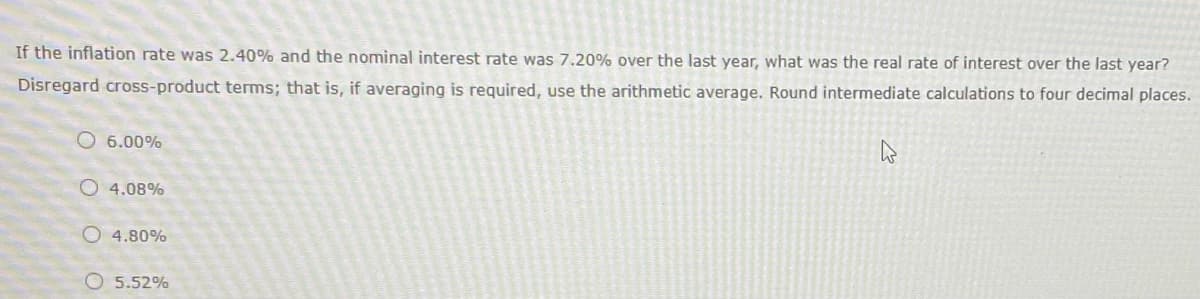

If the inflation rate was 2.40% and the nominal interest rate was 7.20% over the last year, what was the real rate of interest over the last year? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. Round intermediate calculations to four decimal places. k 6.00% O4.08% O4.80%

Q: The Aikido family wants to obtain a conventional loan for 25 years at 13%. Suppose it finds a lender…

A: Step 1 When you and a lender enter into a mortgage, the lender is granted the power to seize your…

Q: Arjun took out a loan for $9,800 from Bank of Montreal at 2.08% compounded monthly, and will be…

A: When the lender lend loan to the borrower, he charges interest on the borrowed amount. The rate of…

Q: Last year, Genten Company had sales of $7465 million. If Genten’s net profit margin was 0.41 and…

A: A ratio is a mathematical relationship between two variables. Ratio interprets the company's…

Q: ! Required information The Bureau of Indian Affairs provides various services to American Indians…

A: In order to do this problem using a single cell excel function, we have to rearrange the data into a…

Q: Steven purchased 1000 shares of a certain stock for $26,800 (including commissions). He sold the…

A: The concept of time value of money will be used and applied here. Money deposited today gets…

Q: Which of the following nine portfolios is NOT efficient (i.e., not on the efficient frontier)?…

A: Efficient frontier gives the optimal portfolios that generate the highest amount of return at a…

Q: Given the following information, what is expected loss of a $200,000 loan in percent?…

A: Hi student Since there are multiple questions, we will answer only first question. Probability of…

Q: Find the effective rate of interest corresponding to a nominal rate of 2.7%/year compounded…

A: The effective interest rate is the rate on the bases of which the return on an investment or loan is…

Q: Year End Cash Flow Alternative A Alternative B 0 -1,000 600 1 600 500 2 600 -2,000 3…

A: NPV and IRR are capital budgeting tools to decide on whether the capital project should be accepted…

Q: Required information The Bureau of Indian Affairs provides various services to American Indians and…

A: Capital budgeting is a technique in which investment projects are evaluated for taking investment…

Q: Required information The Briggs and Stratton Commercial Division designs and manufacturers small…

A: The present worth analysis is a valuable tool for evaluating financial decisions and determining the…

Q: Calculate the net price factor and net price (in dollars). For convenience, round the net price…

A: The question is based on the concept of Financial Management. Sometimes traders provide a series of…

Q: Carrie Tune will receive $32,000 for the next 14 years as a payment for a new song she has written.…

A: The present value of the annuity is the discounted worth that is defined as the process of…

Q: By using the dividend growth model, estimate the cost of equity capital for a firm with a stock…

A: The cost of equity is the return the company is expected to pay to its shareholders. We can…

Q: Problem Solving: In a Worksheet, Answer the Following: Your grouping as per the Entrepreneurship…

A: The budget is prepared to estimate the future income and expenses so that it becomes easy for…

Q: Give 2 examples for each category of Risk given below from your day-to-day life. Insurable Risk,…

A: Insurable risks are those that can be covered by insurance Non-insurable risks are those that cannot…

Q: What do we call the process of finding future value? Discounting Compounding Discount interest…

A: This is based on the concept of time value of money. Amount put aside today or invested today…

Q: Pueblo starts his account with the amount of $8,000. he add $100 each month. the account earns…

A: The concept of time value of money will be used and applied here. Money deposited today gets…

Q: Sales revenue Cost of goods sold Gross profit Selling expenses Administrative expenses Income from…

A: Pronghorn Company Statement of cash flows for the period ended 31st Dec, 2025 Net profit…

Q: If you invest $17,500 today, how much will you have in each of the following instances? Use Appendix…

A: The value of an asset at a future date is its future value. It calculates the nominal amount of…

Q: A stock just paid a dividend of $3 and dividend is expected to grow at a 20% in the next two years.…

A: Intrinsic value is the value of the asset. It is a financial metric by which the value of the asset…

Q: In order to be consistent with Time Value of Money concepts , it is acceptable to add cash flows…

A: Amounts of money are worth more today than they will be in the future due to the concept of time…

Q: Suppose many investors are still interested in acquiring the shares of Company ABC after the initial…

A: The financial market is a platform that allows individuals, businesses, and other entities to buy…

Q: Now you turn your attention to estimating the likely returns on the project. You start with the…

A: The expected return of a project with a probability distribution is calculated as the weighted…

Q: What's the present value of $11,500 discounted back 5 years if the appropriate interest rate is…

A: Present value is the current worth of a future sum of money, given a specific interest rate or…

Q: Top hedge fund manager Sally Buffit believes that a stock with the same market risk as the S&P 500…

A: The stock price is the price at which a company is willing to sell its shares. Share prices can be…

Q: Which of the following is NOT a correct description of venture capital fund? Group of answer…

A: Venture capital (VC) refers to a form of private equity financing that is typically provided to…

Q: Bill paid $10,000 (at CFO) for an investment that promises to pay $750 at the end of each of the…

A: Present value is the current worth of a future sum of money, given a specific interest rate or…

Q: 10. Suppose the interest rate is 8% APR with monthly compounding. What is the present value of an…

A: The concept of money's time worth reveals that any sum is currently worth more than what it will be…

Q: How much would you need to deposit in an account now in order to have $5000 in the account in 10…

A: Present value is a financial concept that represents the value of a future sum of money in terms of…

Q: In order to purchase a home, you must take out a mortgage with a total loan amount $150000. If the…

A: A mortgage is a loan that is paid off slowly and completely by paying equal installments. Each…

Q: Current Attempt in Progress Sunland, Inc., has outstanding bonds that will mature in six years and…

A: Given data in the question is The bond matures in 6 years & will pay an 8% Coupon semi-annually…

Q: How does financial innovation help economic growth?

A: Financial innovation- It is a process of creation of new financial instrument, products, services…

Q: Mary Martell is a finance intern at a big corporation that was given the task to evaluate the…

A: As per Bartleby Answering Guidelines, In case of Multiple Sub-Parts, i can answer only first 3…

Q: Bob makes his first $600 deposit into an IRA earning 7.6% compounded annually on his 24th birthday…

A: Step 1 Future value is the worth of money or an asset at a specific future time. It illustrates how…

Q: company is planning to borrow $3 million on a 7-year, 9%, annual payment, fully amortized term loan.…

A: A loan is a financial arrangement in which one or more people, companies, or other entities lend…

Q: 1. Edison Mfg. needs to borrow $50,000 for six months. If the annual interest rate is 15%, what is…

A: A compensating balance is the amount that the borrower needs to keep as an average balance with the…

Q: A new graduate has successfully found their dream job and wants to start saving for retirement. She…

A: The FV of a payment series refers to the value that the cash flows will have at a particular future…

Q: In a few sentences, answer the following question as completely as you can. Define the three forms…

A: The market efficiency represents how efficiently the market is discounting various informations in…

Q: You have $1M dollars. There are two projects. Each requires an upfront investment of $1M, then…

A: Project A should be chosen in this instance because of its larger NPV. Despite having a better IRR…

Q: It has been said that anyone with a pencil can calculate financial ratios, but it takes a brain to…

A: Financial ratios are based on the mathematical relationship between two financial line items. For…

Q: A contractor bought an asphalt plant from a commercial bank for a certain amount, and the two…

A: A loan is a financial arrangement in which one or more people, companies, or other entities lend…

Q: Kenneth Clark just received a cash gift from his grandfather. He plans to invest in a five-year bond…

A:

Q: Suppose Bank Negara Malaysia sells RM100 million of bonds to Bank A. By using a T-accounts,…

A: Bonds are fixed-income assets that serve as a representation of investor loans to borrowers…

Q: Telekom is one of the Public Listed Companies in Malaysia. Based on this company provide examples of…

A: The agency problem arises when there is a conflict of interest between the principal (such as a…

Q: You purchased a bond at a price of $800. In 15 years when the bond matures, the bond will be worth…

A: A bond reveals the debt instrument that allows the issuer to raise funds from the public. The holder…

Q: future dividend stream, along with the forecasted growth rates, is shown below. Assuming a required…

A: Price of a stock is the PV of all its future dividends. To determine the price of the stock, we…

Q: Last year Dania Corporation's sales were $325 million. If sales grow at 9.9% per year, how large (in…

A: Future value (FV) refers to the value of an investment or an asset at a specified point in the…

Q: A proposal is being considered to improve an existing road connecting two medium size cities in West…

A: Cost-Benefit Method Comparing the anticipated or predicted costs and benefits (or opportunities)…

