Ignore currency symbols. Ignore workings. Show ALL amounts as positive whole numbers. Failure to follow these instructions may result in lost marks. ABC Ltd ("ABC") is a company which sells widgets to the general public. ABC's financial year- end is 30 June. The following additional information was provided to you: 1. The number of issued shares at 1 July 2020 amounted to 13702 and was issued at an average price of 25 per share. 2. The opening balance of Retained Earnings amounted to 850667 3. On 1 September 2020, ABC issued 9225 number of shares to the public at 67 per share. 4. Share issue costs amounted to 8709 5. On 1 December 2020, ABC declared an interim dividend of 12747. The payment was made on 15 January 2021. 6. On 30 June 2021, a final dividend of 39506 was declared. 7. Profit before tax amounted to 1919349 and taxable income was 95% of profit before tax. You are required to calculate the following balances as at 30 June 2021: 1. Share Capital closing 2. Total dividend for the year 3. Retained Earnings closing balance

Ignore currency symbols. Ignore workings. Show ALL amounts as positive whole numbers. Failure to follow these instructions may result in lost marks. ABC Ltd ("ABC") is a company which sells widgets to the general public. ABC's financial year- end is 30 June. The following additional information was provided to you: 1. The number of issued shares at 1 July 2020 amounted to 13702 and was issued at an average price of 25 per share. 2. The opening balance of Retained Earnings amounted to 850667 3. On 1 September 2020, ABC issued 9225 number of shares to the public at 67 per share. 4. Share issue costs amounted to 8709 5. On 1 December 2020, ABC declared an interim dividend of 12747. The payment was made on 15 January 2021. 6. On 30 June 2021, a final dividend of 39506 was declared. 7. Profit before tax amounted to 1919349 and taxable income was 95% of profit before tax. You are required to calculate the following balances as at 30 June 2021: 1. Share Capital closing 2. Total dividend for the year 3. Retained Earnings closing balance

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

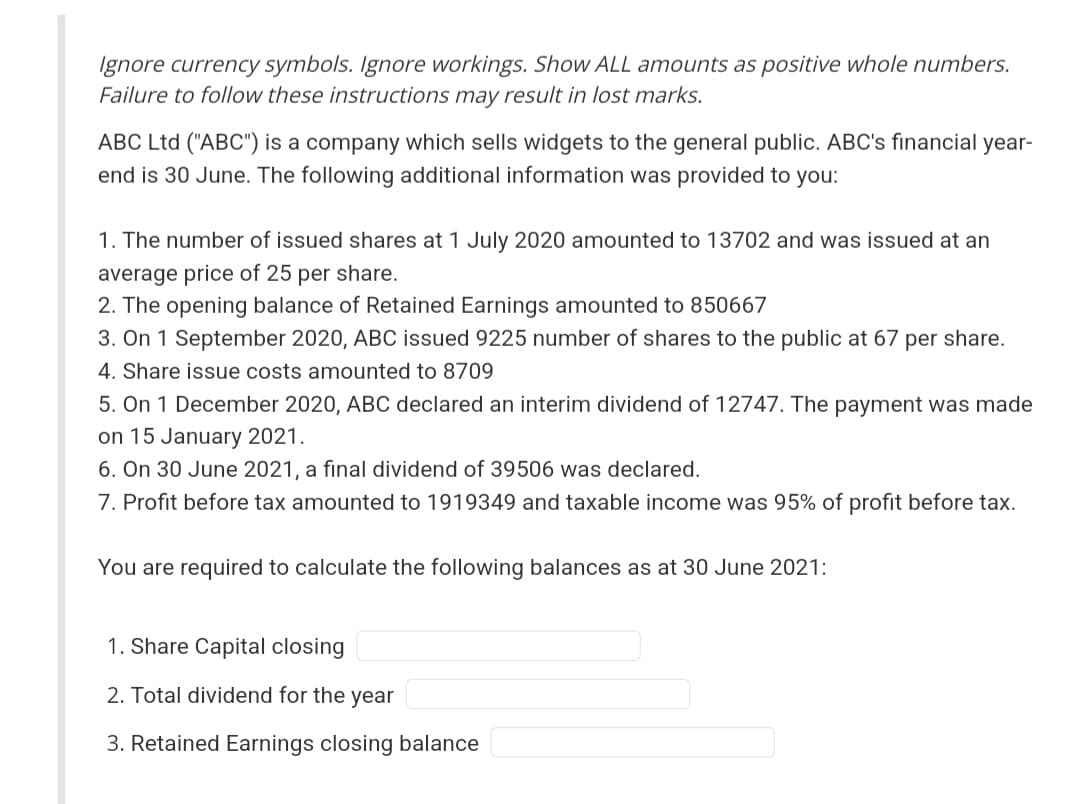

Transcribed Image Text:Ignore currency symbols. Ignore workings. Show ALL amounts as positive whole numbers.

Failure to follow these instructions may result in lost marks.

ABC Ltd ("ABC") is a company which sells widgets to the general public. ABC's financial year-

end is 30 June. The following additional information was provided to you:

1. The number of issued shares at 1 July 2020 amounted to 13702 and was issued at an

average price of 25 per share.

2. The opening balance of Retained Earnings amounted to 850667

3. On 1 September 2020, ABC issued 9225 number of shares to the public at 67 per share.

4. Share issue costs amounted to 8709

5. On 1 December 2020, ABC declared an interim dividend of 12747. The payment was made

on 15 January 2021.

6. On 30 June 2021, a final dividend of 39506 was declared.

7. Profit before tax amounted to 1919349 and taxable income was 95% of profit before tax.

You are required to calculate the following balances as at 30 June 2021:

1. Share Capital closing

2. Total dividend for the year

3. Retained Earnings closing balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education