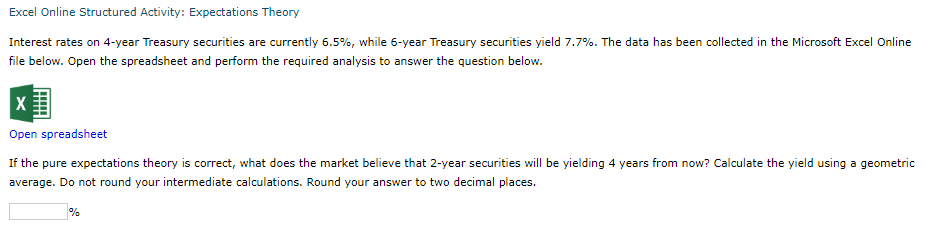

If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round your intermediate calculations. Round your answer to two decimal places.

Q: Using spreadsheet financial functions, calculate the following: Number of periods Petcom’s 2021…

A: Current EPS is $2 The growth rate is 9% per year To Find: Number of periods

Q: nterest rate Tax rate Dividend Common stock on the market Growth rate Debt ratio 9% 30% $2.50 $50 8%…

A: Cost of capital The rate of interest paid by a company to investors for the use of their funds in…

Q: Charles earns an annual salary of $72,100 paid biweekly based on a regular workweek of 36.25 hours.…

A: Gross earnings refer to the amount of money earned by an individual over a period before any…

Q: Pinto.com has developed a powerful new server that would be used for corporations’ Internet…

A: Given Pinto developed a server cost of manufacture- $25 Million working capital at the beginning…

Q: evaluate the sources of financial data which can be used to inform business strategy.

A: Financial Data: Quantitative information used by firms to make financial decisions is called…

Q: long (in years) would $800 have to be invested at 11.6%, compounded continuously, to earn $300…

A: The money invested in deposits grow with time due to the accumulation off interest over the period…

Q: Troy will receive $8678 at the end of Year 2. At the end of the following two years, he will receive…

A: Data given: Year Cash Flows ($) 1 0 2 8678 3 8260 4 2665 5 0 6 0 Rate=4% Formula…

Q: Suppose that the observed spread between the yield on a 4-year zero-coupon riskless bond and the…

A: The Black-Scholes-Merton model can be used to calculate the spread on the yield of financial…

Q: What makes business successful

A: The business is an activity which is generally done with view of making profit and businesses are…

Q: Why is it the same company can be a saver and a user of funds?

A: There is flow of money in the system from saver of money to the who need money and all this is done…

Q: Annual Data Premiums earned Losses incurred Expenses/commissions Dividends paid to policyholders…

A: Combined ratio: It is a measure of profitability of insurance company. Working Note #1 Combined…

Q: Culver Company is considering investing in new equipment that will cost $1428000 with a 10 year…

A: Payback period The method used in capital budgeting to help investors understand the approximate…

Q: What is the accumulated sum of $200 a year for the next 15 years compounded annually at 7.5%?

A: Annuity referes to a series of regular payment for a definite period. If payments are made at the…

Q: A builder is offering $127,574 loans for his properties at 9 percent for 25 years. Monthly payments…

A: A loan is a sum that a borrower requires to meet his or her requirements and wants for a particular…

Q: Moora Inc. Due to the increasing energy costs in the US, Jackie Moora is anxious. The old machine…

A: The process via which entities analyze and evaluate an investment or project's feasibility and…

Q: You borrow 112000 for 10 years from a bank in order to renovate your flat. The effective interest…

A: Whenever a loan is taken or some amount is borrowed by a person he wants to calculate the repayments…

Q: An individual is considering the following scenarios for determine the rate of return of a stock…

A: The rate of return is calculated by taking all the income or gains as a percentage of the initial…

Q: Companies often come across projects that have positive NPV opportunities in which the company does…

A: The NPV of a project is used to find out the profitability of the project by discounting the future…

Q: You want to buy a $216,000 home. You plan to pay 5% as a down payment, and take out a 30 year loan…

A: A home indicates the sum borrowed to purchase a new house. A home loan offers funding to afford the…

Q: Jim and Ann bought a house with a down payment of $16,000 and a $158,000 loan. The loan was for 25…

A: A mortgage is a covered loan provided specifically for the purchase or maintenance of the real…

Q: Securities that plot above the security market line (SML) are undervalued. Select one: True…

A: The capital asset pricing model (CAPM) and security market line (SML) are used to calculate the…

Q: Average Above Average Boom Mean Standard Deviation Coefficient of Variation Covariance with MP…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: You just finished analysing information for the current compensation and benefits program…

A: Honor code: Since you have posted a question with multiple sub-parts, we will solve the one…

Q: The _________ is the internal rate of return a firm must earn on its investment in order to maintain…

A: Since you have asked multiple questions , we will solve the first question for you. If you want any…

Q: Sally receives the following information on her project: PV=100, AC=75, EV=100. How well is the…

A: We have certain metrics of tracking the project in terms of value and cost. We have to find the…

Q: The Wall Street Journal reports that the current rate on 6-year Treasury bonds is 6.70 percent, the…

A: We have the treasury rate and corporate bond rate for 13 years maturity. We have the treasury rate…

Q: You are the finance manager for a particular company. The company plans to purchase $2,000,000 in…

A: Future value of the amount required is the amount being deposited and amount of interest that is…

Q: calculate the total return on a stock, which of the fo O Total Return = Capital Gain - Dividend…

A: When you invest in the market than you expect large rate of retun becuase risk are very much in the…

Q: You enter into a 9-month forward contract on a non-dividend paying stock when the stock price is £35…

A: Forward price is calculated using following equation Forward price = S0×1+rt Where, S0 is spot price…

Q: Shannon has an 8-year, $39,178.45, zero-coupon bond with an annual yield-to-maturity (YTM) of 3.14%.…

A: The investment in a zero-coupon bond is considered to be a non-current asset if the maturity period…

Q: ou need to take out a loan of $35,000 to start up your T-shirt business. You have two possibilities:…

A: Loans are paid by the equal monthly payments and these are fixed payments that carry the payment for…

Q: Sue plans to save $4765, $0, and $5419 at the end of Years 1 to 3, respectively. What will her…

A: Future Value refers to the compounded value of a single cash flow received today, or multiple cash…

Q: Activity 2 A company is currently paying a dividend of $5 per share on its ordinary s The dividend…

A: The value of shares can be calculated based on dividend discount model and value of shares can be…

Q: Pedro bought a new car today from Barboncito Motors. The former proposed to pay the latter the…

A: The monthly payment on a loan refers to the repayment amount extended by the borrower to the lender…

Q: Consider the following income statement: Sales $909,407 Costs…

A: Operating cash flow (OCF) is a measurement of how much money a company generates through regular…

Q: What is the accumulated sum of $12 a year for the next 8 years compounded annually at 10%?

A: The amount that a present investment will gain in value over time when kept in a compound interest…

Q: You are concerned about the market volatility but have found stocks that are attractively priced. In…

A: An investor holding a long position means that the investor has bought these stocks and owns them.…

Q: $ 60,000.00 Length of time needed from today 4 Interest

A: by the appropriate discounting rate that is semiannual, and also adjusting the number of the…

Q: Does at the money ,in the money, out of the money is used to tell about position of strike price in…

A: Value of a call option A call option gives its holder the right to purchase shares at the…

Q: You have just turned 23 years of age and accepted your first job. However, you would like to retire…

A: Current Age is 23 years The retirement age is 58 years Therefore; the Time period of the deposit is…

Q: Expected average annual dividends (2012-2014) Current stock price Expected future stock price (2014)…

A: Capital gain is the return due to price appreciation of the stock. Dividends are regular income…

Q: If economy booms, RTF, Inc. stock is expected to return 11 percent. If the economy goes into a…

A: State of Economy Probability RTF (R) BOOM 73% 11% Recession 27% 3% To Find: Variance

Q: s the limitations of ratio analysis as a tool for str

A: Ratio analysis is used quite often in the decision making but many time that results in quite bad…

Q: As a result of a slowdown in operations, Mercantile Stores is offering to employees who have been…

A: The present value is the current value of the amount that is expected to be received in future. It…

Q: You are the CFO of Carla Vista, Inc.a retailer of the exercise machine Carla Vista6 and related…

A: The cash outflows are related to acquiring capital assets like machinery, building, equipment, etc.…

Q: Can you please do A and B by itself? It is confusing me when you combine both.

A: a) Plot the Security Market Line (SML).b) Superimpose the CAPM’s required return on the SML.…

Q: a. What is your estimate of Terrapin’s (after-tax) Weighted Average Cost of Capital? b. Using…

A: Given Terrapin Industries, a private firm with 100 million outstanding shares, $300M in debt, and…

Q: Now consider a problem with three stocks, where the means, variances riances are as follows: 0.08,3…

A: An optimal portfolio is one that has maximum sharp ratio. For this, the solver of excel is used to…

Q: present the capital asset pricing model and discuss how the theoretical model is made operational…

A: The management use CAPM (Capital Asset Pricing Model) to determine the expected rate of return…

Q: Louis Winthorpe III was evaluating investment opportunities to determine what he should do with his…

A: Honor code: Since you have posted a question with multiple sub-parts, we will solve the first three…

Step by step

Solved in 2 steps

- Start with the partial model in the file Ch20 P08 Build a Model.xlsx on the textbooks Web site. Maggies Magazines (MM) has straight nonconvertible bonds that currently yield 9%. MMs stock sells for 22 per share, has an expected constant growth rate of 6%, and has a dividend yield of 4%. MM plans on issuing convertible bonds that will have a 1,000 par value, a coupon rate of 8%, a 20-year maturity, and a conversion ratio of 32 (i.e., each bond could be convertible into 32 shares of stock). Coupon payments will be made annually. The bonds will be noncallable for 5 years, after which they will be callable at a price of 1,090; this call price would decline by 6 per year in Year 6 and each year thereafter. For simplicity, assume that the bonds may be called or converted only at the end of a year, immediately after the coupon and dividend payments. Management will call the bonds when their conversion value exceeds 25% of their par value (not their call price). a. For each year, calculate (1) the anticipated stock price, (2) the anticipated conversion value, (3) the anticipated straight-bond price, and (4) the cash flow to the investor assuming conversion occurs. At what year do you expect the bonds will be forced into conversion with a call? What is the bonds value in conversion when it is converted at this time? What is the cash flow to the bondholder when it is converted at this time? (Hint: The cash flow includes the conversion value and the coupon payment, because the conversion occurs immediately after the coupon is paid.) b. What is the expected rate of return (i.e., the before-tax component cost) on the proposed convertible issue? c. Assume that the convertible bondholders require a 9% rate of return. If the coupon rate remains unchanged, then what conversion ratio will give a bond price of 1,000?Interest rates on 4-year Treasury securities are currently 5.85%, while 6-year Treasury securities yield 7.85%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round your intermediate calculations. Round your answer to two decimal places.Excel Online Structured Activity: Bond valuation An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 9.4%. Bond C pays a 10% annual coupon, while Bond Z is a zero coupon bond. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Assuming that the yield to maturity of each bond remains at 9.4% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Do not round intermediate calculations. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 4 $ fill in the blank? $ fill in the blank? 3 $ fill in the blank? $ fill in the blank? 2 $ fill in the blank? $ fill in the blank? 1 $ fill in the blank? $ fill in the blank? 0 $ fill in the blank? $ fill in the…

- Excel Online Structured Activity: Bond valuation An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.3%. Bond C pays a 10.5% annual coupon, while Bond Z is a zero coupon bond. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Assuming that the yield to maturity of each bond remains at 8.3% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Do not round intermediate calculations. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 4 $ $ 3 $ $ 2 $ $ 1 $ $ 0 $ $Interest rates on 4-year Treasury securities are currently 6.95%, while 6-year Treasury securities yield 7.95%. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round intermediate calculations. Round your answer to two decimal places. %Currently, 3-year Treasury securities yield8.7%,7-year Treasury securities yield8.4%, and 10 -year Treasury securities yield8.2%. If the expectations theory is correct, what does the market expect will be the yield on 3-year Treasury securities seven years from today? 8.13%8.33%7.73%7.53%7.93%

- The attached file contains hypothetical data for working this problem. Goodman Corporation’s and Landry Incorporated’s stock prices and dividends, along with the Market Index, are shown in the file. Stock prices are reported for December 31 of each year, and dividends reflect those paid during the year. The market data are adjusted to include dividends. The risk-free rate on long-term Treasury bonds is 8.04%. Assume that the market risk premium is 6%. What is the expected return on the market? Now use the SML equation to calculate the two companies' required returns.The project is spreadsheet problems solving. It is necessary to turn in soft copy of the excel solution. It should be well organized and easy to follow. Question) A Treasury bond that settles on August 10, 2013, matures on April 15, 2018. The coupon rate is 5.6 percent and the quoted price is 104. What is the bond’s yield maturity?Submit your solutions as an Excel document. Be sure to clearly label the various parts of the problem. 1. Consider the following two bonds that make semi - annual coupon payments. Assume the first coupon payment occurs in exactly six months, and the bond has a face value of $1000. Coupon Rate Time to Maturity YTM Bond A 3.80% 8 years 3.6% Bond B 3.80% 18 years 4.2% a.) What is the current price (t = 0) of Bond A? Be sure to set up the valuation equation. b.) What will be the price of Bond A exactly halfway in between t = 0 and the first coupon date? c.) Using a spreadsheet, plot the price - yield relationship for both Bond A and Bond B on the same set of axes. Do this for a range of yields from 2% to 11% (in increments of 50 basis points). d.) Use a spreadsheet to compute the annualized Macaulay duration and modified duration for Bond A at a yield - to - maturity of 3.6%. Provide an interpretation of the modified duration with regards to maturity and interest rate risk. e.) Use a…

- Please show working Please answer ALL OF QUESTIONS 1 AND 2A and 2B 1. Stock R has a beta of 1.2, Stock S has a beta of 0.35, the required return on an average stock is 9%, and the risk-free rate of return is 5%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? Round your answer to two decimal places. 2. Harrimon Industries bonds have 6 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 8%. a. What is the yield to maturity at a current market price of: $759? Round your answer to two decimal places. ________% $1,083? Round your answer to two decimal places. _________% b. Would you pay $759 for each bond if you thought that a "fair" market interest rate for such bonds was 13%-that is, if rd = 13%? You would not buy the bond as long as the yield to maturity at this price is less than the coupon rate on the bond. You would buy the bond as long as the yield…Hello, How do i solve this corporate finanace question without the use of excel. A financial calculator can be used if required. Can you please show each step in the calculation process? Find the annual rate of this coupon bond: A corporate bond with a face value of $1,000 and coupons paid semi-annually, sells for $1,058.39. The term to maturity is 15 years. The yield to maturity of similar bonds is 9.5%.Bond valuation related problems should be solved by using a financial calculator or MS excel spreadsheet. Accordingly, you must show the values of all relevant time valu of money variables ABC stock selss for $60.25 per shar. Its required rate of return is 10.25%. The dividend is expected to grow at a constant rate of 7.00% per year. What is the expected year-end dividend, D1?