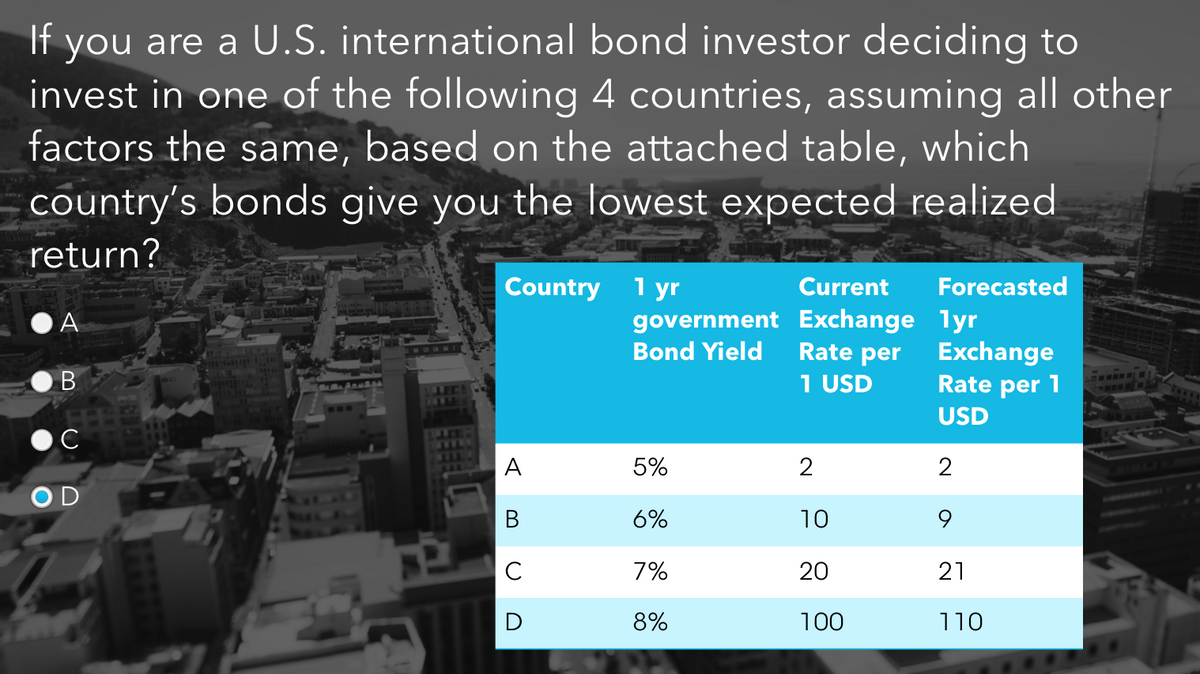

If you are a U.S. international bond investor deciding to invest in one of the following 4 countries, assuming all c factors the same, based on the attached table, which country's bonds give you the lowest expected realized return? A B KA ARMADA Current government Exchange Bond Yield Rate per 1 USD Country 1 yr Forecasted lyr Exchange Rate per 1 USD

Q: Adjusted WACC. Lewis runs an outdoor adventure company and wants to know what effect a tax change…

A: Weight of Equity = we = 35%Weight of Preferred Stock = wp = 15%Weight of Debt = wd = 50%Cost of…

Q: Pizana Computer Company has been purchasing carrying cases for its portable computers at a purchase…

A: Differential analysis-This is a decision making technique. It examines the benefits and costs…

Q: A callable bond pays annual interest of $75, has a par value of $1,000, matures in 20 years but is…

A: To calculate the yield to call (YTC) on a callable bond, you need to use the following…

Q: Maggie's Resorts was wondering how to use capital budgeting to decide if their $7,952,000 expansion…

A: According to bartleby guidelines , if question involves multiple sub parts , then 1st sub 3 parts…

Q: Calculate your rate of return.

A: The rate of return is used to assess an investment's profitability. It determines the gain or loss…

Q: Q5. Consider a six-month European put option on a non- dividend-paying stock. The current stock…

A: For Q5, the objective is to find the lower bound for the price of a European put option and an…

Q: What is the WACC for Snuggly Baby Corp. if the tax rate is 25.00% and the firm has 6,182,000.00…

A: The weighted average cost of capital(WACC) is a financial metric pivotal to corporate finance,…

Q: A 15-year, 4% coupon bond paid semi-annually is currently trading at a yield to maturity of 3.5%.…

A: Number of periods= 15*2=30, Yield to maturity per period= 3.5/2= 1.75%a) Semi annual coupon amount =…

Q: Suppose a U.S. investor wishes to invest in a British firm currently selling for £30 per share. The…

A: Current Selling Price = £30 per shareCurrent Exchange Rate = $2/£Possible prices per share after 1…

Q: Segments of the bonds markets include a) treasury b) municipal c) agency d) corporate e) all of…

A: Features of Bonds are:-Bonds are the financial instruments issued by the government or companies to…

Q: How

A: Property Capital Gains and Losses Flashcards.I got the number -6200 on the capital gains/losses…

Q: A pass-through security issued by Royal Bank is backed by a pool of 5700 identical mortgages. The…

A: Interest payments refer to the periodic cash outflow in the form of the expense of employing the…

Q: Determine the present value of a debt of $8000 due in eleven months if interest at 6-% is allowed.…

A: The PV of an investment refers to the combined worth of the cash flows of the investment assuming…

Q: The expected return on the market is 12.07%, the risk-free rate is 4.94%, and the tax rate is…

A: Weighted average cost of capital (WACC):The weighted average cost of capital (WACC) is a financial…

Q: You want to create a portfolio equally as risky as the market, and you have $2,200,000 to invest…

A: Variables in the question:Investible amount=$2200000 AssetInvestmentBetaStock A $…

Q: Congratulations! You have won the lottery. The lottery offers you the following payout options:…

A: Variables in the question:Option #1: $10,256,000 after 2 years.Option #2: $2,020,000 per year for 2…

Q: 5. What is the rate of return for an investor who pays $1,054.47 for a 3-year bond with a 7% coupon…

A: Given information:Beginning Value (purchase price) = $1,054.47Ending Value (sale price) =…

Q: Consider the following six months of returns for two stocks and a portfolio of those two stocks:…

A:

Q: 3.1 REQUIRED Study the information provided below and answer the following questions:3.1.1 If the…

A: The objective of the question is to calculate the total revenues at break-even if the sales…

Q: Econo Cool air conditioners cost $380 to purchase, result in electricity bills of $166 per year, and…

A: Equivalent annual cost refers to the cost incurred in owning, operating, and the maintenance of an…

Q: Steinberg Corporation and Dietrich Corporation are identical firms except that Dietrich is more…

A: Steinberg:ExpansionRecessionEBIT$3,800,000.00$1,200,000.00Payoff to debt…

Q: Derive the lower bound for European call options on both non-dividend-paying stocks and…

A: A European call option is a financial instrument that, on or before a designated expiration date,…

Q: Please please ASAP, I only have 20 minutes. What amount three years ago is equivalent to $5, 600 on…

A: Present value is an estimate of the present value of future cash values that may be received at a…

Q: A stock price is $20. It has an expected return of 12% and a volatility of 35%. What is the standard…

A: The objective of the question is to calculate the standard deviation of the change in the price of a…

Q: Elijah Enterprises will need to upgrade the computer system in 8 years. They anticipate the upgrade…

A: Time = t = 8 YearsFuture Value = fv = $112,100Discount Rate = r = 11%

Q: Factor Company is planning to add a new product to its line. To manufacture this product, the…

A: NPV is also known as Net Present Value.. It is a capital budgeting technique which helps in decision…

Q: Assume that the market returns are normally distributed with 10% mean and 20% standard deviation.…

A: Standard deviation serves as a fundamental statistical metric, capturing the degree of variability…

Q: please respond to both. You calculated the value of Stock A to be $38 and Stock B to be $33. If…

A: A stock will be undervalued if it's current price is less than it's Intrinsic or fair value.A stock…

Q: A stock with a P/E of 20 and a PEG of 1.5 must have a higher expected growth rate than a stock with…

A: False . Stock value = $37.696

Q: Bonds of Zello Corporation with a par value of $1,000 sell for $960, mature in five years, and have…

A: Face value = $1,000Coupon rate = 7%Years to maturity = 5 yearsReinvestment rate = 6%Bond's price =…

Q: : What is the bond equivalent yield on a Treasury-bill with a face value of $3,000000, a discount…

A: The effective borrowing cost is a financial metric that provides a comprehensive measure of the…

Q: Yield curve A firm wishing to evaluate interest rate behavior has gathered yield data on five U.S.…

A: The yield curve is a graphical indication of the relationship between the maturity period and the…