Q: Carl’s house payment is $1,750 per month and his car payment is $393 per month. If Carl's take-home…

A: Take home pay is the amount of net money that comes in your hand. It is the net amount that is…

The equation states that the nominal interest rate is equal to the sum of the real interest rate and the expected inflation rate. The real interest rate is the nominal interest rate adjusted for inflation, or the rate at which the purchasing power of an investment increases. The Fisher equation is used to calculate the real rate of return on an investment by subtracting the expected inflation rate from the nominal interest rate.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Consider the following table for an eight-year period: Year T-bill return Inflation 1 7.47 % 8.53 % 2 8.94 12.16 3 6.05 6.76 4 5.97 5.04 5 5.63 6.52 6 8.54 8.84 7 10.74 13.11 8 13.00 12.34 Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Average return for Treasury bills % Average annual inflation rate % Calculate the standard deviation of Treasury bill returns and inflation over this time period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Standard deviation of Treasury bills % Standard deviation of inflation % Calculate the real return for each year. (A negative answer should be indicated by a minus sign. Leave no cells…"At a market interest rate of 7% per year and an inflation rate of 5% per year, a series of three equal annual receipts of $100 in constant dollars is equivalent to a series of three annual receipts of $108 in actual dollars." Which of the following statements is correct?(a) The amount of actual dollars is overstated.(b) The amount of actual dollars is understated.(c) The amount of actual dollars is about right.(d) Sufficient information is not available to make a comparison.Suppose you invest $1,500 in an account paying 6% interest per year. How much of this balance corresponds to interest on interest earned in the last (7th) period? (Dollar figures should be approximated to the nearest cent of a dollar, while rates should be expressed in percentage terms without using the "%" symbol and approximated to the nearest second decimal place.)

- Suppose we have the following Treasury bill returns and inflation rates over an eight year period: Year Treasury Bills Inflation 1 10.45% 12.55% 2 11.36 16.00 3 9.06 10.29 4 8.34 7.97 5 8.88 10.29 6 11.23 12.77 7 14.11 16.98 8 15.97 16.90 a. Calculate the average return for Treasury bills and the average annual inflation rate for this period. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Treasury bills % Inflation % b. Calculate the standard deviation of Treasury bill returns and inflation over this period. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Treasury bills % Inflation %…Assume the CPI increases from 139.2 to 142.6 over the period. What is the inflation rate implied by this CPI change over this period? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)If Treasury bills are currently paying 6.35 percent and the inflation rate is 1.6 percent, what is the approximate and the exact real rate of interest? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) A. approximate real rate B. exact real rate

- If Treasury bills are currently paying 6.45 percent and the inflation rate is 1.4 percent, what is the approximate and the exact real rate of interest? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) approximate real rate: exact real rate:1, Consider the following table for an eight-year period: Year T-bill return Inflation 1 7.47% 8.53% 2 8.94 12.16 3 6.05 6.76 4 5.97 5.04 5 5.63 6.52 6 8.54 8.84 7 10.74 13.11 8 13.00 12.34 a, Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. b, Calculate the standard deviation of Treasury bill returns and inflation over this time period. c, Calculate the real return for each year. d, What is the average real return for Treasury bills?Assume inflation is 0.21% per month. Would you rather earn a nominal return is entered0.72% per month, compounded monthly, or a real return of 6.44% APR, compounded annually? (Note: Be careful not to round any intermediate steps less than six decimal places.) The annual rate for the nominal return 0.72% per month is _______ (Type your answer in decimal format. Round to six decimal places.) Part 2 The nominal annual rate for the real return of 6.44% APR is _____ (Type your answer in decimal format. Round to six decimal places.) (Select from the drop-down menus.) Based on a comparison of the two rates and the current inflation rate, you would prefer the ▼ nominal return compounded monthly real return compounded annually option over the ▼ nominal return compounded monthly real return compounded annually option.

- Assume inflation is 0.16% per month. Would you rather earn a nominal return of 0.79% per month, compounded monthly, or a real return of 6.48% APR, compounded annually? (Note: Be careful not to round any intermediate steps less than six decimal places.) The annual rate for the nominal return of 0.79% per month is _____. (Type your answer in decimal format. Round to six decimal places.) Part 2 The nominal annual rate for the real return of 6.48% APR is _____. (Type your answer in decimal format. Round to six decimal places.) Part 3 (Select from the drop-down menus.) Based on a comparison of the two rates and the current inflation rate, you would prefer the (real return or nominal return) option over the (real return or nominal return) option.Say you own an asset that had a total return last year of 17 percent. Assume the inflation rate last year was 4.8 percent. What was your real return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)1. If the stated annual rate of interest compounded annually is 8% then what is the equivalent annual rate compounded daily? Pls show formula used. Final dollar answers should be rounded to two decimal places. Interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. Use timeline if necessary. No excel .Thanks!