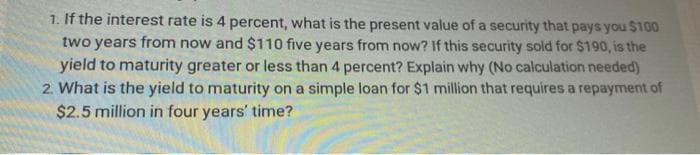

If the interest rate is 4 percent, what is the present value of a security that pays you $100 two years from now and $110 five years from now? If this security sold for $190, is the yield to maturity greater or less than 4 percent? Explain why (No calculation needed)

Q: The real risk-free rate is 2.5% and inflation is expected to be 2.75% for the next 2 years. A 2-year…

A: Given: Real risk free rate = 2.5% Inflation rate = 2.75% Return on assets = 5.95% Maturity risk…

Q: The real risk-free rate of interest, r*, is 4 percent, and it is expected to remain constant over…

A: A Bond refers to an instrument that represents the loan being made by the investor to the company…

Q: The real risk-free rate, r*, is 4.5%, and it is expected to remain constant over time. Inflation is…

A: The question is based on the concept to calculate the interest rate of a bond based on risk premium.…

Q: What is the present value of a security that will pay $7,000 in 20 years if securities of equal risk…

A: Given: Future value (FV) = 7000 Number of years (n) = 20 Interest rate (r) = 7% = 0.07

Q: Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is…

A: Bond price will be Bond price =present value of all coupons +present value of face value…

Q: Consider a bond that has a current value of $1,081.11, a face value of $1,000.00, a coupon rate of…

A: Yield to maturity is the rate of return a bond generates in its lifetime through all the cash flows…

Q: Consider a bond with face value of $1000, a coupon rate of 8% (paid annually), and ten years to…

A:

Q: Recall that on a one-year Treasury security the yield is 5.8400% and 7.0080% on a two-year Treasury…

A: Given information: Yield on a one year Treasury security : 5.84% Yield on two year Treasury security…

Q: Over the next three years, the expected path of 1-year interest rates 4, 1, and 1 percent. Today if…

A: Expectation theory states that the short term interest rate in the future is dependent on the…

Q: onsider a bond with face value of $1000, a coupon rate of 8% (paid annually), and ten years to…

A: Price of bond is Present value of coupon and present value of par value of bond.

Q: If the current price of a 10-year 4.5% coupon bond which pays semiannually is $96.10, what is its…

A: Here, Face value (FV) = $100 Coupon rate = 4.5% semiannually Coupon payments (PMT) = (4.5% of 100)/2…

Q: The real risk-free rate is 2.15%. Inflation is expected to be 2.15% this year, 4.05% next year, and…

A: Yield on maturity is the return anticipated on a bond at the end of the maturity period of the bond.…

Q: 5 year treasury notes are currently yielding 5.75%, and you have found the following interest…

A: Introduction : Current yield ( current rate of return)= 5.75% Inflation premium 2.50% Liquidity…

Q: What is the value of a bond that has a 10 percent coupon, pays interest semiannually, and has 10…

A: Coupon Rate (C)= 10% or 0.1 Time Period (n)= 10 Years Yield to Maturity(Y) = 12% or 0.12 No. of…

Q: An insurance firm needs to make a payment of $10000 in 3 years, the market interest rate to discount…

A: Note: This post has multiple questions. The first three questions have been answered below.

Q: Consider a 1-year, 10% annual payment corporate bond priced at par value. If the recovery rate is…

A: Expected loss given default would be loss to be incurred by investor when issuer fails to repay the…

Q: The real risk-free rate is 2.85%. Inflation is expected to be 3.85% this year, 5.15% next year, and…

A: A marketable debt security with a fixed interest rate and maturity period of 1-10 years, issued by…

Q: (b)You purchase the $110 bond today and sell it off next year at $108. What is its one-year rate of…

A: Given Information : Purchase price of bond = $110 Selling price of bond = $108 Face value of bond =…

Q: The real risk-free rate is 2.5% and inflation is expected to be2.75% for the next 2 years. A 2-year…

A: maturity risk premium = Tt = r + ipt + mrpt where r = risk…

Q: The real risk-free rate is 2.00%. Inflation is expected to be 4.00% this year, 5.00% next year, and…

A: Nominal interest rate is the rate of interest before adjustment of inflation.

