If WideWorld is choosing one of the above mutually exclusive projects (Project A on Project B), assuming the firm's cost of capital is 10%, which project(s) should the company choose to pursue? ... O A. Project B O B. Project A both have negative NPV.

If WideWorld is choosing one of the above mutually exclusive projects (Project A on Project B), assuming the firm's cost of capital is 10%, which project(s) should the company choose to pursue? ... O A. Project B O B. Project A both have negative NPV.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter11: The Basics Of Capital Budgeting

Section: Chapter Questions

Problem 11P: CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS Project S requires an initial outlay at t =...

Related questions

Question

Question 30

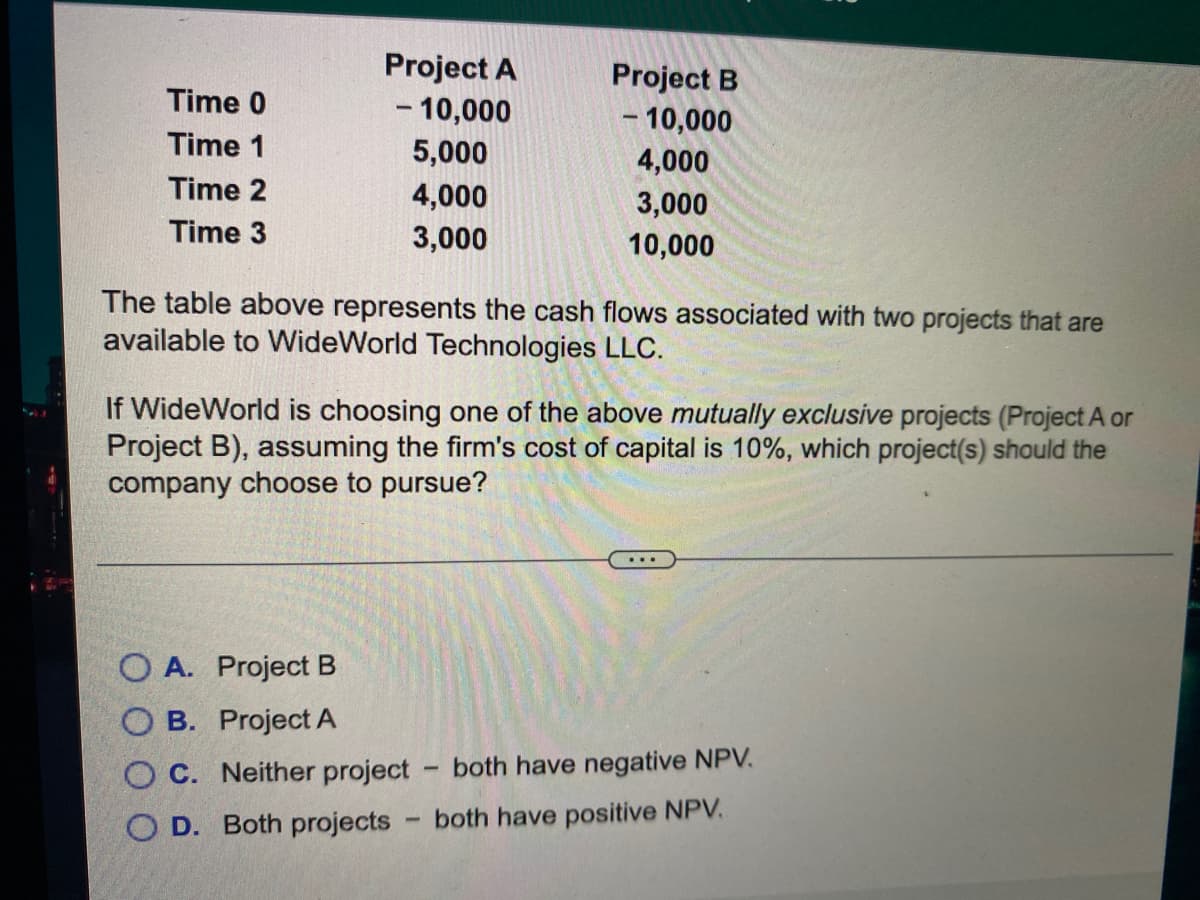

Transcribed Image Text:Project A

Project B

Time 0

- 10,000

- 10,000

Time 1

5,000

4,000

Time 2

4,000

3,000

Time 3

3,000

10,000

The table above represents the cash flows associated with two projects that are

available to WideWorld Technologies LLC.

If WideWorld is choosing one of the above mutually exclusive projects (Project A or

Project B), assuming the firm's cost of capital is 10%, which project(s) should the

company choose to pursue?

...

O A. Project B

O B. Project A

O C. Neither project

both have negative NPV.

O D. Both projects

both have positive NPV.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning