If you start with $100,000 in investment capital, calculate what an investment in SAS would be worth in three years under each of the proposed sales fee schemes. Which scheme would you choose? Do not round intermediate calculations. Round your answers to the nearest cent. Scheme 1: Scheme 2: Scheme 3:

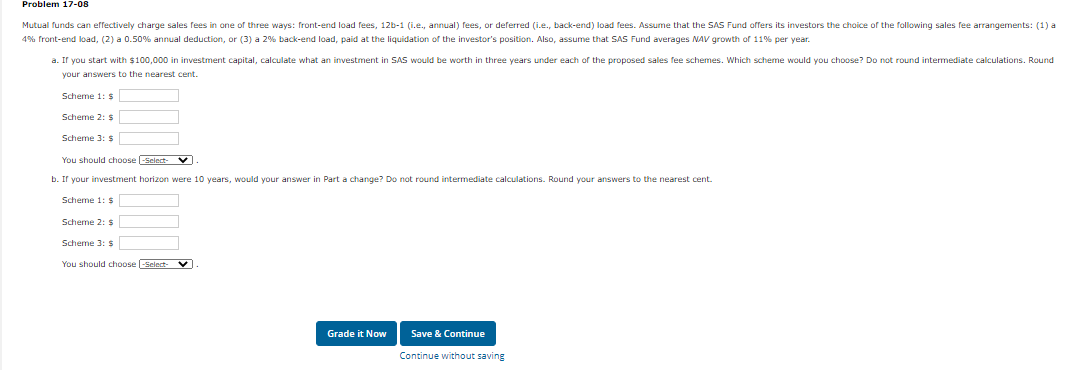

Mutual funds can effectively charge sales fees in one of three ways: front-end load fees, 12b-1 (i.e., annual) fees, or deferred (i.e., back-end) load fees. Assume that the SAS Fund offers its investors the choice of the following sales fee arrangements: (1) a 4% front-end load, (2) a 0.50% annual deduction, or (3) a 2% back-end load, paid at the liquidation of the investor's position. Also, assume that SAS Fund averages NAV growth of 11% per year.

-

If you start with $100,000 in investment capital, calculate what an investment in SAS would be worth in three years under each of the proposed sales fee schemes. Which scheme would you choose? Do not round intermediate calculations. Round your answers to the nearest cent.

- Scheme 1:

- Scheme 2:

- Scheme 3:

- Choose:

- If your investment horizon were 10 years, would your answer in Part a change? Do not round intermediate calculations. Round your answers to the nearest cent.

- Scheme 1:

- Scheme 2:

- Scheme 3:

- Choose:

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images