000; and 3.) prepaid expenses of P7,600 and accrued liabilities of P4,800 are to be recognized. QUESTION: If Joni is to invest sufficient cash to obtain 2/5 interest in the partnership, what amount should she contribute to the new business? (Good Accounting Form)Maria admits Daisy as a partner in the business. Financial position accounts of Maria on September 30, just before admission of Daisy show: Cash, P52,000; Accounts Receivable, P240,000; Merchandise Inventory, P360,000; Accounts Payable of P124,000. It is agreed that for purposes of establishing Maria’s interest, the following adjustments shall be made: (1) An allowance for doubtful accounts of 3% is to be established (2) Merchandise inventory is to be adjusted upward by P50,000 and (3) Prepaid expenses of P7,000 and accrued liabilities of P8,000 are to be recognized. Daisy is to invest sufficient cash to obtain 2/5 interest in the partnership. How much is the total capital of the partnership after dissolutionZ admits A as a partner in business. Accounts in the ledger for Z on November 20, 2018, just before the admission of A, show the following balances: Cash P 6,800Accounts Receivable 14,200Merchandise Inventory 20,000Prepaid expense 1,000Accounts Payable 9,000Z, Capital 33,000 It is agreed that the purposes of establishing Z's interest the following adjustments shall be made:a) An allowance for doubtful accounts of 3% of accounts receivable is to be establishedb) The merchandise inventory is to be valued at P23,000.c) Prepaid salary expenses of P600 and accrued rent expense of P800 are to be recognized. A is to invest sufficient cash to obtain a 1/3 interest in the partnership.(1) Z's adjusted capital before…

- Cara admits Dana in her business as a partner. At November 30, 2010, prior to the admission of Dana, the records of Cara show the following: DR CR Cash ? Accounts Receivable P 192 000 Merchandise inventory 288 000 Accounts Payable P 99 200 Cara, Capital ? The following adjustments are needed in the books of Cara to establish her interest: The allowance for doubtful accounts equivalent of 2 % of accounts receivable is to be establishedThe merchandise inventory is to be valued at P 320,000.Prepaid expenses of P 10,400 and accrued expenses of P 6,400 are to be recognized. Dana invests cash of P 227,280 to give him a one-third…Marie admits Neri as a partner in business. Just before the partnership’s formation, Marie's books showed the following:Cash 2,600Account Receivable 12,000Merchandise Inventory 18,000Accounts Payable 6,200Melai, capital 26,400 It was agreed that, for purpose of establishing Marie's investment in the firm, the following adjustment shall be reflected:1. Allowance for bad debts of 2% should be set up. 2. Merchandise inventory should be valued at P20,200. 3. Prepaid expenses of P350 and accrued expenses of P400 should be recognize.How much cash should Neri invest to secure a one-third interest in the partnership?need answer asap, please. tysm! Marie admits Neri as a partner in business. Just before the partnership's formation, Marie's books showed the following: Cash 2,600 Accounts Receivable 12,000 Merchandise Inventory 18,000 Accounts Payable 6,200 Marie, Capital 26,400 It was agreed that, for purposes of establishing Marie's investment in the firm, the following adjustments shall be reflected: 1. Allowance for bad debts of 2% should be set up 2. Merchandise Inventory should be valued at P20,200 3. Prepaid expenses of P350 and accrued expenses of P400 should be recognized. How much cash should Neri invest to secure a 1/3 interest in the partnership?

- Marie admits nelly as a partner in business. Just before the partnership's formation, Marie books showed the following Cash 2,600 Accounts receivable 12,000 Merchandise inventory 18,000 Accounts payable 6,200 Mark, Capital 26,400 It was agreed that, for purposes of establishing Marie investment in the firm, the following adjustments shall be reflected: . Allowance for bad debts of 2% should be set up. • Merchandise inventory should be valued at P20,200. • Prepaid expenses of P350 and accrued expenses of P400 should be recognized. Using the same information in no. 2. If nelly contributed an equipment with carrying value of P4,000 and fair value of P4.500, how much cash was contributed for a one-fifth interest in the partnership?Marie admits Neri as a partner in business. Just before the partnership's formation, Marie's books showed the following: Cash 2,600 Accounts Receivable 12,000 Merchandise Inventory 18,000 Accounts Payable 6,200 Marie, Capital 26,400 It was agreed that, for purposes of establishing Marie's investment in the firm, the following adjustments shall be reflected: 1. Allowance for bad debts of 2% should be set up 2. Merchandise Inventory should be valued at P20,200 3. Prepaid expenses of P350 and accrued expenses of P400 should be recognized. How much cash should Neri invest to secure a 1/3 interest in the partnership?Prepare the Statement of Financial Position as at 28 February 2021. (The notes to the financial statements are not required.) INFORMATION The following list of balances was obtained from the accounting records of Stanger Stores (with Stan and Gerald as partners) on 28 February 2021, the end of the financial year, after all the adjustments and closing transfers were completed. LIST OF BALANCES AS AT 28 FEBRUARY 2021 Debit (R) Credit (R) Capital: Stan 2 400 000 Capital: Gerald 1 200 000 Current account: Stan 4 000 Current account: Gerald 102 000 Land and buildings 3 440 000 Equipment at cost 320 000 Accumulated depreciation on vehicles 152 000 Fixed deposit (matures on 31 March 2022) 162 000 Trading inventory 830 000 Debtors control 84 000 Provision for bad debts 4 000 Bank 60 000 Cash float 10 000 Creditors control 100 000 Loan: Web Bank (R160 000 is payable in the next financial year) 960 000 Accrued expenses 2 600 Income received in advance 1 400 Consumable stores on hand 2 000…