Q: What is the present value of a security that will pay $17,000 in 20 years if securities of equal…

A: Present value refers to the value of money today. Sometimes, present value is also known as…

Q: The real risk-free rate is 2.5% and inflation is expected to be 2.75% for the next 2 years. A 2-year…

A: “Hey, since there are two different questions are posted, we will answer first question. If you want…

Q: Suppose the yield on a 10-year T-bond is currently 5.05% and that on a 10-year Treasury Inflation…

A: Given: 10 year Treasury bond yield =5.05% 10 year Treasury inflation = 1.80% MRP on T bond = 0.90%

Q: What is the present value of a security that will pay $22,000 in 20 years if securities of equal…

A: Future value is total of initial investment plus compound interest on that. Compound interest could…

Q: The real risk-free rate is 3.25%, and inflation is expected to be 2.25% for the next 2 years. A…

A: We know that the treasury security yield is determined by the addition of risk-free rate, inflation…

Q: The real risk-free rate is 3.25%, and inflation is expected to be 3.75% for the next 2 years. A…

A: given, rf=3.25%inf2= 3.75%T security yield = 9.25%

Q: Suppose that for a price of $960 you purchase a 7-year Treasury bond that has a face value of $1,000…

A: Rate of Return = Coupon + Capital AppreciationTotal Investmentx100

Q: present value of a security

A: The present value is the computations used under the concept of the time value of money, where the…

Q: What is the present value of a security that will pay $10,000 in 20 years if securities of equal…

A: The formula used as follows: Present value=Future value1+rt

Q: What is the present value of a security that will pay $32,000 in 20 years if securities of equal…

A: We need to use the concept of time value of money to solve the question. According to the concept of…

Q: You will be paying $10,000 a year in tuition expenses at the end of the next two years. Bonds…

A: a) The computation of duration of obligation: Hence the duration of obligation is 1.4808. and…

Q: A bond with a face value of $1,000 has 10 years until maturity, carries a coupon rate of 9%, and…

A: Yield to maturity (YTM) is the effective rate of return or the current yield that is expected to be…

Q: The real risk-free rate is 3.5% and inflation is expected to be 2.25% for the next 2 years. A 2-year…

A: Maturity Risk relates to risk directly related to term of investments. Maturity Risk Premium(MRP) is…

Q: An insurance company must make payments to a customer of $10 million in one year and $4 million in…

A: Here, The interest rate or yield curve is 'r' Duration of payment is 't'

Q: What is the present value of a security that will pay $6,000 in 20 years if securities of equal risk…

A: Present value (PV) is the current value of a future sum of money or stream of cash flows given a…

Q: What is the present value of a security that will pay $18,000 in 20 years if securities of equal…

A: Present value is the value of the money in current time that is expected to be received in future…

Q: Suppose that you bought a 14% Drexler bond with time to maturity of 9 years for $1,379.75…

A: Here, As the Face Value of the Bond is not given in the question, we are assuming it to be $1,000.…

Q: The market price of a 100 TL nominal value treasury bill is 94 TL and has 75 days to maturity. What…

A: Market Price is 94 TL Days to MAturity = 75 Face value = 100 TL Yield on Bond = 100 TL-94TL…

Q: A trader, Peter, buys a treasury note with a face value of 1000, which will mature in 180 days.…

A: Treasury notes is a debt financial instrument that offers stable interest rates. It is issued for…

Q: A bond with a face value of $1,000 has 10 years until maturity, carries a coupon rate of 9%, and…

A: FV = $1,000 Coupon Rate = 9% N = 10-1 = 9 YTM = 9% Using Financial Calculator : PV = $1,000.

Q: What should the current market price be for a bond with a $1,000 face value, a 10% coupon rate paid…

A: Current market price of bond is the present value of all future coupon payments and the present…

Q: For all problems assume that the interest rate is 12% •What is the future value in year 11 of an…

A: Future Value of Annuity: The future value of annuity due refers to the future value of a series of…

Q: D) Suppose you can invest in a money market security that matures in 75 days and offers a 3% nominal…

A: Annual effective interest rate is interest rate considering after the effect of compounding.

Q: What is the value of this perpetuity? 5-year bond with a coupon rate of 4% has a face value of…

A: A Perpetuity is a series of payments of fixed amounts and at fixed intervals for an indefinite…

Q: How much should a $10,000 face- value, zero-coupon bond, maturing in 10 years, be sold for now if…

A: Given: Face value is $10,000 Years = 10 Interest rate = 4.5%

Q: idering investing in a four year security which pays 6,000 in one year. 6,000 in two years, 6,000 in…

A: Bonds are the debt obligations of a business on which it requires to pay regular interest to the…

Q: You will receive $100 from a savings bond in 2 years. The nominal interest rate is 8.40%. a.…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Assume a continuously compounding dollar interest rate of 5%. If you long a 1-year forward contract…