Q: A company has a 12% WACC and is considering two mutually exclusive investments (that cannot be…

A: NPV (Net Present Value): NPV measures the difference between the present value of cash inflows and…

Q: OMG Inc. has 4 million shares of common stock outstanding, 3 million shares of preferred stock…

A: Weighted average cost of capital:The weighted average cost of capital (WACC) is a financial metric…

Q: a. Calculate the annual cash flows ( annuity payments) from a fixed - payment annuity if the present…

A: Annual cash flows refer to the amount that defines the inflow and outflow of the cash during the…

Q: Company C's capital includes $5 million in bonds and 8 million common shares with a market price of…

A: A rights issue, also known as a rights offering or rights offering, is a method through which a…

Q: Applied Software has a $1,000 par value bond outstanding that pays 12 percent interest with annual…

A: Face Value = fv = $1000Coupon Rate = c = 12%Yield to Maturity = r = 7%

Q: Sidman Products's common stock currently sells for $67 a share. The firm is expected to earn $7.37…

A: An investor who invests in stock receives a regular dividend or the dividend grows every year at the…

Q: Matterhorn Mountain Gear is evaluating two projects with the following cash flows: Project Y -$…

A: YearProject-XProject-YNet flow (Project X - Project…

Q: The Canadian Dollar (CAD) has shown higher volatility in recent days. The spot rate is $0.5/CAD1.…

A: Forward Rate:The forward rate refers to the exchange rate at a future point in time, agreed upon…

Q: . Project 2 has a computed net present value of $26,300 over a 4-year life. Project 1 could be sold…

A: Net present value is one of the most important methods of capital budgeting based on the time value…

Q: Solve the principal: Interest rate: 5.75%, Time: 3 1/4 years, simple interest $240

A: The objective of the question is to find the principal amount given the interest rate, time, and the…

Q: A project requires an investment of $900 and has a net present value of $300. If the internal rate…

A: NPV = $300Initial investment = $900IRR = 14%

Q: please respond to both. One difference between stocks and bonds is that bonds mature, but stocks do…

A: Both stocks and bonds are issued by the corporations to raise money from public to meet day to day…

Q: A newly issued 20-year-maturity, zero-coupon bond is issued with a yield to maturity of 8.5% and…

A: Time = t = 20 YearsYield to Maturity = r = 8.5%Face Value = fv = $1000

Q: options are: regression moving average weighted moving average correlation exponential smoothing

A: The objective of the question is to match the given terms with their most appropriate descriptions.

Q: Consider the following information: Stock A Stock B Stock C State of Economy Boom Bust .14 .22 .40…

A: The financial condition that is expected to prevail in a country is known as the state of the…

Q: ou have two bonds in your asset portfolio. The first bond has a yield to maturity of 5% and a price…

A: Bonds are the financial instruments issued by firms to holders for a specific time period. This is a…

Q: You are going to value Lauryn's Doll Company using the FCF model. After consulting various sources,…

A: The amount of money remaining for the company after paying all operational and capital costs is…

Q: Evaluate the following capital project proposals, given a capital budget of $750 million. project:…

A: Initial outlay (IO) is the cost of the investment, and the present value of cash flow (PV) is the…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- In the bond market you are given the following information. All amounts are in the US dollar. CF stands for cash flows and all bonds mature in Year 3. One can buy or sell only integer quantity of bonds. Based on the no-arbitrage principle, what is the price of Bond C today? In other words, what is X? Price Today CF Year 1 CF Year 2 CF Year 3 Bond A 95.00 6 6 106 Bond B 107.00 11 11 111 Bond C X 7 7 107Assume that interest rate parity holds and that the 90-day risk-free securities yield is 5% in the United States and 5.3% in Germany. In the spot market, 1 euro equals $1.40 (1.4 dollars per euro). What is the 90-day forward rate? rh 1.25% 5.0% rf 1.33% 5.3% Euro 0.7143 $1.40 Spot Rate Forward Rate 1.943396 Is the 90-day forward rate trading at a premium or a discount relative to the spot rate?If the spot rate is $0.50/NZ$ and the formate rate is $0.55/NZ$. The intreste rate in USA is 9% and the intreste rate in New Zealand is 4%. What would be per doller benefit for the US investor from Investing in New Zealand bonds. A. $0.054 B. -$0.054 C. $0.090 D. $0.040

- Assuming that interest rate parity holds. In both the spot market and the 90 day forward market, 1 Japanese ye equals .0089 dollar. In Japan, 90-day risk free securities yield 4.3%. What is the yield on 90-day risk free securities in the US? Do not round intermediate calculations. Round your answer to two decimals places.A European company issues a bond with a par value of $1,000, 13 years to maturity, and a coupon rate of 6 percent paid annually. If the yield to maturity is 11 percent, what is the current price of the bond? Group of answer choices $640.46 $622.56 $658.44 $662.51 $636.66PIMCO gives the following example of an Inflation Linked Bond (ILB), called a Treasury Inflation Protected Security (TIPS) in the US. "How do ILBs work? An ILB’s explicit link to a nationally-recognized inflation measure means that any increase in price levels directly translates into higher principal values. As a hypothetical example, consider a $1,000 20-year U.S. TIPS with a 2.5% coupon (1.25% on semiannual basis), and an inflation rate of 4%. The principal on the TIPS note will adjust upward on a daily basis to account for the 4% inflation rate. At maturity, the principal value will be $2,208 (4% per year, compounded semiannually). Additionally, while the coupon rate remains fixed at 2.5%, the dollar value of each interest payment will rise, as the coupon will be paid on the inflation-adjusted principal value. The first semiannual coupon of 1.25% paid on the inflation-adjusted principal of $1,020 is $12.75, while the final semiannual interest payment will be 1.25% of $2,208, which…

- IBM is considering having its German affiliate issue a 10-year, $100 million bond denominated in euros and pricedto yield 7.5%. Alternatively, IBM’s German unit can issuea dollar-denominated bond of the same size and maturityand carrying an interest rate of 6.7%.a. If the euro is forecast to depreciate by 1.7% annually, what is the expected dollar cost of the eurodenominated bond? How does this compare to the costof the dollar bond?b. At what rate of euro depreciation will the dollar cost ofthe euro-denominated bond equal the dollar cost of thedollar-denominated bond?c. Suppose IBM’s German unit faces a 35% corporate taxrate. What is the expected after-tax dollar cost of theeuro-denominated bond?Suppose you (U.S. investor) purchase a 5-year, AA-rated Euro bond for par that is paying an annual coupon at the rate equal to 8 percent. The bond has a face value of 1,000 Euros. The spot exchange rate at the time of purchase is USD1.15/EUR. At the end of the year 1, the bond is upgraded to AAA-rated and the yield changes to 7.5% per annum continuous compounding. In addition due to changes in macroeconomic environment, the exchange rate also changed to USD1.25/EUR. Assume that a U.S. investor holds this bond for one year and sells it in the market at the end of year 1. EUR is the abbreviation for Euro and USD is the abbreviation for U.S. dollar. What is the overall gain / loss in U.S. dollars for the U.S. investor at the end of year 1 (t = 1 year)? (Roundoff your answer to four decimal places, in order to get as accurate answer as possible on Canvas. If your answer is -$1.2345, loss of $1.2345, then type your answer as -1.2345.)The following facts are available about a convertible bond: Market Price of issuer's common stock = S = 100, uS = 110, dS = 90, Interest Rate = 3%, Face Value of a Convertible Bond (E) = 1,000. Using the One Period Binomial Model to create a replicating portfolio, calculate the price of this convertible bond. a. $1,001.67 b. $1,018.51 c. $1,033.98 d. $1,041.15 Do it correctly with step by step explanation.

- The Philippines BOT is issuing a Retail Treasury Bond. The bond is now trading at Php52 per Php100 par value. A put or call option on the bond with an exercise price of Php53.5 per Php100 might be sold by an over-the-counter options dealer. It's possible that you'll have to choose between European and American options. Assume the contract covers Php10 million in bond face value and is cash settled. What is the value of the short call to pay the long call if the long call exercises his right at the Php55 bond price? How much would the buyer pay for the Php10 million face value bond if it was deliverable? Interpret the result. (Show complete solution.)If the YTM on the following bonds are identical except, what is the price of bond B? Bond A Bond B Face value $1,000 $1,000 Semiannual coupon $45 $35 Years to maturity 20 20 Price $1,098.96 ?If a P1,000 bond sells for P1,125, which of the following statements are correct? I. The market rate of interest is greater than the coupon rate on the bond. II. The coupon rate on the bond is greater than the market rate of interest. III. The coupon rate and the market rate are equal. IV. The bond sells at a premium. V. The bond sells at a discount. a. I and IV b. I and V c. II and IV d. II and V