Q: Consumer loans, by this definition: Some of the most expensive Least borrower-friendly More are comi...

A: A loan that is given by financial institutions to consumers to fulfil their needs is known as a cons...

Q: An investor buys a property for $665,000 with a 25-year mortgage and monthly payments at 8.5% APR. A...

A: Mortgage Loans: A legitimate consent to acquire cash from a bank or other monetary association, part...

Q: Why is financial topic a taboo among parents and children?

A: Financial statements refer to the statements which shows the revenue earned by the company during a ...

Q: Which regulatory agency has the primary responsibility for supervising the following categories of f...

A: Answer to Ques (a) The Bank of Canada has the primary responsibility for supervising the Chartered B...

Q: You need to choose between making a public offering and arranging a private placement. In each case,...

A: Given: Particulars Public offering Private Placement Issue amount $10,300,000 $10,300,000 ...

Q: Amir has a $2 off coupon for his favorite sub shop. To get the deal, he must buy a 6” sandwich and c...

A: As we know discount is given when goods purchase in a bundle of series, and such discount is applied...

Q: Salem wishes to withdraw AED 30,000 at the end of each year of the next 6 years from his bank accoun...

A: Annual withdrawal amount (A) = AED 30000 n = 6 years r = 10%

Q: A store in a more popular location expects to sell 6 eyePhones every 15 minutes. How many eyePhones ...

A: Solution:- We know 1 hour = 60 minutes So, Expected sales in one hour = (Sales in 15 minutes/15) x ...

Q: Scottie Adams Bird Supplies issued 10% bonds, dated January 1, with a face amount of $190,000 on Jan...

A: Data given: Face value=$190,000 Coupon rate = 10% (compounded semi-annually) = 10%/2 = 5% n= 10 year...

Q: How many percent was the increase in salaries and expense in year 2020

A: Note : Only first question is answerable because only income statement is provided. Percent increa...

Q: How much dividend was paid in year 2019? How much dividend was received by each share of stock in 20...

A: Stockholders' Equity Ending balance = Beginning balance + Net income - Dividend paid

Q: mplement Method) . In Landers Superstore - Alabang having a march sales in all electronic gadgets th...

A: Multiple discounts are given to the customers for improving the sales of the company and these disco...

Q: How much of the original principal is still unpaid after he has made the 8th payment?

A: Get the annuity first using P = 600000,i =12%= 0.12 , n = 15 P= A*(1-(1+i)^-n)/i 600000=A*(1-(1+12%)...

Q: Make a personal assessment of any government bank in the Philippines.

A: A financial institution (FI) is a company that deals with financial and monetary transactions such d...

Q: Harmeling Paint Ball (HPB) Corporation needs a new air compressor that costs $90,000. HPB will need ...

A: Leasing refers to a contract under which one party agrees to rent an asset owned by another party fo...

Q: A $43,000 new car loan is taken out with the terms 9% APR for 48 months. How much are monthly paymen...

A: A loan is an agreement where an amount is forwarded with the promise to pay it back along with some ...

Q: Consider the following risk-free bonds available for sale in the bond market (assume annual Ecoupons...

A: The term structure of interest rates: Also known as the yield curve, the term structure of interest ...

Q: Foreign banks are authorized to perform banking operations only if they convert as domestic banks. ...

A: A foreign bank is a type of international bank that has branches in India but is headquartered in an...

Q: Explain the call-put parity relation and how it is justified. Black-Scholes-Merton formula uses f...

A: There are three shares traded in the market namely (a) Share, (b) Call option, (c) Put option. If th...

Q: Calculate 1.04 as a ratio.

A: A ratio is a relationship between two variables that shows how much of one variable is contained in ...

Q: Define the difference between a proprietorship and a partnership. What are the advantages and disadv...

A: The business entity can be established, managed, and operated using a variety of business structures...

Q: Meyer of Georgia wants to issue bonds to pay to make electric Avenue higher the current interest rat...

A: The cost of debt: The coupon rate at which an entity can issue bonds is its cost of debt. However, t...

Q: manufactured. material, labor and equipment needed to produce one unit of each commodity is shown be...

A: A manufacturer is producing a commodity X and Y with a profit per unit 120 and 100 respectively. cos...

Q: Suppose you receive cashflows of $10 at year 1, $12 at year 2, $14 at year 3 and $16 at year 4. What...

A: Solution:- Value of cash flows at year 2 = Future value of year 1 cash flow for 1 year + Year 2 cash...

Q: ABC Corporation plans to issue an 8%, 15-year, P5,000,000 face value bonds. It will incur P300,000 a...

A: Here we are required to calculate Cost of the Bond by Yield to Maturity formula and Trial & Err...

Q: How many percent was the increase in net income compared to previous year

A: Note :- Only first question can be answered with the given information. Percent increase in net in...

