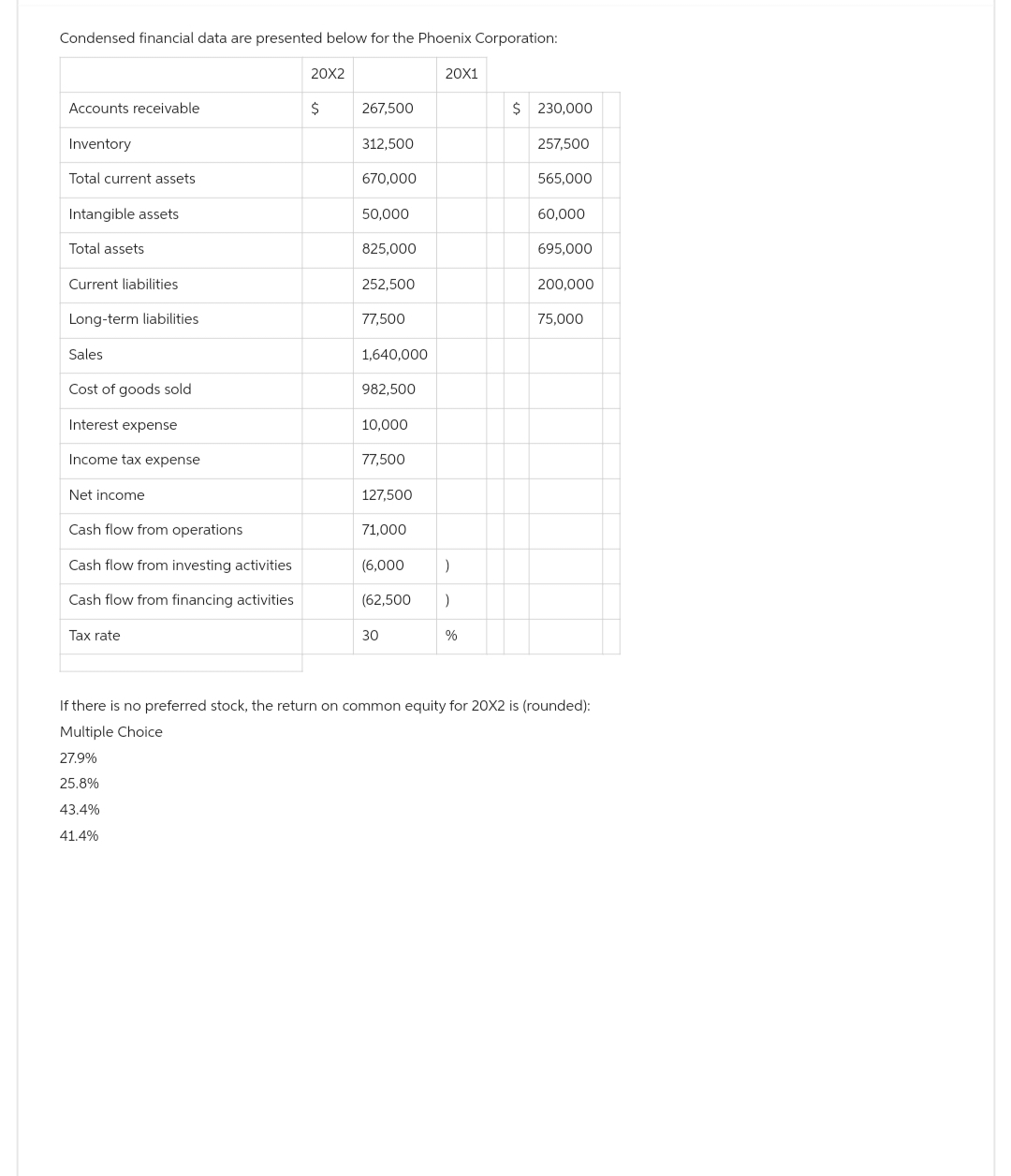

If there is no preferred stock, the return on common equity for 20X2 is (rounded): Multiple Choice 27.9% 25.8% 43.4% 41.4%

If there is no preferred stock, the return on common equity for 20X2 is (rounded): Multiple Choice 27.9% 25.8% 43.4% 41.4%

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter12: Valuation: Cash-flow Based Approaches

Section: Chapter Questions

Problem 2BIC

Related questions

Question

Please help me with show all calculation thanku

Transcribed Image Text:Condensed financial data are presented below for the Phoenix Corporation:

Accounts receivable

Inventory

Total current assets

Intangible assets

Total assets

Current liabilities

Long-term liabilities

Sales

Cost of goods sold

Interest expense

Income tax expense

Net income

Cash flow from operations

Cash flow from investing activities

Cash flow from financing activities

Tax rate

20X2

$

267,500

312,500

670,000

50,000

825,000

252,500

77,500

1,640,000

982,500

10,000

77,500

127,500

71,000

(6,000

(62,500

30

20X1

)

)

%

$ 230,000

257,500

565,000

60,000

695,000

200,000

75,000

If there is no preferred stock, the return on common equity for 20X2 is (rounded):

Multiple Choice

27.9%

25.8%

43.4%

41.4%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning