If profits and losses shall be based on ratio of simple average capital balance how should the profit be distributed between Julian and Felipe? a. Julian, P258,333; Felipe, P141,667 b. Julian, P241,667; Felipe, P158,333 c. Julian, P250,000; Felipe, P150,000 d. Not given 5. If profits and losses shal! be based on ratio of weighted average capital balances how should the profit be distributed between Julian and Felipe? a. Julian, P288,889; Felipe, Pl 11,111 b. Julian, P267,606; Felipe, P132,394 c. Julian, P244,444; Felipe, PI55,556 d. Not given

If profits and losses shall be based on ratio of simple average capital balance how should the profit be distributed between Julian and Felipe? a. Julian, P258,333; Felipe, P141,667 b. Julian, P241,667; Felipe, P158,333 c. Julian, P250,000; Felipe, P150,000 d. Not given 5. If profits and losses shal! be based on ratio of weighted average capital balances how should the profit be distributed between Julian and Felipe? a. Julian, P288,889; Felipe, Pl 11,111 b. Julian, P267,606; Felipe, P132,394 c. Julian, P244,444; Felipe, PI55,556 d. Not given

Chapter21: Partnerships

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Hi! This topic is about Partnership Dissolution.

The number 4 and 5 are my questions. choose the letter of answer. Thank you!!!

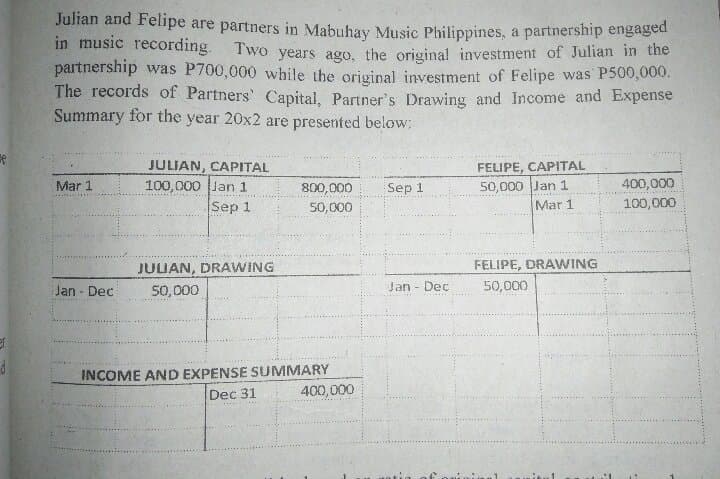

Transcribed Image Text:Julian and Felipe are partners in Mabuhay Music Philippines, a partnership engaged

in music recording. Two years ago, the original investment of Julian imn the

partnership was P700,000 while the original investment of Felipe was P500,000.

The records of Partners' Capital, Partner's Drawing and Income and Expense

Summary for the year 20x2 are presented below:

JULIAN, CAPITAL

100,000 lan 1

Sep 1

FELIPE, CAPITAL

50,000 Jan 1

Mar 1

400,000

100,000

Mar 1

800,000

50,000

Sep 1

JULUAN, DRAWING

FELIPE, DRAWING

Jan - Dec

50, 000

Jan - Dec

50,000

INCOME AND EXPENSE SUMMARY

400,000

Dec 31

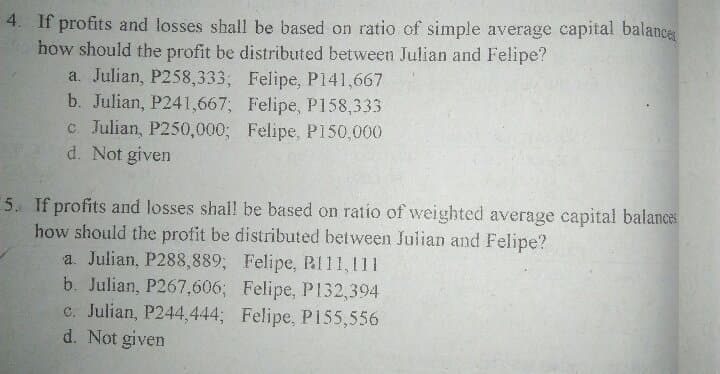

Transcribed Image Text:4. If profits and losses shall be based on ratio of simple average capital balance

how should the profit be distributed between Julian and Felipe?

a. Julian, P258,333; Felipe, P141,667

b. Julian, P241,667; Felipe, P158,333

c. Julian, P250,000; Felipe, P150,000

d. Not given

5. If profits and losses shal! be based on ratio of weighted average capital balances

how should the profit be distributed between Julian and Felipe?

a. Julian, P288,889; Felipe, PI11,111

b. Julian, P267,606; Felipe, P132,394

c. Julian, P244,444; Felipe, P155,556

d. Not given

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT