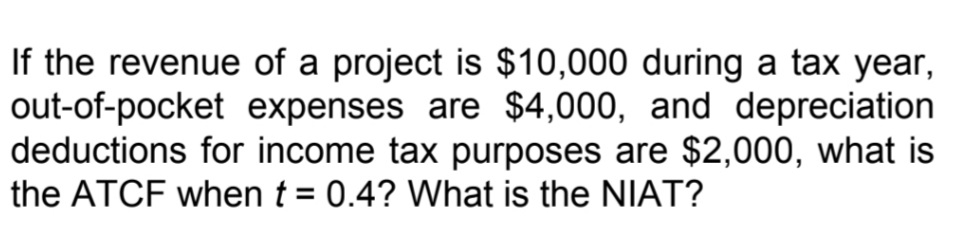

If the revenue of a project is $10,000 during a tax year, out-of-pocket expenses are $4,000, and depreciation deductions for income tax purposes are $2,000, what is the ATCF when t = 0.4? What is the NIAT?

Q: Approximate the after-tax ROR on a project that had a first cost of $500,000, a salvage value of 20%…

A: In finance, the return is a benefit for an investment. It involves any adjustment in the estimation…

Q: Your company, RMU Inc., is considering a new project whose data are shown below. Under the new tax…

A: The money that enters a firm is referred to as cash inflow.Sales, investments, or finance might all…

Q: A firm must decide between two designs. Their effective income tax rate is 22%, and MACRS…

A: The annual worth is calculated using the following formula:- Annual Worth (AW )=NPVPVAF(r%,n) Step…

Q: Consider the following after-tax cash flows: (a) Compute the project balances for Projects A and D,…

A: Cash flows are the cash and cash equivalents that flows in and out of the business in a particular…

Q: Consider an asset that costs $665,000 and is depreciated straight-line to zero over its nine-year…

A: Calculation of after cash flow from sale of asset:The after-cash flow from sale of asset is…

Q: Estimate the approximate before-tax rate of return (ROR) for a project that has a first cost of…

A: Introduction: Return on investment: Return on investment is the measurement of the performance of…

Q: The initial cost of a project is 1000 monetary units, its useful life is 5 years and the scrap value…

A: Gross income can be defined as the difference between the revenues earned by selling the product and…

Q: A machine costs P50,000.00. If the after-tax cash inflows for years 1-5 are: P20,000.00, P10,000.00,…

A:

Q: In a project, revenue was $400 millions and costs was $200millions . Tax rate of the company was…

A: Given the following information: Revenue: $400 millions Cost: $200 millions Tax rate: 30%

Q: A company that decides to value a project in which it wants to enter, presents the information in…

A: NPV means PV of net benefits which will arise from the project in coming years. It is equal to the…

Q: used. If the desired after-tax return on investment is 10% per year, which de should be chosen?…

A: The net present value is the difference between the present value of cash flow and initial…

Q: The capital cost of a property is $5900000. A CCA rate of 20% is applied. The tax rate is 30%. Take…

A: A) Closing book value of Property Year Opening value ($) CCA @ 20% Closing Value ($) 1 5900000…

Q: A corporate expects to receive $34,442 each year for 15 years if a particular project is undertaken.…

A: Initial investment (X) = $114290 Annual cash inflow = $34442 Annual expenses = $7570 Depreciation =…

Q: A company estimates that it will have $402,330 in sales and $90,850 in operating costs annually.…

A: The cash flow statement (CFS) is a financial statement that outlines the movement of cash and cash…

Q: What is the capitalized cost of a structure that will require construction cost of P1,000,000…

A: solution given initial cost =1,000,000 P800,00 each year for the next 4 years annual year…

Q: Estimate the approximate after-tax rate of return (ROR) for a project that has a before-tax ROR of…

A: Rate of return measures the net gain or loss of the investment over a given specified period of the…

Q: The following is a simplified project annual income statement for Ma & Pa Incorporated for each year…

A: Note: As per the policy, we are supposed to solve the first three subparts only at a time. Kindly…

Q: In the fourth and final year of a project, XYZ expects operating cash flow after taxes of P440,000.…

A: The cash flow of the year is what is received after payment of all operating expenses and all…

Q: A company expects to need to increase their net working capital by $200,000 at the beginning of a…

A: At the beginning of the project, the investment in working capital of 200000 is a cash outflow.

Q: A company with a WACC of 14% is evaluating two projects for this year. The following is the…

A: Capital budgeting is the evaluation of the project's return to compare it with the required return.…

Q: a. Project B costs $10,000 and will generate after-tax cash inflows of $900 in year 1, $2,400 in…

A: A. Calculation of payback period (in years): 4 years (approx) End Of year cash inflows cash…

Q: Suppose an asset has a first cost of $8,000,a life of five years, a salvage value of $2,000 atthe…

A: Cash Flow form Operation after tax may be calculated using either: Direct method or Indirect method.…

Q: Fort requires equipment costing $320,000. It is a 9-year project, and is depreciated straight line…

A: cost of equipment= $320,000 life span of the project= 9 years Sales generated= $189,000 cost=…

Q: Californian Wave Inc. is now at the end of the final year of a project. The equipment originally…

A: Given information, Original cost =P17,500 Depreciated=65% Tax rate =25% Selling price =P6,000

Q: A project has annual depreciation of $25,900, costs of $102,500, and sales of $151,500. The…

A: To find: Operating cash flow

Q: A firm has recently purchased Class 10 equipment for $100,000 with a CCA rate of 30%. What is the…

A: "Since you have asked multiple questions, we will solve the first question for you". If you want any…

Q: Consider an asset that costs $422,400 and is depreciated straight-line to zero over its 8- year tax…

A: Given, Asset cost = $422,400 Selling Price = $52800 Tax rate = 24%

Q: our company, RMU Inc., is considering a new project whose data are shown below. Under the new tax…

A: Cash flow is the amount of cash that comes in (cash inflow) and that goes out (cash outflow) of a…

Q: Consider an asset that costs $311,000 and is depreciated straight-line to zero over its six-year tax…

A: Given: Cost of asset =$311,000 Life = 6 years Used life = 4 years Salvage value = $58,000

Q: A road is constructed at the capital cost of $10 million. At the end of Year 10, major improvements…

A: Annualized Cost refers to equivalent cost that is incurred on project on annual basis. It is…

Q: For the property with the capital cost of $71,220, and using the applicable income tax rate of 29%,…

A: If you sell an asset for greater than its UCC value (undepreciated value): DTE is negative (sale…

Q: A company anticipates a taxable cash expense of $80,000 in year 2 of a project. The company's tax…

A: Cash expense $80,000 Less: Tax benefit ($80,000 x 30%) $24,000 Net cash expense $56,000

Q: What is the NPV for the following project if its cost of capital is 10 percent and its initial after…

A: Initial Cost = $5,000 Cost of capital = 10% Time Period = 4 Years

Q: Consider a project with inflows of $20,000 and outflows of $13,000. If the tax rate is 33%, and if…

A: Annual inflow (A) = $20000 Annual outflow (O) = $13000 Tax rate (T) = 33% Let D = Depreciation

Q: What is the IRR for the following project if its initial after tax cost is $5,000,000 and it is…

A: Information Provided: Initial cash outflow = $5,000,000 Operatin Cash inflows Year 1 = $1,800,000…

Q: Use the spreadsheet to determine the after-tax internal rate of return. For this problem, assumea a…

A: Annual depreciation = Initial costUseful life= $200,00010 years= $20,000

Q: A two-year project has sales of $582,960, cash costs of $411,015, and depreciation expense of…

A: Depreciation expense = $68,109 Tax rate = 0.24 Depreciation tax shield is also known as saving of…

Q: salvage value of $0at d to be $44,000 and expenses are projected t nas an incremental income tax…

A: Taxable income will be calculated by deducting the depreciation and expenses from annual gross…

Q: As a member of UA Corporation's financial staff, you must estimate the Year 1 cash flow for a…

A: Operating cash flow of the project helps in understanding if the business is able to generate…

Q: A project has sales of $462,000, costs of $274,000, depreciation of $28,000, interest expense of…

A: Given: Sales =$462000Cost =$274000Depreciation =$28000Interest expense =$3400Tax rate =35%

