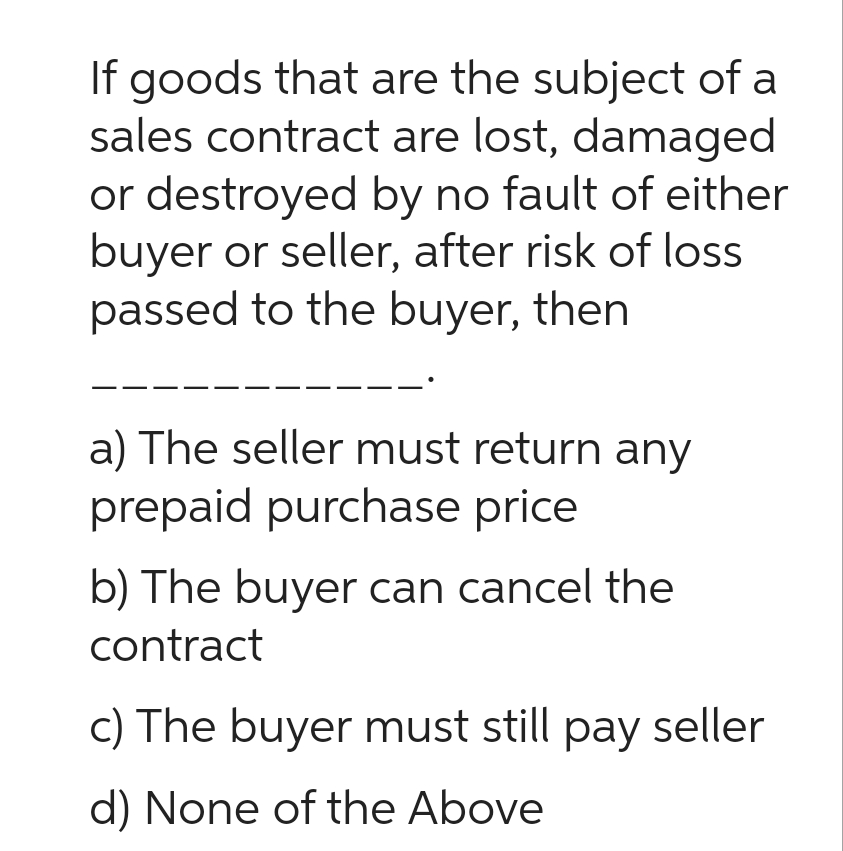

If goods that are the subject of a sales contract are lost, damaged uno fault of nith pone

Q: Baird Company is considering investing in two new vans that are expected to generate combined cash…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: Pullman Corporation had retained earnings of $2,100,000 at January 1, 2015. During the year the…

A: Retained earnings are the unallocated profits available for distribution to the shareholders. So the…

Q: J. Lo's Clothiers has forecast credit sales for the fourth quarter of the year: Fourth Quarter…

A: The cash collection schedule is prepared to estimate the cash collection during the period. The…

Q: Addison, Inc. uses a perpetual inventory system. The following is information about one inventory…

A: LIFO Method :— It is one of the method of inventory valuation in which it is assumed that recent or…

Q: Thomas Ramsey is the owner of Atlas Magazine. On January 1", Atlas Magazine purchased printing…

A: DEPRECIATION EXPENSE Depreciation means gradual decrease in the value of an asset due to normal wear…

Q: Calculating Basic Earnings per Share XYZ Company has net income of $580,000 before an extraordinary…

A: Earnings per share (EPS) is a financial metric that indicates the amount of a company's net income…

Q: Company is appr ched by a new customer to provide 1,680 units of its product at a special price of…

A: Special Order Decision Analysis Is a Method Businesses Use To Evaluate The Net Income Of Accepting…

Q: On November 1, 2020, Cheng Company (a U.S.-based company) forecasts the purchase of goods from a…

A: Forward contract is a Standardized item which is traded on exchange it happens between two parties…

Q: Jazz Corporation owns 50% of the Williams Corp. stock. Williams distributed a $30,000 dividend to…

A: Dividend received deduction As per section 57(i) of ITA, The interest taht is charged on the…

Q: en Thumb Nursery has 47,000 shares outstanding at a market price of $63.45 per share. The 000.…

A: EPS is an important indicator of a company's financial health, as it can provide insight into the…

Q: The Rink offers annual $400 memberships that entitle members to unlimited use of ice-skating…

A: As you have asked multiple question we can solve only first question please repost the question with…

Q: 72 Revenue Recognition and Ethics. The following article was published in Newsday on February 9,…

A: Introduction:- This question is related to revenue recognition and ethics, specifically regarding…

Q: You are the accountant for the Millenium Corporation. Last year the company purchased a $2,500,000…

A: When a business purchases an asset, such as machinery or a vehicle, it can claim a portion of the…

Q: C Ltd has two departments A & B. Overhead is applied based on direct labour hours in department A…

A: Lets understand the basics. Overhead rate is calculated by the entity based on budgeted details to…

Q: P12-2 Analyzing Comparative Financial Statements by Using Percentages and Selected Ratios LO12-5,…

A: A company's profitability in relation to its total assets is determined by its return on assets. In…

Q: 9-45. Activity-Based versus Traditional Costing—Ethical Issues Cathedral City Services (CCS) is a…

A: As per the guidelines we can solve only first three sub-parts for you if you want to get another…

Q: thank you so much for answering question 1. Will you please answer question two? Thank you again

A: Variable cost is the cost which changes with change in production volume and fixed manufacturing…

Q: Regular Company produces audio equipment, specifically headphones and speakers. A new CEO has just…

A: Manufacturing overhead is the indirect costs that are incurred during the manufacturing process,…

Q: On January 1, 2013 Westman Fuji sold for $40 and on January 1, 2014 Westman Fuji sold for $39.50.…

A: Ratio analysis used identify the business performance of the company. It is used to measure…

Q: Paleo Bay Divers is a company that provides diving services such as underwater ship repairs to…

A: FLEXIBLE BUDGET A flexible budget is a budget that is prepared for different levels of activity or…

Q: Required Information [The following information applies to the questions displayed below] On April…

A: The treasury stock decreases the total shareholders' equity. the sale of treasury stock increases…

Q: Individual L donated $10,000 to a Canadi donation tax credit? (Enter the amount an

A: Donations given to charities are subjected to tax credits from federal government and also from…

Q: if you can double check 1a and 1b 2a and i need answer 4 as well

A: A flexible budget is a kind of a budget that can be changed multiple times if the revenue or…

Q: The costs associated with two alternative types of Kombucha are listed below. Brandless Kombuchal…

A: Decision making is a process of tr taking decision between two alternative. In decision making…

Q: Mary and Sue both work for WAWA. They b $1000 a year in health care expenses. Mary flexible spending…

A: Tax is a mandatory financial charge imposed by a government on individuals, businesses, or other…

Q: Armand Company projects the following sales for the first three months of the year: $14,300 in…

A: Cash budget: It implies to a financial estimation that reflects all the inflows and outflows of cash…

Q: Show the balance sheet after the loan is established using purchased liquidity to fund the loan.…

A: When a loan is established, it means that a borrower has been granted access to a specific amount of…

Q: Please explain these Ferguson cases under Australia Taxation? Theory question please concentrate ?…

A: In simple terms, the Ferguson issue concerned the issue of whether or not a taxpayer who rented cows…

Q: AgriFoods, Incorporated prepares and delivers agricultural products to industrial-scale kitchens and…

A: When a business receives an amount for revenues to be earned in the future, then that amount is,…

Q: 13-1 Ellen catering acquires a delivery truck at a cost of $36,000. The truck is expected to have a…

A: Depreciation is used to allocate capital expenditure of asset over the period of useful life of…

Q: Keggler's Supply is a merchandiser of three different products. Beginning inventories for March are…

A: Production budget :— This budget is prepared to estimate the number of units to be produced for the…

Q: The Bronco Corporation exchanged land for equipment. The land had a book value of $131,000 and a…

A: Exchange means to give up something for something else. Here in the question, Land is exchanged with…

Q: Required information [The following information applies to the questions displayed below.] AMP…

A: Section 179 was introduced to enhance capital investment. Section 179 for 2022 provides that the…

Q: Windsor Inc. uses a calendar year for financial reporting. The company is authorized to issue…

A: The portion of company's generated profit that is to be allocated to the common stockholders of the…

Q: Please explain these Ferguson cases under Taxation. Theory question, please concentrate. Under…

A: The Ferguson cases refer to a series of legal cases that occurred in Australia in the 1970s and…

Q: The WIP account given below relates to the activities of Jones Ltd for the month of April: April 1…

A: The direct costs and overhead applied are debited to work in process account. The finished goods…

Q: Tom's Toolery is operating at 90% of its productive capacity. It is currently paying $26 per unit…

A: Decision making in management accounting is the process of selecting the best out of the…

Q: Please explain these Myer Emporium cases under Taxation. Theory question, please concentrate. Under…

A: The Myer Emporium cases refer to a series of legal cases that occurred in Australia in the 1970s and…

Q: Cullumber Corp. is thinking about opening a soccer camp in southern California. To start the camp,…

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows)

Q: How can a single revenue recognition standard address all the complexities and unique clauses…

A: INTRODUCTION:- Revenue recognition is an important aspect of accounting and financial reporting, and…

Q: In a recent pay period, Blue Company employees have gross salaries of $18,960. Total deductions are:…

A: Please find the calculations of the Company's total payroll expense in Step 2 below.

Q: The manager of a plant that manufactures stepper drives knew that MACRS and DDB were both…

A: Depreciation is an expense provided for regular usage of tangible fixed assets in the process of…

Q: The following information is provided for Apolis Inc. Total common stockholders' equity on Dec. 31,…

A: Net income=Dividends declaredPayout ratio Return on equity=Net incomeAverage common stockholders'…

Q: Sharon Incorporated is headquartered in State X and owns 100 percent of Carol Corporation, Josey…

A: Under the solicitation bounds of Public Law 86-272, the business income should be assigned to the…

Q: Gates Inc., a calendar year firm, currently uses a plant asset in operations that originally cost…

A: An impairment loss is recorded when an asset's fair value becomes lower than its carrying value. The…

Q: Under the constitution: Prohibition against taxation of non-stock, non-profit [educational]…

A: Hi student Since there are multiple questions, we will answer only first question. If you want…

Q: Transactions during 2021 were as follows: a. On January 2, 2021, equipment were purchased at a total…

A: The entire cost that a business record for property or equipment on its books, less any discounts,…

Q: 1 2 3 12 13 14 15 16 17 18 4 5 Accounts Receivable 6 Inventory 7 Equipment 8 Accumulated…

A: Cash Flow Statement - Cash Flow Statement is a financial statement that includes inflow and outflow…

Q: Hildreth Company uses a job order cost system. The following data summarize the operations related…

A: Job order cost sheet is used for recording the production cost incurred on each job. Production cost…

Q: Hy Marx Company recorded a right-of-use asset of $610,000 in a 10-year operating lease. Lease…

A: Lease is defined a contractual agreement incorporated between two business entities where one entity…

T6.

Step by step

Solved in 3 steps

- 92. Which of the following is not a mode of extinguishment of contract of sale? Group of answer choices a. Redemption, whether legal redemption or conventional redemption b. Fulfilment of suspensive condition on sale of a determinate thing whose acquisition of ownership by the seller depends upon a contingency c. Resale of the goods by the unpaid seller d. Cancellation of sale of personal property in instalments by the seller in case the buyer defaulted in at least two instalmentsPurchase commitmentsA. Are obligations of the company to acquire certain goods at a fixed price and fixed quantity sometime in the futureB. require disclosures when considered common and significantC. Giving rise to a purchase price falling below the agreed price is accounted for as debit to loss on purchase commitments and credited to an estimated liabilityD. All of the aboveE. None of the aboveOwnership of inventories is normally transferred to the buyerA. when legal title to inventories is transferredB. when the purchase price if fully paidC. upon shipment of the goodsD. upon filling up the sales orderWhen accounting for inventoriesA. the form of sales contract is more important than its substanceB. the agreement between seller and buyer shall be considered in determining the timing of transfer of ownership over the goodsC. sales contract is ignored since ownership over inventories are transferred only upon receipt of delivery by the buyerD. a journal entry is made only upon receipt…A contract does not qualify for revenue recognition if Either party can unilaterally cancel the contract before performance without compensating the other party. The contract is wholly unperformed. Contract terms allow cancellation without penalty by either party at any time prior to delivery of the goods. Any one of these choices apply.

- As a general rule, the buyer has the right to examine the goods before accepting them. The following are the exceptions to the general rule, except Group of answer choices When there is stipulation that the goods shall not be delivered to the buyer until he has paid the price When the good are marked with the words collect on delivery When there is an agreement to that effect When the usage of trade permits examinationRevenue should be recognized over time when a performance obligation is satisfied over time. That occursif (1) the customer consumes the benefit of the seller’s work as it is performed, (2) the customer controlsthe asset as the seller creates it, or (3) the asset has no alternative use to the seller and the seller can be paidfor its progress even if the customer cancels the contractIn deciding whether to accept a special order, freight charges paid by the buyer are relevant. a) True b) False

- 1."A sale of Goods Contract once made can never come to an end".Discuss the above statement with relevant examples.Statement I: In case of doubt, a contract purporting to be a sale with right of repurchase is construed as an assignment of rights. Statement II: The creditors of the vendor cannot make use of the right of redemption against the vendee until after exhausting the property of the vendor. Only Statement I is true. Only Statement II is true. Both statements are true. Both statements are false.In order to say that the buyer is insolvent in order for the seller to exercise his right to stoppage in transitu, such insolvency should be judicially declared. True or False

- 1. From pages 5-1 and 5-2 of the VLN, which statement is FALSE as it relates to a trade discount? Group of answer choices A. It is a concept. B. The company provides a good or service at a reduced price. C. A contra revenue is recognized at the time of sale. D. It causes the sale to be recognized at the reduced, agreed upon price.4. An encumbrance represents the estimated future liability for goods or services resulting from placing a purchase order or signing a contract. True or FalseWhich of the following feature/s related to FOB shipping point under shipping terms, except? a. Title and control of the goods the moment the carrier signs the bill of lading with the buyer b. Buyer assumes risk of transportation and is entitled to route the shipment c. Buyer is responsible for filing claims for loss or damage d. Seller is responsible for filing claims for loss or damage.