Q: Assume you have an optimal risky portfolio with an expected return of 17% and a standard deviation…

A: Given: Expected return = 17% Standard deviation = 27% Risk free rate = 5% Risk aversion = 2

Q: On September 6, Irene Westing purchased one bond of Mick Corporation at 91.75%. The bond pays 5.25%…

A: Bonds are the debt securities which are issued by the companies or the government to arrange the…

Q: 15. If you make a single deposit into an account, at what annual interest rate compounded yearly…

A: It can be calculated using Yield to maturity can be calculated by following function in excel =RATE…

Q: Debt ratio of JFC * STATEMENT OF FINANCIAL POSITION AND INCOME STATEMENT OF 3 COMIPANIES AS DECEMBER…

A: Solution:- Debt ratio means the ratio of total debt of a company to its total assets. So, Debt ratio…

Q: What is the simple interest on ₱ 30,000 for six months at a simple interest rate of 12% (b) What is…

A: Answer - Part a - Calculation of Simple Interest - Simple Interest = PRT /100 Given, P = 30,000 R =…

Q: Matchroom's investment appraisal committee have worked out the Net Cash flows in the working shown…

A: Discount Rate 10% Discount Rate 20% Year Net CashFlows 0 -£ 1,14,285.71 1 £…

Q: a. What minimum amount of shares must Nancy purchase to have a sales charge of 5.50%? (Round up to…

A: Fund generation or fundraising refers to a process which is used by the company to raise and gather…

Q: WHAT IS CASH CONVERSION CYCLE OF GLOBE? NOTE: PLEASE SHOW YOUR SOLUTION AND DONT USE EXCEL

A: The cash conversion cycle : The cash conversion cycle represents the time taken by a company to…

Q: Riley Co. has a DOL of 140% and a DFL of 113%. If sales decrease by 12%, what is the expected…

A: Solution: We know, Degree of Operating Leverage (DOL) measures the percentage change in operating…

Q: . $122.72 million

A: Net present value is useful for calculating the current total value of all the future streams of…

Q: by payback . period? What are their significancs and drawbacks? Find the payback periods of given…

A: 1. The payback period is the period within which the initial investment is recovered. Payback period…

Q: Finance Use covered interest rate parity (CIP) to show that a fixed exchange rate and free capital…

A: Interest rate parity (IRP) is a concept that connects interest rates, spot exchange rates, and forex…

Q: A firm's overall cost of capital that is a blend of the costs of the different sources of capital is…

A: A company can raise funds through 1. Equity and 2. Debt issue

Q: Stocks 2. Bonds 3. Real estate

A: The stock simply means shares. The ownership of a company is divided among shares. A single share…

Q: Question 6. One day, a letter arrives in your mailbox. The letter comes from a trusted attorney…

A: Compound interest. FV = A ( 1 + r)n Where FV = amount avaliable including compound interest after n…

Q: When a merger takes place between two companies to form a single firm, the target company to operate…

A: Given: Particulars 1 2 3 After tax cash flows $19.00 $28.50 $34.20 Growth rate 3% Beta…

Q: Slow 'n Steady Enterprises currently pays an annual dividend of $1.50 /share. Investors expect that…

A: Annual dividend = $1.5 Equity cost of capital = 0.09 Value of one share = ?

Q: Current Liabilibes Cash 61.2 58.5 Accounts payable Notes payable / 396 short-term debt Current…

A: Solution: We know, Net working capital means the net current assets over the current liabilities of…

Q: Compare and contrast the three types of business organizations (Sole proprietorship, Partnership,…

A: We have to compare and contrasts three different types of business organization across parameters…

Q: O a. None of the above Ob. Decrease in Money Supply O C. Increase in Money Supply d. No Change in…

A: Solution: Credit Creation Multiplier is a multiple which shows that how much multiple times the…

Q: It costs about $39,716 per year to attend Georgia Law School (including tuition, off- campus room…

A: Solved using Financial Calculator PV = 119,148 PMT = 800 I/Y = 5.28/12 = 0.44 CPT N = 242.61 months…

Q: a. Compute the net present value of each project. b. If the company accepts all positive net present…

A: Net present value = - Initial outlay + Present value of future cash flows. Net present value is…

Q: 1. Determine the volatility for the following three stock portfolio

A: Standard deviation is measured to measure the volatility of the stocks in the portfolio. Where,…

Q: . A certain sum of money is divided among A, B, C in the ratio 2:3:4. If A's share is $200, find the…

A: As per Bartleby guidelines, If multiple questions are posted, only the first 1 question will be…

Q: maxımum time to complete. It also show to plan her projects effectively.

A: C. The critical path method

Q: A computer platform requires $160,000 initial investment and additional $80,000 after 10 years. The…

A: A project or asset is to be capitalized at the present value. To calculate the capitalized value of…

Q: What is the simple interest on ₱ 30,000 for six months at a simple interest rate of 12% . What is…

A: Simple interest is interest on investment without any compounding. Compound interest is the interest…

Q: Inflation

A: Inflation means increase in prices of different products.

Q: You buy a 6 year bond with an annual 5% coupon at par value, $1000. If the yield to maturity at the…

A: Solution: Bond value is the present value of the cash inflows receivable from the bond for the…

Q: 9. For the three-part question that follows, provide your answer to each part in the given…

A: Cost of Car is $18,000 Down Payment is $1,000 Monthly payments are $375 Total number of periods are…

Q: If we compare two mutually exclusive projects using __________ problems can arise if the projects'…

A: If we compare two mutually exclusive projects using Pay back period method problems can arise if the…

Q: Maturity (years) Price 2 $94.53 3 $91.83 4 $89.23 $97.25 $87.53 The above table shows the price per…

A: Price = PV = $89.23 Years to maturity = N = 4 Years Face value = FV = $100

Q: Explain whether it is better for an investor to buy a discount bond and pay a price below its face…

A: Bond Issued at premium If coupon rate is higher than the prevailing interest rates. , it is called…

Q: idering investing in a four year security which pays 6,000 in one year. 6,000 in two years, 6,000 in…

A: Yield to maturity is the return realized while holding till the maturity of the security and which…

Q: Please explain everything without any plagiarism do in your words will give you many upvotes

A: In capital budgeting we use several different tools to determine the financial feasibility of a…

Q: Given the information below for HooYah! Corporation, compute the expected share price at the end of…

A: Here, To Find: Expected share price =?

Q: Question 5: Find the missing EAR and APR in each of the following cases: APR Number of Times…

A: Effective rate is computed based on its compounding period and Effective rate always equal to or…

Q: 3860. How much she st in each fund?

A: A well-balanced portfolio includes a mix of assets such as stocks, bonds, real estate, and gold…

Q: 3) What is the capitalized worth, when i 12% per year, of $2.000 per year, starting in year one and…

A: Annual cost (A) = $2000 Repeating cost (R) = $11000 in year 5, every 4 years i = 12%

Q: A woman expects to have $10,000 in 4 years to buy a pair of earrings. She plans to create a sinking…

A: FV Amount required = $10000 Period = 4 years pmt Amount deposited every 6 months Fund…

Q: Investors in IBM common stock expect the firm to pay a dividend next year of $1.79 per share.…

A: Next dividend (D1) = $1.79 Growth rate (g) = 6% Stock price (P0) = $76

Q: Could I Industries just paid a dividend of $1.25 per share. The dividends are expected to grow at a…

A: Dividend discount model refers to a stock valuation model which is used by the company for…

Q: QUESTION 4 Which of the following statements are correct? Pick two correct answers. Deposits are…

A: Given, Meaning of deposits:- It is an amount of money which is paid into a bank and to the society…

Q: Pperating cycle of GLOBE * STATEMENT OF FINANCIAL POSITION AND INCOME STATEMENT OF 3 COMPANIES AS…

A:

Q: you mean by payback period? What are their significano:s and drawbacks? Find the payback periods of…

A: Payback period is a tool of capital budgeting that enables a company to determine the duration…

Q: A student needs P4000 per year for 4 years to attend college. Her fath invested P5000 in a 7%…

A: A. Assuming Investment made at the start of Year 1 Future Value at end of year 16 = Present Value *…

Q: The payback rule is generally most useful when:

A: The payback period is the time taken to recover the money spent on the project. According to the…

Q: Explain how the parties involved in a project finance manage risk.

A: Given, The parties are involved to manage the risk in a finance project. The finance project is a…

Q: A family has a $134,345, 25-year mortgage at 5.1% compounded monthly. (A) Find the monthly payment…

A: Solution:- When a loan is taken, it is to be either repaid as a lump sum payment or in installments.…

Q: Year ended December 31 (in Smillions) 2006 2005 Total sales 610.1 558.8 (366) 192.8 Cost of sales…