Q: How do you calculate the rate on an Adjustable Rate Mortgage? O Survey the cost of funds an local ba...

A: Adjustable rate mortgage :- Adjustable rate mortgage is a kind of mortgage whoes rate is adjustable ...

Q: J-ALLEN TECH is offering a television set for $9,000.00 on Hire Purchase. It can be bought by making...

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for...

Q: Explain the spectrum of INTEREST, including all the terms used and their various differences.

A: Interest rate is the rate a lender charges on the borrowed fund or principal amount. It is mentioned...

Q: An investor has the opportunity to invest in four new retail stores. The amount that can be invested...

A: Net Present Value or NPV can be defined as the value determined by deducting the present value of ca...

Q: OPS Invest PLC issues a 4-year maturity 9% Coupon Bonds to finance a sustainable Solar energy yield ...

A: Time period = 4 years Coupon rate = 9% Yield to maturity = 10% Par value = $1,000

Q: Harmeling Paint Ball (HPB) Corporation needs a new air compressor that costs $90,000. HPB will need ...

A: The lease liability is the responsibility to make rental payments based on the present value of the ...

Q: 8. (1): 100.000$ after 8 years received discount 10.5% (2): 100.000$ what present value is after i

A: Since multiple questions are asked, we will solve 1st question for you as per prescribed guidelines....

Q: 46. If money is worth 10% compounded quarterly, what monthly savings is required monthly in order to...

A: Future value is the value of a current asset at a future date based on an assumed rate of growth (FV...

Q: Jim’s Shoes Ltd manufactures elite sports shoes. The main raw material for the production of these s...

A: Net present value or N.P.V. is the capital budgeting technique which helps in the decision making pr...

Q: 1. Differentiate the two main subdivisions of the Philippine Financial System. 2. Discuss the elemen...

A: "Since you have asked multiple question we will be solving First question for you if you want any sp...

Q: The owners of a corporation are the The primary goal of the corporate management team is to v the sh...

A: Wealth Maximization: This concept implies increasing the firm value by increasing the value of shar...

Q: A reputable company plans to place an investment with a private equity firm with an amount of Php 10...

A: NPV is the difference between present value of cash inflows and initial investment. NPV =PV of all c...

Q: An investor purchased a 91-day, $10,000.00 T-bill on its issue date for $9920.61. After holding it f...

A: A Treasury Bill (T-Bill) is a Treasury Department-backed one-year or less U.S. government debt oblig...

Q: In-line with the primary objective of shareholder wealth maximization, what other objective may be i...

A: A company that can raise funds from the general public is known as a public limited company. A publi...

Q: NPV Project A Project X $0 Cost of Capital 0% 22% 30% 12% What is the IRR of Project A? O A. 12% В. ...

A: Internal rate of return Internal rate of return is the method of capital budgeting that measures the...

Q: sonal assistan ification of a uring that the

A: Introduction : In simple words, the given question relates to the concept of insurance. In an insura...

Q: Moving to another question will save this response. Question 3 What is the yield to maturity of a 13...

A: Yield To Maturity: It refers to the expected rate of return for debt holders given that all coupon ...

Q: Finance professionals make decisions that fall into three distinctive areas: corporate finance, capi...

A: Corporate finance deals with the capital structure of a company, funding, and it also consists of al...

Q: Using the Human Life Value Method, how much life insurance does Carl need? Family Share of Earnings ...

A: Human life value method-This is an universal accepted approach to establish the economic value of a ...

Q: Blackpink Co. has 5% preferred stock with a par value of P 100. Selling price is P 123.50 per share ...

A: Money paid on an annual basis to the preferred stockholders for the issue of preferred stock is the ...

Q: A "mortgage" is a loan contract and is actually made up of which two contracts: O Index & Margin O N...

A: Solution:- Mortgage means borrowing money by pledging an immovable property as a security against th...

Q: Compare the results of the three methods by quality of information for decision making. Using what y...

A: The question is related to Capital Budgeting. The Internal Rate of Return is the rate at which pres...

Q: You deposit $2000 in a risky investment that loses 3 % interest yeaçly. Unfortunately, the money is ...

A: Future Value: The future value is the amount that will be received at the end of a certain period. T...

Q: You expect to have it $12,000 in one year. A bank is offering loans at 3.5% interest per year. How m...

A: Amount available after one year (FV) = $12000 Interest rate (r) = 3.5%

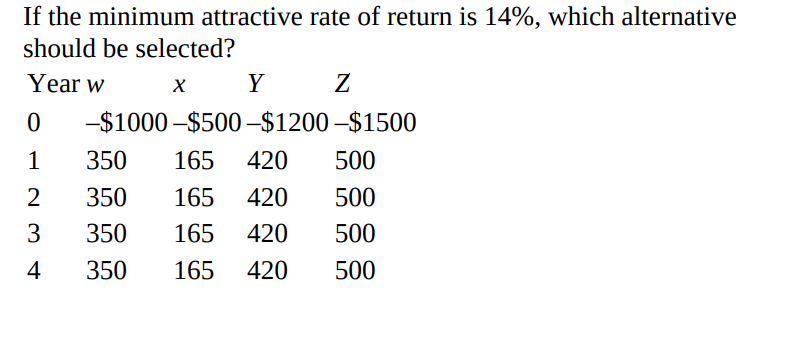

If the minimum attractive

should be selected?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- A firm evaluates all of its projects by applying the IRR rule. If the required return is 18 percent, will the firm accept the following project?CF0 = -$30,000CO1 = $20,000C02 = $14,000C03 = $11,000 yes or noWhich alternative should be selected using the incremental rate of return analysis, if MARR =11.0%? Do- nothing A B C D First Cost 0 $10,000 $4000 $10,000 $7000 Annual benefit 0 1,806 828 1,880 1,067 Life 10 Years ROR 12.5% 16.0% 13.5% 8.5% a. B, because its ROR is the highest b. Something other than C, because C costs the most initially c. C, because the C-B increment has a ROR of 11.78% and the A-B increment has a ROR of 10.5% d. C because C has the highest annual benefitA project you are considering is expected to provide benefits worth $225,000 in one year. If the risk-free rate of interest (rf) is 8%, then the value of the benefits of this project today are closest to: A) $190,333 B) $208,333 C) $225,000 D) $243,000

- If you invest £100 now and expect to receive £133.1 in 2 years time, what is the Internal Rate of Return of this project? a015% b)10% c)0% d)33%What is the approximate expected coefficient of variation (=CV) of returns for a projected one-year project that is 50%-50% probabilities to give +15% return as it is to provide a 5% loss (-5%)? (Please Show Work) A) 0 B) 25 C) 5 D) 2 E) 3Complete the following analysis of cost alternatives and select the preferred alternative. The study period is 10 years and the MARR=15%per year. "Do Nothing" is not an option. A B C D Capital investment $15,000 $15,900 $13,500 $18,000 Annual costs 240 310 450 90 Market value at EOY 10 900 1,250 1,750 2,000 FW (15%) −$64,656 −$69,369 ??? −$72,647 The FW of the alternative C is ... nothing.(Round to the nearest dollar.) Select the preferred alternative. Choose the correct answer below. A. Alternative D B. Alternative B C. Alternative C D. Alternative A

- You estimate that a planned project for your company has a 0.3 chance of tripling the investment in a year and a 0.7 chance of halving the investment in a year. What is the standard deviation of the return on this project? A.1.5625 B.1.3126 C.1.2247 D.1.1457Compute the traditional payback period (PB) and the discounted payback period (DPB) for a project that costs $329,000 if it is expected to generate $94,000 per year for five years? The firm’s required rate of return is 12.5 percent? Should the project be purchased?2. Your firm is considering the following 3 mutually exclusive alternatives. Interest rate is10%. A B CInitial Cost $35,000.00 $21,000.00 $42,000.00Annual Benefit $4,200.00 $3,300.00 $5,000.00Salvage value 0 $1,000 $1500Project life Forever 20 year 50 a. Calculate the Benefit-Cost ratio of each projectb. Which of the 3 alternatives should be selected using B/C ratio analysis (show yourwork)?

- How much would you invest today in order to receive $30,000 in each of the following independent scenarios: 10 years at 9% 8 years at 12% 14 years at 15% 24 years at 10% Use the appropriate EXCEL spreadsheet in the Chapter11 TVOM Examples.xlsx downloadto complete the following table: Present Value (PV) Rate Time (Years) Future Value (FV) A 9% 10 $30,000.00 B 12% 8 $30,000.00 C 15% 14 $30,000.00 D 10% 24 $30,000.00 PLEASE NOTE: All dollar amounts will be with "$" and commas as needed and rounded to two decimal places (i.e. $12,345.67). Use the present value of $1 table in the Appendix B PV FV Tables downloadand verify that your answers above are correct: Future Value (FV) Rate Time (Years) FV Factor (from Table) Present Value (PV) A $30,000.00 9% 10 B $30,000.00 12% 8 C $30,000.00 15% 14 D $30,000.00 10% 24 PLEASE NOTE: All PV Factors will be rounded to three decimal places (i.e. 1.234). All dollar amounts will be with "$" and…The NPV of a project is $8,000. If the IRR is 12%, which of the following is the required rate of return for the project? Group of answer choices A.12.00% B.none of these are possible answers C.15.97% D.11.75%Lipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%. Then decide which product should be selected and why ?