Q: mpany project capitalized for $ 50,000 invested in depreciable assets will earn a uniform annual…

A: The income return on investment is defined as cash flows.The interest or dividends paid by a…

Q: Consider an asset that costs $690,000 and is depreciated straight-line to zero over its eight-year…

A: Salvage value can be defined as the value of an asset received by the company after completing or…

Q: $500,000 was invested in depreciable property to obtain before-tax annual revenues of $108,333.33…

A: Capital expenditure differs from revenue expenditure in the sense that the benefits from such…

Q: A mining project requires the purchase of new drilling equipment at a cost of $69750. A further…

A: The revenue expenditure can be claimed as tax deductible expenditure. Accordingly, tax benefit can…

Q: Consider an asset that costs $665,000 and is depreciated straight-line to zero over its nine-year…

A: Given information: Asset cost is $665,000 Asset sold for $137,000 Total life is 9 Used for 5 years…

Solve the math in a detailed way.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Nicholas Health Systems recently reported an EBITDA of $25.0 million and net income of $15.8 million. It had $2.0 million of interest expense, and its federal tax rate was 21% (ignore any possible state corporate taxes). What was its charge for depreciation and amortization?A project has the following net profit after tax set out below. The average book value of the assets in the project is 131,028. What is the accounting rate of return of this project? Enter your final answer in decimals to four decimal places (e.g., if your answer is 5.55%, then enter 0.0555). Year Net Profit After Tax 1 5,097 2 7,365 3 8,627 4 10,946Consider a project with inflows of $20,000 and outflows of $13,000. If the tax rate is 33%, and if the cash flow in Year 1 is $6,500, what is the depreciation amount? Select one: a. $5,485 b. $5,387 c. $5,333 d. $5,438 e. $5,529

- A project capitalized for P 50,000 in depreciable assets will earn a uniform annual income of P 19,849 in 10 yrs. The costs for operation and maintenance total P 9,000 each year. If the company expects its capital to earn 12% before income taxes, is the investment worthwhile? Use ROR, annual worth and present worth methods in justifying the investment.Consider an asset that costs $1,280,170 and is depreciated straight-line to 83,206 over its 14-year tax life. The asset is to be used in a 4-year project; at the end of the project, the asset can be sold for $128,169. If the relevant tax rate is 0.21, what is the aftertax cash flow from the sale of this asset (SVNOT)?What is the NPV of a 6-year project that costs $100,000, has annual revenues of $50,000 and costs of $15,000? Assume the investment can be depreciated for tax purposes straight-line over 6 years, the corporate tax rate is 35%, and the discount rate is 14%.

- Consider an asset that costs $1,156,294 and is depreciated straight-line to zero over its 10-year tax life. The asset is to be used in a 3-year project; at the end of the project, the asset can be sold for $214,463. If the relevant tax rate is 0.24, what is the aftertax cash flow from the sale of this asset (SVNOT)?A project capitalized for ₱25,000 invested in depreciable assets will earn a uniform, annual income of ₱29647 in 10 years. The cost for operation and maintenance total ₱5,000 a year, and annual taxes and insurance will cost 5% of the investment. The company expects its capital to earn 14% before income taxes.Using the Annual Worth method, what is the total annual cost of the project?Trinity has a project costing $2,050,000 that will have the following after tax cash flows in years 1-5: Year 1 2 3 4 5 CF 905,000 -175,000 800,000 -150,000 790,000 If the WACC is 7.50%, find the MIRR and NPV. Show your work

- A project has the following cash in and out flows in its first year: Income generated: R100 000 Cost of sales R30 000 Depreciation R10 000 What would the tax payable for the first year of the project be if the tax rate is 27%?Consider an asset that costs $601,119 and is depreciated straight-line to zero over its 10-year tax life. The asset is to be used in a 4-year project; at the end of the project, the asset can be sold for $184,314. If the relevant tax rate is 0.27, what is the aftertax cash flow from the sale of this asset?A company anticipates a taxable cash expense of $80,000 in year 2 of a project. The company's tax rate is 30% and its discount rate is 10%. The present value of this future cash flow is closest to: Select one: a. $(56,000) b. $(19,835) c. $(46,281) d. $(24,000)