A: Answer - Net Profit margin = net income / sales

Step by step

Solved in 2 steps with 2 images

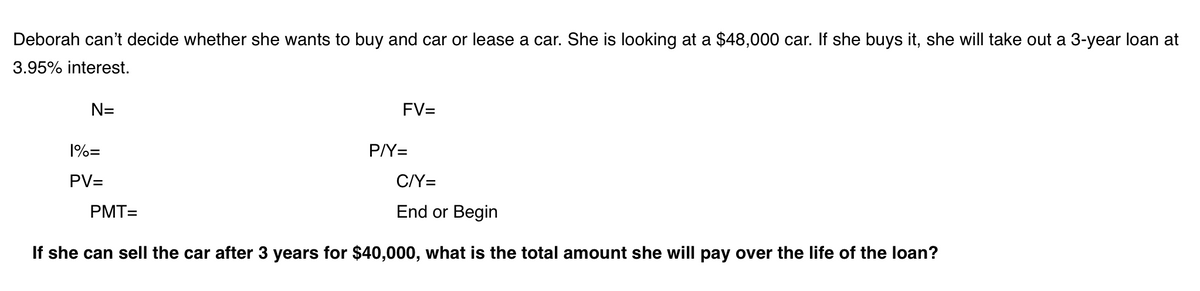

- Michiko and Saul are planning to attend the same university next year. The university estimates tuition, books, fees, and living costs to be 12,000 per year. Michikos father has agreed to give her the 12,000 she needs to attend the university. Saul has obtained a job at the university that will pay him 14,000 per year. After discussing their respective arrangements, Michiko figures that Saul will be better off than she will. What, if anything, is wrong with Michikos thinking?Erin can’t decide whether she wants to buy and car or lease a car. She is looking at a $45,000 car. If she buys it, she will take out a 3-year loan at 3.75% interest. N= FV= I%= P/Y= PV= C/Y= PMT= End or Begin What is the total amount that Erin will pay over the life of the loan?Laura wants to buy a delivery truck. The truck costs $53,000, and will allow her to increase her after tax profits by $39,000 per year for the next 10 years. She will borrow 72% of the cost of the truck for 10 years, at an interest rate of 7%. Laura's unlevered cost of capital is 19% and her tax rate is 39%. The loan includes a $1,000 application fee. What is the NPV of buying the truck on these terms?

- Patricia finances a $49,100 car with annual payments at a 3.10% interest rate over 8 years, at which time the car will have zero value. If she wants to sell the car in 2 years, how much does she need to sell the car for to break even? a.$6,955 b.$42,145 c.$5,655 d.$51,838 e.$37,925Laura wants to buy a delivery truck. The truck costs $76,000 , and will allow her to increase her after tax profits by $14,000 per year for the next 10 years. She will borrow 82% of the cost of the truck for 10 years, at an interest rate of 6%. Laura’s unlevered cost of capital is 17% and her tax rate is 21%. The loan includes a $2,000 application fee. What is the NPV of buying the truck on these terms? Please use the APV method.Tori is planning to buy a car. The maximum payment she can make is $3400 per year, and she can get a car loan at her credit union for 7.3% interest. Assume her payments will be made at the end of each year 1–4. If Tori’s old car can be traded in for $3325, which is her down payment, what is the most expensive car she can purchase?

- RT is about to loan his granddaughter Cynthia $20,000 for 1 year. RT’s TVOM, based upon his current investment earnings, is 12%, and he has no desire to loan money for a lower rate. Cynthia is currently earning 8% on her investments, but they are not easily available to her, and she is willing to pay up to $2,000 interest for the 1-year loan. Solve, a. Should they be able to successfully negotiate the terms of this loan? b. If so, what range of pay backs would be mutually satisfactory? If not, how many dollars off is each person from reaching an agreement?Christina Sanders is concerned about the financing of a home. She saw a small Cape Cod–style house that sells for $90,000. If she puts 10% down, what will her monthly payment be at (a) 30 years, 5%; (b) 30 years, 512%512% ; (c) 30 years, 6%; and (d) 30 years, 612%612% ? What is the total cost of interest over the cost of the loan for each assumption? (Round your answers to the nearest cent.)Ken wants to remodel his basement and he wants to pay back no more than $18,000. If he gets a low interest loan at 3.75% compounded semi - annually and plans to repay the loan in one payment in 3 years, how much can he borrow? Show all workings.

- Amanda must decide to buy or lease a car that she has selected. She has negoiated a purchase price of $35,000 and can borrow money from her credit union by putting $3,000 down and paying $751.68 per month for 48 months at 6% APR. Alternatively, she could lease the car for 48 months at $495 per month by paying $3,000 capitalized cost reduction and a $350 dispostition fee on the car whic is project to have a residual value of $12,100 at the end of the lease. 1. What is the buying dollar cost? 2. What is the leasing dollar cost?Cheryl wants to save for a car. She has $4050 in a savings account earning 2.2% compounded quarterly. If Cheryl has four years until she gets her driver’s license, will she have enough to buy a used car that costs $4500? If not, how much more does she need?