A: Forward price is the price of the underlying asset which needs to be paid on a predetermined date.…

Step by step

Solved in 2 steps

- (1) What is the value at the end of Year 3 of the following cash flow stream if the quoted interest rate is 10%, compounded semiannually? (2) What is the PV of the same stream? (3) Is the stream an annuity? (4) An important rule is that you should never show a nominal rate on a time line or use it in calculations unless what condition holds? (Hint: Think of annual compounding, when INOM = EFF% = IPER.) What would be wrong with your answers to parts (1) and (2) if you used the nominal rate of 10% rather than the periodic rate, INOM/2 = 10%/2 = 5%?2. It is now January 1, 2x16, and you will need P100,000 on January 1, 2x20. Your bank compounds interest at an 8% annual rate. How much must you deposit today to have a balance of P100,000 on January 1, 2x20? 4. What is the present value of a security that will pay P290,000 in 20 years if securities of equal risk pay 5% annually? 5. What is the future value of a 5%, 5-year ordinary annuity that pays P8,000 each year? If this was an annuity due, what would be its future value?suppose the interest rate on a 3 year treasury note is 1.00% and 5 year notes are yielding 3.50% Based on the expectatiions theory, what does the market believe that 2 year treasuries will be yielding 3 years from now?

- you are considering investing in a four year security which pays 6,000 in one year. 6,000 in two years, 6,000 in 3 years and 17,500 in 4 years. the security currently trades at a price of of 18,483.77. What is the yield to maturity of the security? What is duration?What is the present value of a security that will pay $10,000 in 5 years if securities of equal risk pay 3.5% annually? What is the present value of a security that will pay $3,000 in 10 years if securities of equal risk pay 12% annually? What is the present value of a security that will pay $10,000 in 3 years if securities of equal risk pay 5% annually? What is the present value of a security that will pay $5,000 in 20 years if securities of equal risk pay 7% annually? What is the present value of a security that will pay $8,989 in 13 years if securities of equal risk pay 22% annually? What is the present value of a security that will pay $1,989 in 22 years if securities of equal risk pay 13% annually?Suppose the interest rate on a 3-year Treasury Note is 1.25%, and 5-year Notes are yielding a 3.50%. Based on the expectations theory, what does the market believe that 2 year treasuries will be yielding 3 years from now?

- What is the yield to maturity on a simple loan for $1 million that requires a repayment of $2 million in five years’ time?1. Suppose that a loan of $9,000 is given at an interest rate of 2% compounded each year. Assume that no payments are made on the loan. Follow the instructions below. Do not do any rounding. (a.) Find the amount owed at the end of 1 year. $_____?(b.) Find the amount owed at the end of 2 years. $_____? 2. If the rate of inflation is 2.5% per year, the future price p(t) (in dollars) of a certain item can be modeled by the following exponential function, where t is the number of years from today. p(t)=2000(1.025)t Find the current price of the item and the price 10 years from today. (Roud your answers to the nearest dollar as necessary.) Current Price: $_____?Price 10 years from today: $_____?You will receive $100 from a savings bond in 2 years. The nominal interest rate is 8.40%. a. What is the present value of the proceeds from the bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. If the inflation rate over the next few years is expected to be 3.40%, what will the real value of the $100 payoff be in terms of today’s dollars? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. What is the real interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) d. Calculate the real payoff from the bond [from part (b)] discounted at the real interest rate [from part (c)]. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

- The formula below tells us how to obtain the maturity value on a simple discount loan if we are given the proceeds, the discount rate, and the term. If a loan's annual simple discount rate is 7.56%, how many years would it take for the debt to double? (This is called the doubling time of a loan). Round your answer to the nearest tenth of a year. Hint: divide both sides of the equation by P. If M is twice as much as P, what should the fraction on the left-hand side equal?Explain the nature of the potential lending losses associated with each of the following: default risk, liquidity risk, and maturity risk. What would you pay for an annuity paying $3,000 per year for 12 years if the interest rate is 10%?If the discount rate is 19%, what is the present value of 3500 USD received at the end of each year for 23 years? a) 12450.5 b) 10000.5 c) 17500 d) 25000 e) 18084.5 ================= What is the market value of Beril Gıda A.Ş.'s bond with a nominal value of USD 12,000, maturity of 5 years, with an annual interest payment of 25%, and the desired return rate of 24%? a) 10250 b) 12327 c) 5427 d) 20000 e) 17500 ================== 12000 USD over the 12% interest deposited in the bank at the end of each year, how many USD will it reach at the end of the 15th year? a) 234356.4 b) 375000 c) 634356.5 d) 447356.4 e) 250225.5